Healthy Body, Healthy Portfolio

He who has health has hope; and he who has hope has everything. – Arabian Proverb

Just like you need to be healthy in your body, you have to be healthy in your portfolio. How are these analogous you ask? Well, simple. In both you have to be proactive, not reactive. For your health you eat properly, stay hydrated and get plenty of exercise (or so we hope!), the same goes for your portfolio. You plan and diversify to ensure that, should one day an event cause a bit of “sickness,” both you and your portfolio, will have the strength and fortitude to regain health quickly.

Watch for more of this month’s discussion in finding some strength and peace of mind in uncertainty.

Transcript

Hi there. Mike Brady with Generosity Wealth Management, a comprehensive, full service financial services firm headquartered right here in Boulder, Colorado.

So, my face is very red and you might notice that. It looks all splotchy, but I am completely healthy. I’m 51 years old, very fair skinned and I have a lot of accumulated years of skin damage. Every six months my doctor uses that liquid nitrogen and zaps out those precancerous cells. When I went there two or three months ago he said “Mike, I’m going to have to dunk your whole head in a liquid nitrogen or we can do twice a day Fluorouracil ointment on your face. It is basically a chemical that will cause your face to get red and it will peel off, but then new healthy skin will emerge.” So believe it or not it’s been a week since I stopped taking it and now I’m in the healing phase. Hopefully I’ll be looking even younger when my face completely heals. But I just wanted to let you know I’m using my productive time of isolation at home to the best that I can. Those of you who are reading this now I’ve given you a reason to watch at least the first minute of the video.

It’s been a couple of weeks since we’ve spoken and since I’ve given a video but I want to give a little update of what’s been going on. Then I want to equate your portfolio investments to reaching your financial goals to your body and to being healthy because I think that’s a good analogy and a good way to think about things.

