Ireland in Trouble

Wonderful.

Remember that the PIIGS countries are Portugal, Ireland, Italy, Greece, and Spain.

Two down, three to go. Like municipalities (see above) they’re going to continue to have problems in 2011.

Wonderful.

Remember that the PIIGS countries are Portugal, Ireland, Italy, Greece, and Spain.

Two down, three to go. Like municipalities (see above) they’re going to continue to have problems in 2011.

This is a quarter you’re going to hear about Quantitative Easing.

I hate it.

From the banks’ point of view, it makes perfect sense. For you and me, not so good.

How did QE work in Japan and the UK? Not well at all.

I’m doing more research into this developing area of the world this next week.

I’ll keep you posted.

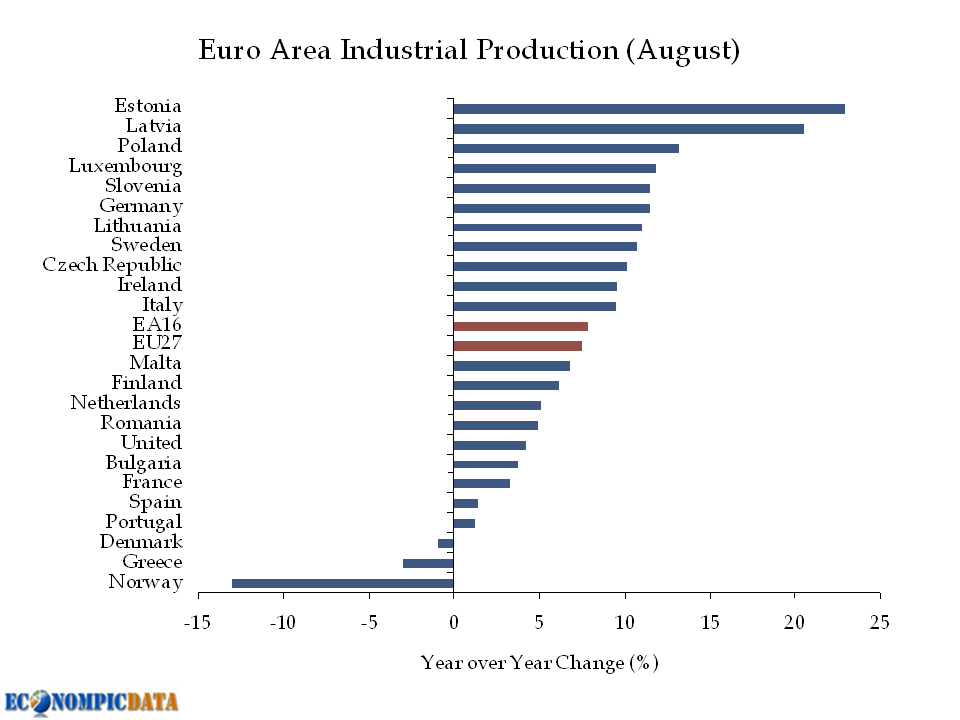

CLICK FOR FULL ARTICLE – EASTERN EUROPE

This week is the 3rd Quarter 2010 review and 4th Quarter preview.

If you go back and rewatch my July video (July Video) I stated I thought the 3rd quarter would be up and it definitely was.

Dow Jones + 10.27% for the 3rd Quarter and S&P + 10.72%. Of course, these are unmanaged indexes.

The markets were way down at the end of the last quarter, so this brings the indexes positive for the year +3.5% for the Dow and +2.3% for the S&P 500.

4th quarter? I think things will continue to be up, but the important thing is to ensure you have the right allocation to equities in case I’m wrong. I think the year will end positive for the equity markets.

Listen to my 4th quarter preview video for more analysis and 4th quarter action items.

But what makes me nervous?

This article sums up a lot of my feelings.

Does that mean I’m bearish for the 4th Quarter?

I guess you’ll have to wait until my 4th Quarter preview in a couple of weeks to find out.

Click on this link for FULL ARTICLE