April 2019: First Quarter Review

Wealth is the ability to fully experience life. –Henry David Thoreau

2018 is but a distant memory as 2019 has come in fast and furious! In a very short amount of time we wiped away all of 2018’s losses in the unmanaged stock market indexes. This is a quarter that investors and financial advisors dream of, however now more than ever it is time to keep a level head. You hear me say the same thing over and over, and for good reason. Investing is a commitment and in this commitment you need to stay calm.

In the video I discuss humility and bias. Why? Because none of us can predict the future, we do our best to try by watching the news and this forecast and that one, however these media reports consistently report to stretch either negativity or positivity. Middle of the road, even newscasts don’t make headlines, so it’s our job to take everything with a grain of salt.

Watch my short video or read the transcript below and I give a quick breakdown of what we’ve seen so far in 2019.

________________________________________________________________________________________

Transcript

Hi there. Mike Brady with Generosity Wealth Management, a comprehensive financial services firm headquartered right here in Boulder, Colorado.

First quarter is over of 2019 and it was a banner year. These are the types of quarters that investors and financial advisors, frankly, live for. In a very short amount of time we wiped away all of 2018’s losses in the unmanaged stock market indexes.

And so now I want to kind of shift into bias. The bias of those in the media is not to be even-keeled. It is to be sensational either to pump things on the upside and be overly enthusiastic or to be very negative. Just to say oh my

So think about it even from a relationship point of view. If you are afraid of being disappointed in friendships is the answer to have no friends? No. The answer is why don’t I look at myself and see if I can moderate my reaction to my disappointments when a friend might disappoint me. That’s the more logical way I would argue in your relationship or friend relationships but also as it relates to investments. Is the better way to be overly optimistic, overly pessimistic or to take your news with a filter but look for the even way? To understand that hey, my bias might be pessimistic but wait a second, is this the real truth?

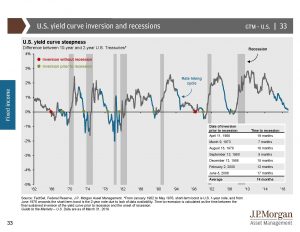

I would argue that since there’s a huge variance there of delay and some false positives that it’s not as good of an indicator as you would be led to believe. But even then it’s an indicator of the economy. The economy is not the stock market. It’s very important to remember that. If you look back at the early 90’s there was an indicator of a recession which did happen. However, does that mean that you shouldn’t have investments? No way. The 90’s were one of the best ten year timeframes ever and I certainly wouldn’t take that as an indicator. The last ten years has been a relatively moderate recovery from the Great Recession when you look at all the underlying GDP numbers versus the averages. However, this last ten years I’m certainly proud that many people invested in the markets and kept their investments over the last ten years. The unmanaged stock market indexes have been very favorable even if the economy was not as ripping and roaring as they have in prior decades.

Anyway, Mike Brady, Generosity Wealth Management, 303-747-6455. Give me a call at any time. Have a wonderful day. Thank you. Bye bye.