Generosity Wealth Management

InsightsWe are committed to straightforward, respectful, and frictionless interactions, where details matter and clients leave each exchange with confidence and hope.

Roths and Tax Rates

2010 is the year of the Roth Conversion and maybe the end of lower taxes. In 2010 there are unique Roth Conversion rules that expire at the end of the year. With higher tax rates next year, what should you do? Listen to my video below to find out why this is so...

Tax Rates Hikes

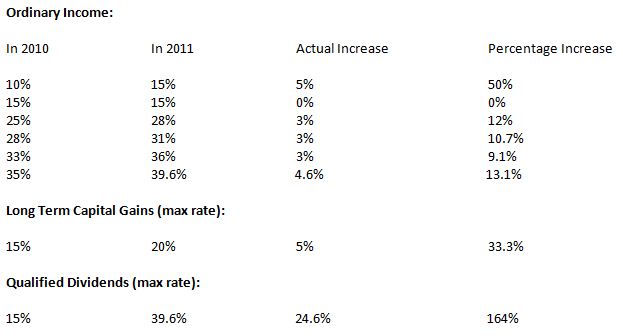

As a follow up to my video in the next blog, unless Congress passes a new tax law in a lame duck session by the end of the year, higher taxes are in your future. Here's the chart

QE2

Quantitative Easing ( known as QE 2 amongst friends) is coming this quarter. In my opinion, it's being priced into the markets already. What is it? A scheme by which the money supply is increased and hopefully starve off deflation and boost the economy. Sorry, I'm not...

Future of Estate Planning Remains up in the Air

In the same vein as my video and article on Unresolved Tax Bills in Congress, the Estate Tax is STILL not resolved for next year. What a disaster! The Estate Tax exemption is about to revert to $1,000,000 again in just a few months.

Mr. Potato Head turns 60

Enough with all the serious tax, Roth, and estate planning talk. How about celebrating Mr. Potato Head! He just turned 60. Yeah! CLICK FOR FULL ARTICLE

3rd Quarter Review / 4th Quarter Preview

This week is the 3rd Quarter 2010 review and 4th Quarter preview. If you go back and rewatch my July video (July Video) I stated I thought the 3rd quarter would be up and it definitely was. Dow Jones + 10.27% for the 3rd Quarter and S&P + 10.72%. Of course, these...