Math and Humility

“There is nothing noble in being superior to your fellow man; true nobility is being superior to your former self.” – Ernest Hemingway

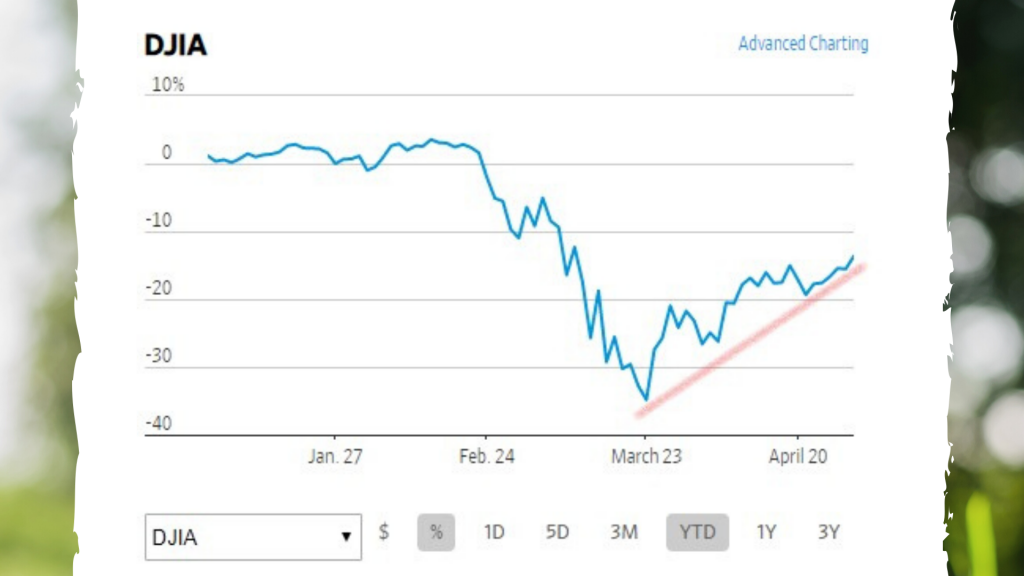

The market took a deep dive as the Coronavirus pandemic broke loose, but contrary to what many pundits believe would happen, the market is rebounding quite well so far. We have regained a significant amount of what was given up at that time. Let’s take a look at the math, it’s important to know how it works. And we’ll also talk humility – the future; it is inherently unknowable.

Transcript

Hi there. Mike Brady with Generosity Wealth Management, a comprehensive, full service financial services firm headquartered right here in Boulder, Colorado.

It’s about five or six weeks into our stay at home order. Hopefully you’re doing well. I like short hair and my hair is feeling long to me, but other than that I’m doing well and I certainly hope that you’re doing well as well. I am going to make this a relatively short video I just want to talk about where things are currently, what’s kind of happened in the last couple weeks since I last spoke with you. A little bit of humility speaking about the importance of humility and then we’ll kind of wrap things up for today.

So, up on the screen is a chart as of today and what you’re going to see is in the last month, you know, four/five weeks ago we were at our lowest for the year and at that time there were lots of pundits who were saying that the market is going to continue to go down and down and down and, of course, they were wrong. We’ve regained very quickly a significant amount of what was given up at that time. I think I mentioned if you go back to my video at the end of March and the beginning of April I talked about that when things are the most uncomfortable is when some of the most successful investors invest; Warren Buffett says to be greedy when others are fearful. And at the end of March was a very fearful time and really, at least so far from what we’re seeing in that on my stock market index, a great time for you to have bought in.

From a math point of view it is important to know kind of how the math works. If you have $100 and you lose 50 percent, that’s $50 left. In order to get back to you even you have to make 100 percent, $50 on the $50, just to break even. If you lose 20 percent, in order to break even to go back up you have to make a 25 percent. This is important because we went down almost 40 percent. It’s going to take quite a number of percentages if you’re just adding the percentages per day in order to break even. We are definitely on the right track. The momentum is there. There’s been an awful lot of reasons given in the last month for the market to recover how nicely how it has done. None of them are exactly right and none of them are exactly wrong so this really leads into my conversation around humility.

I watch the news all day long, I mean on the screen, I don’t watch it on a TV I watch it and I read it. And the headlines and the reasons I see them change all day long every single day and because of that I’m cynical that anyone has exactly the answer. If we went back I could sit here and show you day by day how the market is up because of renewed optimism and then the next day the market might go down a little bit and it’s like renewed pessimism. I mean really all in the same day? Within a day or two? That’s ridiculous. I think that it is more important to stick to the plan, have that long-term and get out of the way than it is to have an exact reason or an exact answer for why something went one way or the other. When you’re investing for a week or a month or even a quarter you’ve got to be right. You’ve got to call that thing correctly. When you’re investing for multiple years, five years, ten years, 20 you don’t have to be quite as accurate in the short-term. Of course it’s better to have good luck and get it at the bottom and the low and that adds to it, don’t get me wrong. But it’s important to be invested in it as well, particularly when you look back from two, three, five, 20 years from now.

So, having humility is very important. If I was to say exactly what the weather is going to be like next week you would say “Mike you might have a good idea but you’re crazy.” Why? Because I’ve seen weathermen be wrong so many times before. Well, I’m just telling you that people who tell you exactly what’s going to happen are also like the weathermen who profess to know with great confidence exactly what the future holds. I’m just saying I don’t buy into that and hopefully you never hear that from me as well. I always hedge my language by saying this is what I believe, here’s what I think and that kind, but it’s about the future; it is inherently unknowable.

Mike Brady, Generosity Wealth Management, www.Generositywealth.com. Have any questions any concerns give me a call.

I will send another video out in a week or two or if something really big happens. Always stay tuned because if something momentous happens I want to be there in order to explain it and kind of get through all of the noise of the TV and all that chaos to say this is what it really means and this is why it may or may not be important. Thank you. You have a wonderful day. Bye bye.