Extended Corporate Profits

In the meantime, they’ll continue to be volatile.

In the meantime, they’ll continue to be volatile.

I’ve had a relatively low position in stocks for clients for quite some time, but I’ve decided to lower it even further. I’m quite concerned about the correlation between Europe and the US, emotion/news driven volatility, and the uncertainty about what the Fed will do.

The risk just doesn’t warrant having as high a percentage as I’ve had.

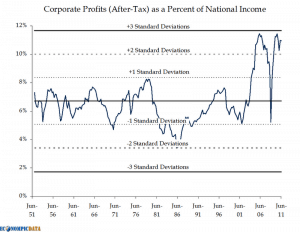

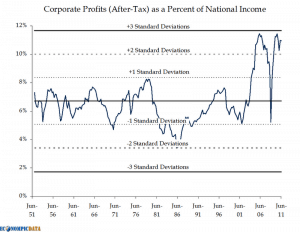

On the flip side, profitability, efficiency, and cash balances have all been rising in the firms that comprise the S&P 500.

Is the return worth the risk?

Click on video to hear more.

TRANSCRIPT:

Hi there, Mike Brady with Generosity Wealth Management, here in Boulder, Colorado and the question is “where do we go from here?” And we’re getting a lot of conflicting information. In the last month or so we’ve had huge volatility. We’re basically in a trading range, we have been for the last three or four weeks, but it’s been a trading range that’s extremely volatile. And we’re talking a half percent to one percent up over a few days and then “Boom!” a negative two, three, four percent.

We’ve seen the correlations between the European markets and the U.S. and Asia; very high. And as we look back, five, ten, twenty years, the correlations for the international market have become increasingly correlated. We’re a global market now. And so what happens in Europe is, irritatingly, affecting our situation here today.

We’re also seeing a lot of emotions. And we’re seeing a lot of news driven markets- which just absolutely irritate the heck out of me. We as a market, as investors, keep waiting for some bail out, some news from the government: and that just absolutely distorting things.

Philosophically, I’m going to go off on a kind of a slight tangent here. I understand that the government will always be a part of our free market system. It’s never been 100% free. However, the interaction we’re having now, it’s like this 900 pound gorilla in the room; that makes things kind of difficult.

Kind of on the flip side, as we’re looking at some of the positive things. We’ve got almost all of the S&P 500 have done their earnings for their second quarter. And year over year growth is about 12% over the previous year. And if we take out some of the financials, we’re talking almost 20% earnings, net earnings growth.

You’ve got net margins, back in 2008, that’s efficiency of almost 6%. Now we’re going all the way up to 9.27. So when you look at companies, at balance sheets, Apple’s got 76 billion dollars in cash. I mean a lot of these companies have cash on the side-lines, they have been very efficient. Unfortunately, the negative effect of that is they have trimmed their work forces. But as you’re looking at some of the larger companies, the S&P 500, they’ve become very efficient over the last three or four years. They’ve kind of trimmed, as they see it, the fat, and they’re sitting on huge sums of investable assets that they can redeploy at some point. They’re just not redeploying it right now. And so that’s very frustrating.

I am, long term, when I say long term, we’re talking three to five years, bullish on the market. I think that, you know, we’re set up for that. But on the flip side, I mean, I hear all the arguments about how Europe is imploding- which it is. How that’s going to drag our financial system down. What’s going to happen with the EU and the Euro is anybody’s guess. And so, there’s a lot of reasons right now where it could go either way. I mean I just want to sit here and admit that.

What I’m doing, in my portfolio, is I am decreasing some of the equity positions that I have. I’m absolutely going to continue to have some. But from the very conservative to the very aggressive models that I have for clients, I am decreasing the equity positions. Most recently, most likely in the next week or two, we’re going to hear what, if anything Bernanke and the Fed is going to do. We’ve been talking about a little bit about this twist where they buy a bunch of medium to long duration treasuries- to shore up…, well to keep interest rates low.

So, you know, there’s a lot of things in play but I’m just telling you that right now I’m going to decrease my equity position. The market could go up. Once again, I’m going to be happy three to five years from now. But right now, it’s kind of hard to analyze which way it’s going to go. And in that particular case, are you getting the return for the risk that you’re taking and right now I’m questioning that. So I’m going to reduce some of my equity positions and decrease the percentage, of course still stay in the game.

Anyway, Mike Brady, Generosity Wealth Management, here in Boulder, Colorado, my phone number is 303.747.6455.

I have a new blog on my web site, www.generositywealth.com. And I highly encourage you to go there and look at it. I’m going to have archives going back a number of years. And I think it hopefully will be, I think it will be very helpful and very interesting as you go back maybe two years of weekly or every other week, videos like this or other things that I’ve found interesting and (some) analysis. So you can go and get a flavor of what I’ve been talking about for the last couple of years.

I am taking new clients I would love it if you gave me a call or passed this video along to someone who might be interested in a comprehensive wealth management firm, Generosity Wealth Management, that’s me. You have a wonderful week, we’ll talk to you later, bye, bye.

