Generosity Wealth Management

InsightsWe are committed to straightforward, respectful, and frictionless interactions, where details matter and clients leave each exchange with confidence and hope.

Have Emerging Markets Gotten Oversold?

I think highly of Mark Mobius, and he makes a strong argument that emerging markets, while they've had some correction this year, is still a great place to invest. I happen to agree with him. It's a great article, so be sure to click and read. Have Emerging Markets...

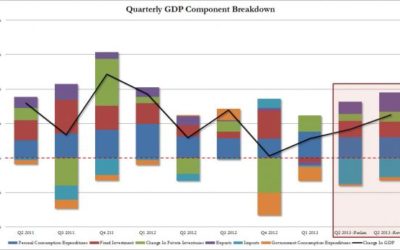

Revised GDP rises to 2.5%

The numbers are increased mainly due to net trade numbers being positive, while personal consumption and fixed investments declined. If the positive net trade numbers continue, this is very good for us. The decrease in personal consumption and fixed investments is a...

5% 30 Year Mortgages

According to Lou Barnes, a local mortgage broker who is frequently quoted in the national press, when the 10 year treasury yield hits about 3.33%, we'll be back to 5% 30 year mortgages. Right now, the 10 year treasury is around 2.775%, up about 1.1% in just a few...

Baby Ostriches Dancing in Circles

So, you're wondering what the connection to a video of Dancing Baby Ostriches have in common with a financial newsletter. Absolutely nothing. I figure, a newsletter that starts off with a discussion of equity and bond direction, followed up with emerging markets, GDP...

The Quarter in Review

The second quarter was a tough quarter, particularly at the end. Continued emphasis on government fiscal and monetary policies, both here and abroad, played havoc with bond, stock, and precious metal investors. It's enough to make my hair turn white! Click on my video...

ADV and Privacy Notices

At least once a year I update my Form ADV with the State of Colorado. What is that you ask? It's a form and brochure that describes what Generosity Wealth Management is, who I am, and how we do business. If you would like a copy, please click on the link below. For...