The big lesson for 2020, because it is an election year, is to keep our politics out of our investments. We give whoever is in power, our particular politicians and our president too much credit and too much blame. In this video we’ll take a look at 2019 and how it’s been in comparison to years previous. Don’t expect any predictions about 2020, I don’t know the future any more than you do. The best thing that I can do is counsel you on how we can increase the probability of positive outcomes. How can we set things up to take full advantage of the favorable conditions if they’re forward, watching and keeping control of our emotions if they’re not.

Check out my full video review:

________________________________________________________________________________________

Transcript

Hi there. Mike Brady with Generosity Wealth Management, a comprehensive, full-service financial services firm headquartered right here in Boulder, Colorado. Recording this on the evening of Friday, December 27. It’s my year end video and there’s still one and a half business days left – Monday and Tuesday, but I figured we were close enough. Assuming nothing major happens on the last day and a half we’re good to go for a good conclusion for 2019 which is one of those years that we all live for.

As we look back at the unmanaged stock market indexes over the last three or four years we had 2015 positive, 2016 positive, 2017 positive, 2018 negative and 2019 positive. Historically for a four-year presidential, the year that’s the election year it has historically been positive, more than 50 percent, but more subdued than the other three years. Who knows? I mean that’s the thing is you’ve got to have a long-term strategy. You don’t do things month by month or year by year.

As a matter of fact I would say that the big lesson for this next year because it is an election year is let’s keep our politics out of our investments. If you are pleased with the current president, you’re happy and you’re saying it’s a big mandate on his policies of 2017 but then in 2018 it flipped–it was sharply negative. And then 2019 it’s sharply positive. I mean I think that we give whoever is in power, our particular politicians and our president too much credit and too much blame. I can have that argument with you not today over this video. All I can really say is when you’re watching news all day long you’re going to come away thinking that everything is politics and it’s just not true. There’s a bigger world than that. And you’re going to come away thinking that everything has an answer. You look up at the clouds in the sky and our mind looks for patterns, makes that bear or that nice sheep up in the sky when it really isn’t there. Well, journalists have a tendency to say the reason why this happened – it went up, it went down, whatever, it was volatile, nonvolatile was because of this. Take it with a grain of salt. It’s just not quite as simple as they would led you to believe in the few minutes that they have on TV.