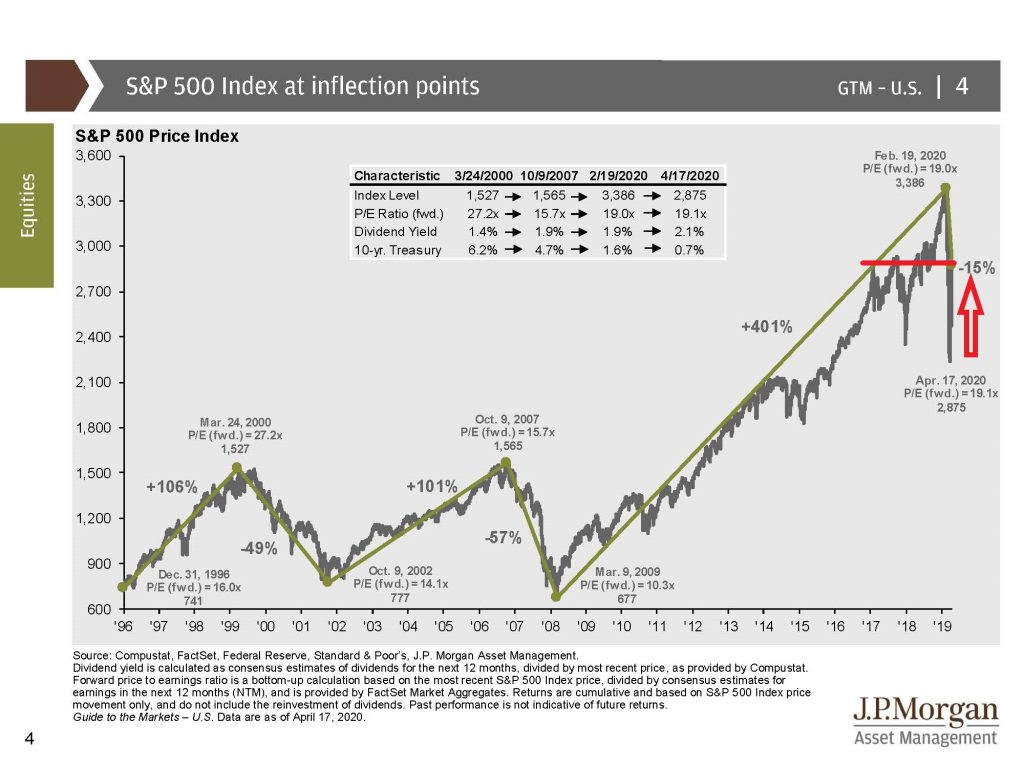

I’m going to put a chart up on the screen and this is a multiple year, multiple decade chart. What you can see is from where we were on the S&P 500 which is an unmanaged stock market index to where we are now is dramatic. The last two to three weeks have been a nice rebound from the lows that we tested two or three weeks ago. This is great. Remember, go back and watch my videos. This is my eleventh video since February 1 and what I talk about is that the economy and the stock market are tied together but they are not necessarily lockstep. Sometimes you can overshoot so the stock market is forward thinking. Therefore, it can sometimes overshoot what that mark is or what it believes in the future. You’re going to see up there that from a time point of view we’ve given up a year’s worth of gain, but it’s not like we’ve given up 12 years’ worth of gain. Quite the opposite and that’s why it is important to have investments, at least in my particular opinion.

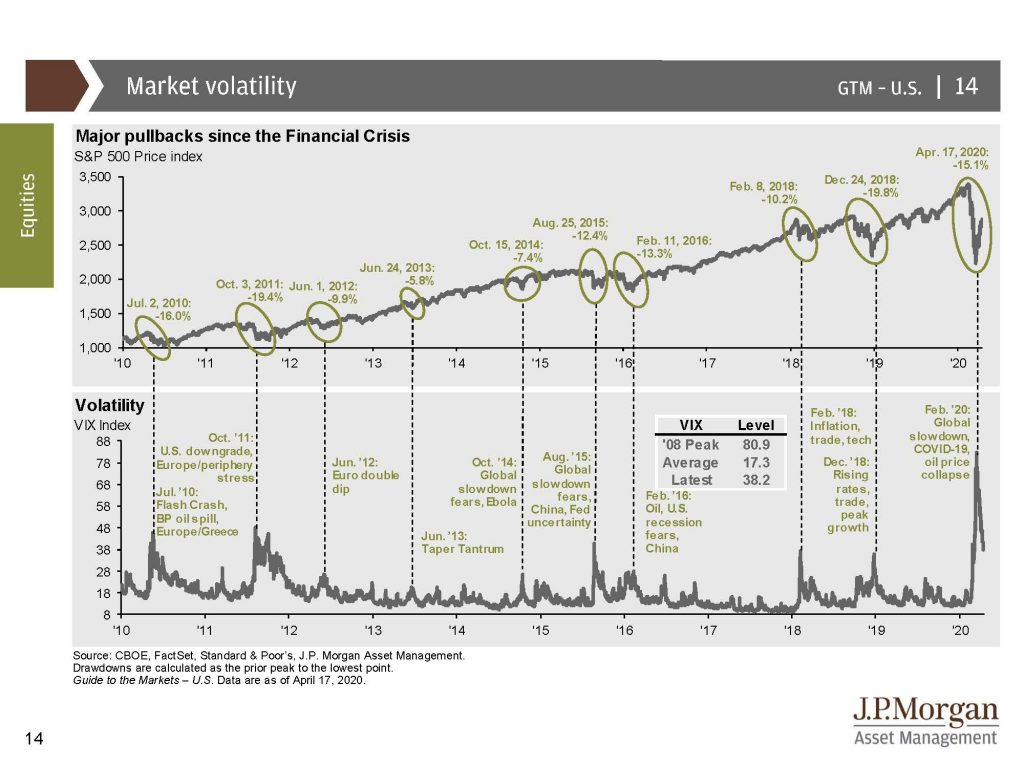

I’m going to put another sheet up on the screen and what you’re going to see is all the pullbacks since the financial crisis of 2008. It’s like the old adage that every general is fighting Vietnam or every analogy to any kind of skirmish that we’re ever in is equated to Vietnam. Well it feels like every pullback that we’ve had has been equated to the 2008 crisis which was quite dramatic and probably the biggest one in all of our lives. But they have all recovered and you can see that, and this one is no different.

