Bank Assets as a Percentage of GDP

How do other countries fair as a percentage of their GDP?

Luxembourg 2,461

Ireland 872

Switzerland 723

Greece 141

US 82

Want the full list? CLICK FOR FULL ARTICLE

How do other countries fair as a percentage of their GDP?

Luxembourg 2,461

Ireland 872

Switzerland 723

Greece 141

US 82

Want the full list? CLICK FOR FULL ARTICLE

What is your interest rate sensitivity? If you reply “what does that mean”, then you definitely need to listen to my video below.

I talk about a quick and dirty way to estimate how a Rising Interest Rate will negatively effect your particular bonds and/or bond funds.

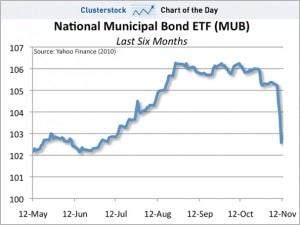

We’re now seeing the worst falls in Municipals since Lehman’s collapse back in September 2008. Ouch! I also say that the worst is before us, not behind.

To do: Watch your municipal holdings and know what your exposure is!

Ireland has a bailout (thank you EU and IMF) and now the yields for Portugal, Spain, and Italy are going through the roof.

This does NOT bode well for the rest of the PIIGS, Europe, and the Euro.

To do: What’s your exposure to what I think is the next big collapse?

CLICK FOR FULL ARTICLE: MUNIS SEE WORST FALLS SINCE LEHMAN COLLAPSE

I think the problems are starting to hit and 2011 will be a big year of reckoning.

Look at the chart to the right. Ugly.

Why is this happening?

There’s the looming end of the Build America Bonds program, questions about how state and local governments will manage their debts, and the impact of huge pension and health care obligations that seem unsustainable.

CLICK FOR FULL ARTICLE: WHAT’S WRONG WITH MUNI BONDS? EVERYTHING .

Wonderful.

Remember that the PIIGS countries are Portugal, Ireland, Italy, Greece, and Spain.

Two down, three to go. Like municipalities (see above) they’re going to continue to have problems in 2011.

We’re 1/3 done with the quarter, elections were yesterday, and lots left in the year.

In this week’s video, I give a little update on the quarter and year so far, plus a discussion about why you have to take the comparison of your portfolio to an unmanaged index with a grain of salt.

Listen to my video below to find out more.