S

This means that it’s a high probability that as Europe falls, it will impact our US markets. How much is the question, but our fates seem to be intertwined.

This video covers a range of thoughts

* Conviction — what do you believe in?

* Humility — the market doesn’t care what you think

* Knowledge — If you do action A, is B the outcome?

I hope you click on my video and watch–I try to make it the best 3 to 5 minutes of your week. Okay, maybe that’s stretching it, but worthwhile nonetheless.

TRANSCRIPT:

Hi there, Mike Brady with Generosity Wealth Management, and this week I’m going to talk about two or three different things, one is conviction, the second is humility and another is just knowing what… oh, the answers to everything, which I guess kind of gets down to humility as well.

I last did a video about a week and a half ago and at that time I said “Gosh, I hope you’re not hearing from me every day”, that means things have calmed down just a little bit. And what has happened in the last week and a half is we’ve had, mainly, some one percent days plus or minus. Which in an environment where it is three to five percent in a day, that actually seems quite calm. But we’d have one percent, one percent, one percent, and then a big three percent drop. What’s very interesting is that although that three percent drop might just give away what you’ve gained over the last three days it seems so dramatic, so huge, when in fact if had been less one percent, less one percent, a slow dribble, it’s not quite as shocking to the system.

And this kind of gets down to a little bit of humility and kind of knowing everything. The market is a very complicated organism, OK? And the only people who understand exactly what is going to happen, there are some people like that, they’re called analysts and journalists, OK? And it is my belief that, many different factors go into what happens on a given day, a given week, a given month, into the particular market.

Let me just step back for a minute and talk about my philosophy in general; about the chaos theory. Things are very complicated- and sometimes things just happen. If A happens B does not necessarily happen. And sometimes B happens and there are a number of things that lined up for B to happen. The market is no different.

In an economy, or a country, let’s just say, in order for it to go from a developing country to a developed country, there are a lot of things that have to happen; you have to have an educated work force, you’ve got to have good governance, and confidence in the judicial system, you’ve got to have an economic system that is free and fair… There’s a number of different things that have to happen in order for a country to really move forward. And if one or two of them are happening, but not all the others, then you’re really not hitting all the cylinders. And so, it kind of gets to my belief in investing that you’ve got to have a conviction.

What do you believe in? Do you believe that the United States is what your bet is long term; whether it’s one year, five years, ten, thirty years. If not, you know, then I might question whether all of my discussions about the stock market are really for you. And if that’s the case we can talk about it, and give me a call; because there might be other non-equity, non-U.S. things that you should gravitate towards. What do you believe in? If you believe in nothing you’re going to be pulled one way or the other and all of these journalists who give you exact answers, which is what we wish that we would have about why a certain event happens. You’re going to be persuaded by one over the other, left and right, etc.

That boils down to my last topic- which is really humility. We have to understand that sometimes things just happen and what we believe is going to happen doesn’t always turn out the way we want it.

You know, I still have a conviction that this a market that I want to participate in but I’m still diversified. I still have some hedging positions. And the last three or four weeks, I have to absolutely admit it is much more drastic that what I had, you know, forecast four weeks ago. But that being said, the conviction is the same but I also have to remember that the market doesn’t really care what Mike Brady thinks; doesn’t care what Generosity Wealth Management thinks; doesn’t really care what you think. So therefore, we have to continue to change our beliefs. And so I have made some changes in the last three or four weeks. I’ve shared them with you over the video as things have progressed. But we also have to have conviction, but we also have to have some humility and also understand that sometimes things, and particularly on some of these days just knee-jerk happens. And so we have to kind of help smooth those things out, try to keep them out of our mind and not let them completely throw us off base.

I’m recording this on a Friday morning, Bernanke just spoke a little while ago and the market knee-jerked down then knee-jerked back up. And so, you know, those things are going to happen, it’s just part of it and we have to stay true to what we believe.

Going forward, I mentioned this at a previous video, that I’m going to have dynamic asset allocation as one of my offerings for my clients and my management system because I do believe that there’s a way that we can keep to our conviction, stay invested most of the time and strategically choose one sector over another. And it’s something that I’m very excited about. It’s something I’ve been working on for a very long time and I’m just about to kind of, offer it to all of my clients.

Anyway, Mike Brady, Generosity Wealth Management, 303.747.6455.

Eeeh, I’m supposed to smile! My mom tells me that I don’t smile enough in these videos but you know, I take this stuff very seriously, and so maybe that seriousness comes out in my lack of smiling here. But anyway, I hope you have a wonderful weekend and we’ll talk to you later bye bye.

That might sound good, but what it really means is that the prices are plunging.

Stay away from Greece and watch Europe closely.

Greek Bond Yields Surge – Link

This video covers my current thinking

* There are some BEAR signs in the market I’m concerned about

* What does the market really care about (hint: recession and Europe)

* Why so much volatility last week?