What I want to talk about today is the philosophy and how to have a healthy portfolio or a healthy mindset because I believe that our attitude is very important in some of the fundamentals.

Let’s talk about our body. I had a great conversation with a doctor client of mine 6 to 12 months ago and he said something I thought was really poignant and I’m remembering it now. He said “Mike, the body in general if you just leave it alone it’s going to be fine. As a doctor it’s first do no harm and that’s what the doctor said.“ Now it’s Mike Brady talking and I have to tell you that I grew up with that philosophy. My parents believed that in general you leave the body to handle most of its stuff for 90-95 percent of it. Of course you need to see a doctor, but not every time you get a little tiny cut or a cough or a sneeze. Well, your portfolio is very similar to your body.

Prior to getting sick you need to eat well, you need to exercise, you need to watch your weight. There are certain fundamental things that you need to do to be a healthy human being. You need to have multiple types of exercise. If you’re only doing one you might have an overtraining problem and that might lead to an issue down the road. If you’re an active person, you eat well, you eat different types of food so that when you become sick – which you know that you will become sick. You will get a cough or a cold or even the flu at some point and you will be well prepared for that situation. Now, if you spend all of your time in conversation of “gosh, I wonder when I’m going to get the cold. Gosh, I wonder when I’m going to get the flu.” Or you situate your whole life to avoid a cough or a cold or the flu, that’s not a very exciting life and I don’t think that it’s very helpful.

It’s the same way with portfolio. It’s important to be well diversified in advance and to have a healthy portfolio and understand that you will have a cold or a sneeze or a cough or even the flu at certain points in time. While it might be interesting to say “gosh, I wonder when the market is going to have a correction”, I don’t believe that’s very helpful. If you were healthy and you were doing everything that you can to have a healthy portfolio like you do everything you can to have a healthy body, it doesn’t really matter. It’s going to happen. That’s wasted energy–that’s wasted effort. If you do everything you can to avoid that portfolio correction or the market going down or to have any short-term loss, you haven’t really lived in your portfolio. I think you’re going to hurt yourself long term. That’s in my opinion.

Of course, there are lots of hypochondriacs out there in your life and for them every cough and cold is immediately to the worst case scenario. It’s no different with our media and with certain investors as well. Avoid that–avoid that tendency. If I have just described to you when it comes to the portfolio that every single cough or sneeze is all of a sudden the absolute worst case and you sit there and worry yourself needlessly. You might say to yourself “yes Mike, but this is different. Flu can sometimes kill you. Maybe your analogy doesn’t really work.” My answer is you’re right, it is not a perfect analogy.

