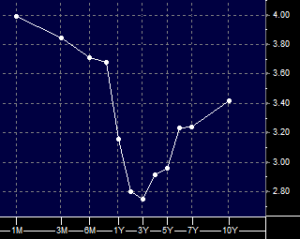

In China, we don’t have the same type of statistics because of their young open economy, but recently their yield curve has “inverted”.

I’m watching this and realizing it’s just another of many economic indicators out of China pointing towards a slower economy.

I really don’t want much (if any) exposure to the Chinese Stock Market.

This also has consequences to the whole global trade market as China is the 2nd largest economy right now. We truly are a global economy, and what affects China affects the US.

Stay tuned to my newsletters this year as the China story unfolds.