* What should you (or me if I’m your adviser) be doing?

* Dynamic Asset Allocation management coming your way….

If this week is calmer than last week, then I may not do a video 2 or 3 times. For all our sakes, let’s hope that’s the case!

TRANSCRIPT:

Hi there, Mike Brady with Generosity Wealth Management,

and recording this on a Monday morning, August 15th, and hopefully

you are getting this in your e-mail on Monday afternoon. With every day being

so very important and news-worthy, I want to get this out as quickly as

possible.

Last week, I mean big swings; 400 plus or minus and just

unbelievable. The volatility on Friday and so far today is starting to tamper

down: which is great. I think that anyone who believes in efficient market

theory is,,,, I’m just not there. I’m not on the bandwagon with them. That

really says that the available public information is factored into the market.

And when you are seeing huge swings like that I think you’re seeing a lot of

emotionality. You’re also seeing a lot of short covering and you’re also seeing

some programmed trading- people who have got losses in there or various

triggers at various points; just starting to execute automatically. I make no

judgments about any of those techniques or reasons, it’s just; they are what

they are.

Right now, I think what we need to ask ourselves and what

the market is asking itself is; are we in a recession? And; is the Euro going

to survive? Because Europe and the Euro is going to be a big driver going

forward in the next quarter or two. I think we’re seeing a year and a half of,

if you’ve been watching my videos, it’s starting to implode. And so it’s

starting to slow up,… sorry, it’s starting to speed up and some major decisions

are being made at this point in time.

Are we in a recession? I think we are in a recession. We’re

going to look back three to six months from now and say, “gosh, we were in a

recession then.” Even if the numbers don’t say so right now.

There are some bearish indications that have me

concerned. One of them is four months of down months. If August is a down month

in the market, that is definitely a clear sign that we are in a recession.

Sorry, I’m just looking at my notes here.

Second is just the market volatility- you don’t see this

kind of volatility in a bull market. You see this kind of stuff in a bear

market.

Third is just the sentiment of the investors. It is

really quite negative. That’s also a bear signal.

Fourth is the Fed. At the end of the day when you look in

between the lines of what the Fed is saying, the Fed is saying that we’re in a

recession by the tones that, and overtures that they’re giving.

There are a couple of things that I think you need to do.

Kind of getting back to some practicality here; look at your portfolio and

rebalance. You probably have various mutual funds, ETF’s, stocks, ect. And make

sure that you’re not completely out of whack. If you used to be ten per cent

this and now you’re fifteen or twenty and you really don’t want that. Now is

the time to evaluate it.

The second is, for your particular categories, let’s say

that you want a certain per cent in large cap or small cap or internationals or

whatever it might be, make sure you’ve got the best in class. When’s the last

time you reviewed the particular mutual fund, ETF, index, etc., to insure that

it is performing the way that you think it should perform.

In the last couple of years we’ve had, mainly, kind of a

nice bull market and so it’s… now we’ve had a couple of weeks of down, and so the

question is: did it perform the way it is supposed to? So is there any change

within that category that you need to make.

I still believe that internationals are something that

you ought to have a very small, if any, position in. I do have some

international exposure but it is extremely small. And, because, getting back to

what I said earlier, I think that is going to be one of the major drivers going

forward.

The last thing you can do is look at your municipals. I

have a friend of mine, and we spoke last week and he, I think, pretty much

thinks I’m crazy in some of my pessimisms with municipals. That’s OK. At the

end of the day I could be completely wrong and municipals could do fine going forward

and maybe even have a little rally, that’s fine. But the question is, I think, the

risk is too great out there- I mean your down-side versus your upside? With the

yield between one and four per cent for these municipals, sorry that is just

not very exciting to me for the risk that you’re going to take. And I think the

risk on the downside, if we have some defaults, is just greater than what the

upside potential is. That’s just my analysis, I could be completely wrong as it

relates to municipals but it is just the risk reward ratio is not there for me.

That is what I’m thinking about right now. One thing that

I’m going to let you know is, I’ve been working very hard for a number of

months now on some dynamic asset allocation models. I’ll be talking about that

more individually with my clients, and also writing about it in my newsletter,

etc. It is just another investment management strategy that I want to

compliment some of the other things that I’m doing with my clients and

offerings for prospective clients. So I’ll be talking about that in the coming

weeks.

Also, if you don’t get another video from me this week-

this is a good thing! Not that you don’t hear from me or that I don’t have to

do another video. It just means that maybe things have settled down a little bit.

You don’t have to say, every single day, “Oh my gosh! What’s

going on? What does this actually mean? What does this mean for me over at

Generosity Wealth management?” So if you don’t get a video from me maybe it

means, whooo, maybe things have settled down a bit. We’re not quite on the

ledge that we were a couple of weeks ago.

Anyway, Mike Brady. Generosity Wealth Management, 303.747.6455.

And you have a wonderful day and maybe a wonderful week. Bye bye now.