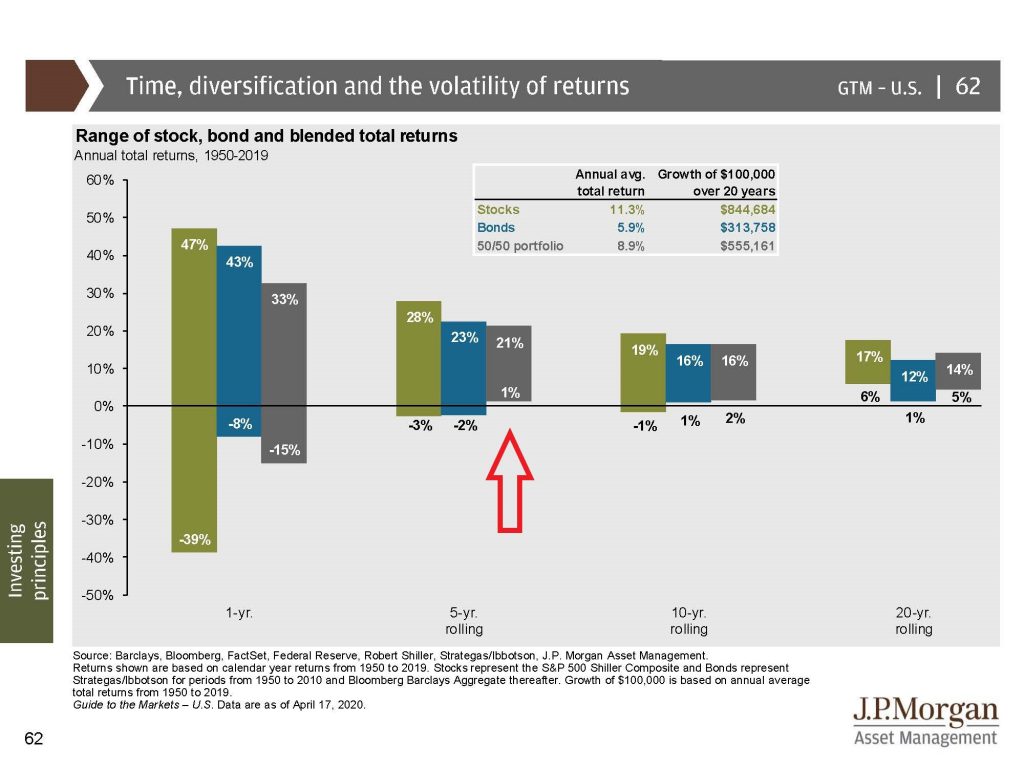

I’m going to put a chart up on the screen and since 1950 a diversified portfolio, a 50 percent unmanaged stock market mix, 50 percent unmanaged bond index. A diversified portfolio has always recovered within five years. It could be different in the future. Does the flu kill people? Absolutely, it does. I heard a statistic and you know this because of everything that we’re going through, killed 60,000, 70,000, 80,000 people in the United States last year. “Mike, isn’t that very similar to a portfolio. We’ve got to make sure that we don’t kill ourselves.” Yes, that’s why you have to go into it very healthy. You can reduce that probability of that happening of dying from the flu, but you can’t eliminate it.

What if I told you that at least historically a portfolio has always come back. It has always come back. And in order for you to die, everybody else has to have died as well. Unlike the flu when it would be just you, if you have a diversified portfolio you might get sick and everybody around you might get sick. But in order for you to die then everybody dies and then what’s the whole purpose. It’s the same way with a portfolio. In order for your portfolio to go down to zero, if you’re diversified with hundreds of stocks, maybe thousands of stocks within a mutual fund or bonds or various investments, marketable securities, all of them have to go down to zero and everybody that you know, everyone around would have gone down and we are in a real Armageddon situation.

Please, I recommend that you look at my last video. Do you arrange your entire life, your whole portfolio, around the absolutely worst case scenario of everything going down to zero in that incredibly unlikely, but possible, situation? My answer would be absolutely not. And, if so, I’m probably not your guy because I think that makes no reasonable sense.

Just like you need to be healthy in your body, you need to be forward thinking – you have to be healthy in your portfolio. Some people are not. Some people just never think about it. They don’t care what they eat, they don’t care about exercise. When they get sick they load their body up with lots of chemicals. They’re very reactionary. That’s not the way I think things should be. It’s very similar to a portfolio. They’re reactionary and they’re freaked out and they’re doing all kinds of crazy things in the midst of all their emotions. They’re thinking with their stomach, not with their head. Those of us who are thinking with our heads have already thought about it. We know it’s going to happen. Great. I don’t know how long it’s going to last just like I might not know how long my cold or my sneeze or my flu is going to last. But I have high confidence because I’m healthy going into it that I will emerge from it and then move on with my life. It’s no different with a portfolio.

Mike Brady, Generosity Wealth Management, 303-747-6455. You have a great day. Bye bye.