Investing in Previous Year Winners

One thing to watch out for is assuming the future will reflect the past. As a matter of fact, that whole “past performance is no guarantee of future result” is actually true.

So, looking at history over the past 14 to 15 years, what would happen with your returns and volatility if you had invested for the year based on the best asset class for the prior year?

Inquiring minds want to know.

Therefore, you should watch my video.

Hi there, Mike Brady with Generosity Wealth Management, a comprehensive full service wealth management firm headquartered right here in Boulder, Colorado. Today I want to talk about volatility, I want to talk about diversification and picking an asset class based on the prior year’s returns.

I was at a conference maybe two weeks ago, three weeks ago, something like that and this presenter had these charts, which I’m going to share with you today, that I thought were so fascinating. A lot of it has to do with setting yourself up for success. You’ve heard this if you’re watching my videos, as I certainly hope that you are, about setting yourself up for success because I’ve heard I just want the highest return, volatility doesn’t matter.

Well, my experience has been that volatility only matters when you’re right in the middle of it and it’s happening to you. Therefore, let’s set ourselves up for that success. I’m going to throw up here on the chart an example of all kinds of asset classes that you could have been in. You go back all those years and all the different colors and each one of them are stocks and bonds and international and commodities and all different types of asset classes. Now, let’s pretend like we’ve invested, so the highest one for each one of those years keeps changing because you can see that top row there the color keeps changing. If we took the previous year’s highest, the one who won for that year, and you invest in it the next year, what do you think would happen with your returns?

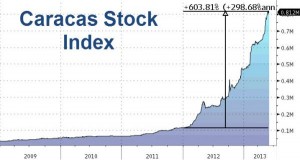

Well, this chart that I just threw up on the video will show you that the blue line there and this is a little bit cherry picking because this goes back to the beginning of 2000 and if you remember at that time it was right after the internet craze and I remember, I mean I’ve been doing this for 23 years, and the confidence level of all these people were oh my God, you’ve got to get into internet and you’ve got to do this, look at how great it did in ’97, ’98, ’99, I mean you’re a fool if you don’t do this. If you had done that, look at that blue line, the blue line is for the last 13 years if you had picked and invested your money into the previous year’s best asset class that’s what happens, okay. The red is if you invest in the worst asset class for the previous year, but if you invest in a diversified global diversified, meaning global stocks and bonds and some cash, then you’ve got that green one right in the middle. It’s not as good as going right into the worst. It’s definitely better than going into the best, but it also is a slightly smoother ride, which is absolutely essential.

This next graph I think is really interesting in that the red is the 100% stock market index. What would happen if you got only 50% of the decline so if it went down 50, you went down 25, and you only got 50% of the up so that it went twice as much up as you did, you would have that green versus the red, so the red is what you would have if it was $1000 or a million, it doesn’t really matter, but you would have a much higher rate of return with a lot less volatility just by having half of the down and half of the up because if you recall losing 50% means you have to have a 100% return just to break even. If you have $100 and you lose 50, that’s $50. You have to make 50 on 50 just to break even. If you lose 20% you have to make 25 just to get back, lose 33 you’ve got to make 50, that’s just the way math works.

There was one other chart that I really wanted to share with you. This chart right up there, this is my last one for the day, which is on the right-hand side there, the question is the cycle of emotion. You go through some caution, some confidence, enthusiasm and greed, and then you go to indifference, denial, etc., all the way down there, so our emotions. I’m a behavioral finance guy who’s interested in that, that some of the nontechnical aspects that we bring to investing are as important, if not more important than some of the technical aspects. I just acknowledge that and so I’m always wanting to set ourselves up for success. These are the types of things that I talk with clients about all the time and if you are not one of my clients I’d love to talk with you about it.

Mike Brady, Generosity Wealth Management, 303-747-6455. Have a great week. We’ll talk to you later. Bye-bye.