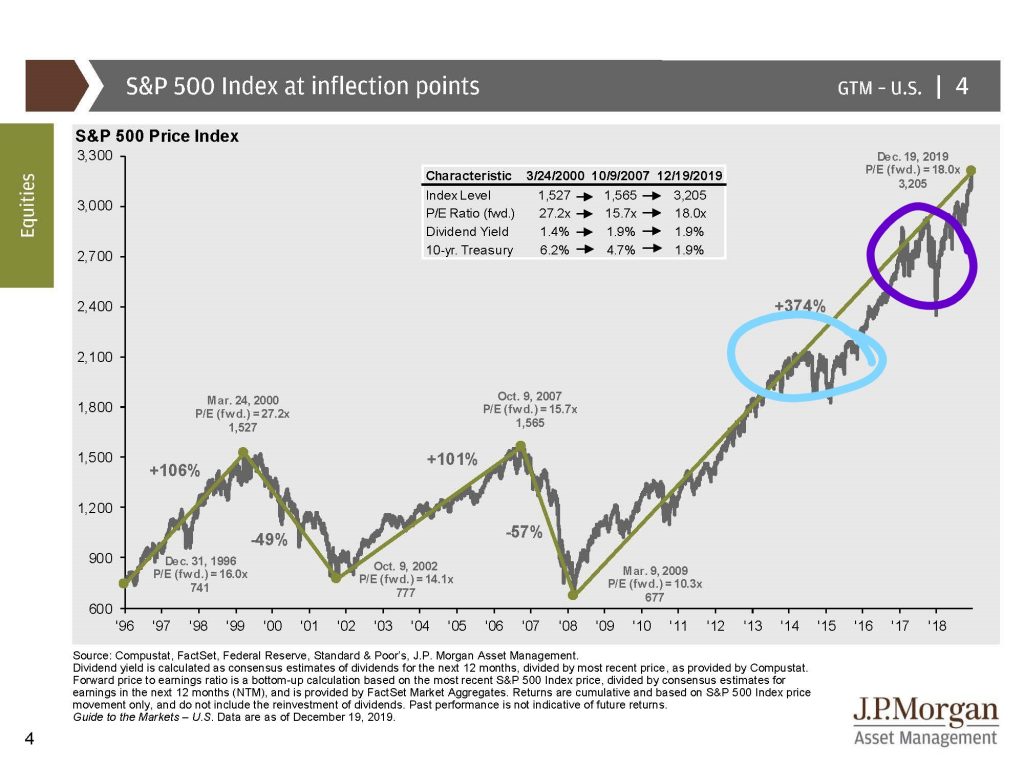

I’ve got lots of charts today that I want to share with you because it is the end of the year. This is a chart I’m putting up on the screen for the last number of years since 1996. You’re going to see I did a couple of circles on the far right-hand corner. You’re going to see a huge runup going all the way up from 2009 to the present. You can see that I did it in blue there. There were a couple of years where it was kind of stagnant and then we had a big upswing again. And then you can see there in 2018 it was kind of sideways again.

If you only focus on those as your whole focus, your investment strategy is to avoid the downturns then you’re never going to have the upturns in my opinion. So, you can’t look at it that way. I mean who goes into a friendship saying well, I don’t really want to have this person as a friend with all the good times because I’m worried that we might have an argument. I mean that’s ridiculous. Don’t treat investments the same way. You don’t go in so fearful of some of the negative things when on balance I would argue the positives outweigh the negatives.

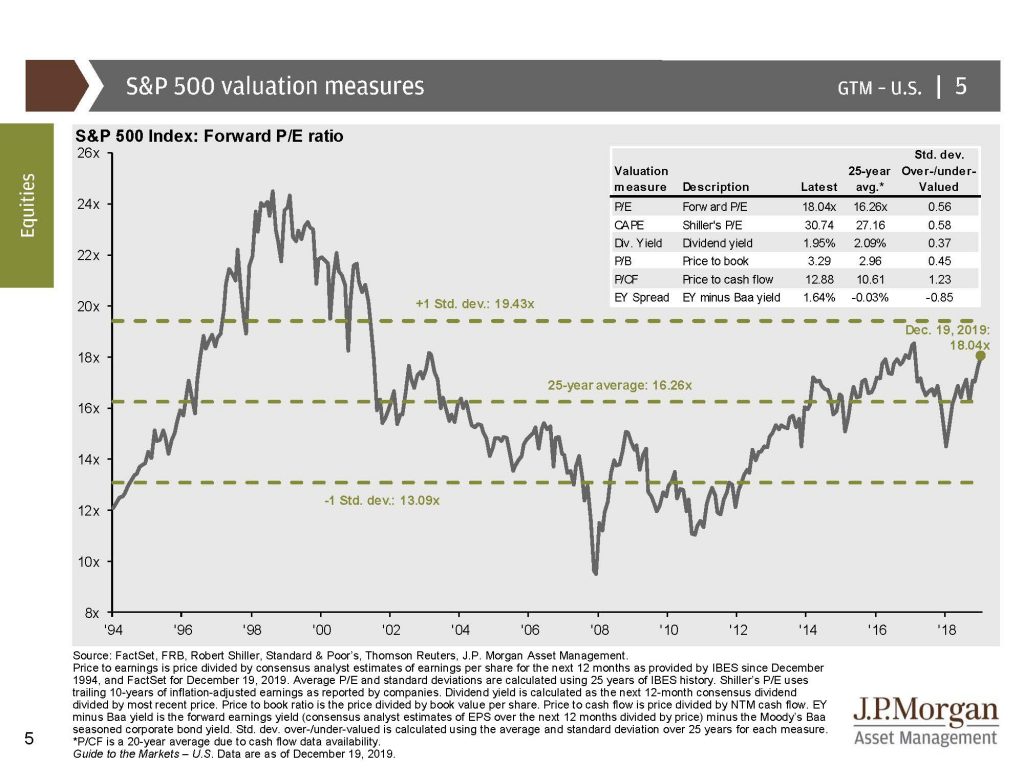

This next screen you’re going to see is corporate profits are positive so I just want to talk about how 2019 was an incredible year and the corporate profits continue going forward and with the earnings estimates as well. You’re going to see that the S&P valuation level – this next chart on the far right-hand side – it’s nowhere near where it was in the late 1990s. I’ve heard a few pundits on TV talking about is this right before a big bubble and the huge valuations after a big runup in the stock market. The answer is they’re nowhere nearing that. From my point of view it’s trying to compare apples and oranges, make a story where there is no story.

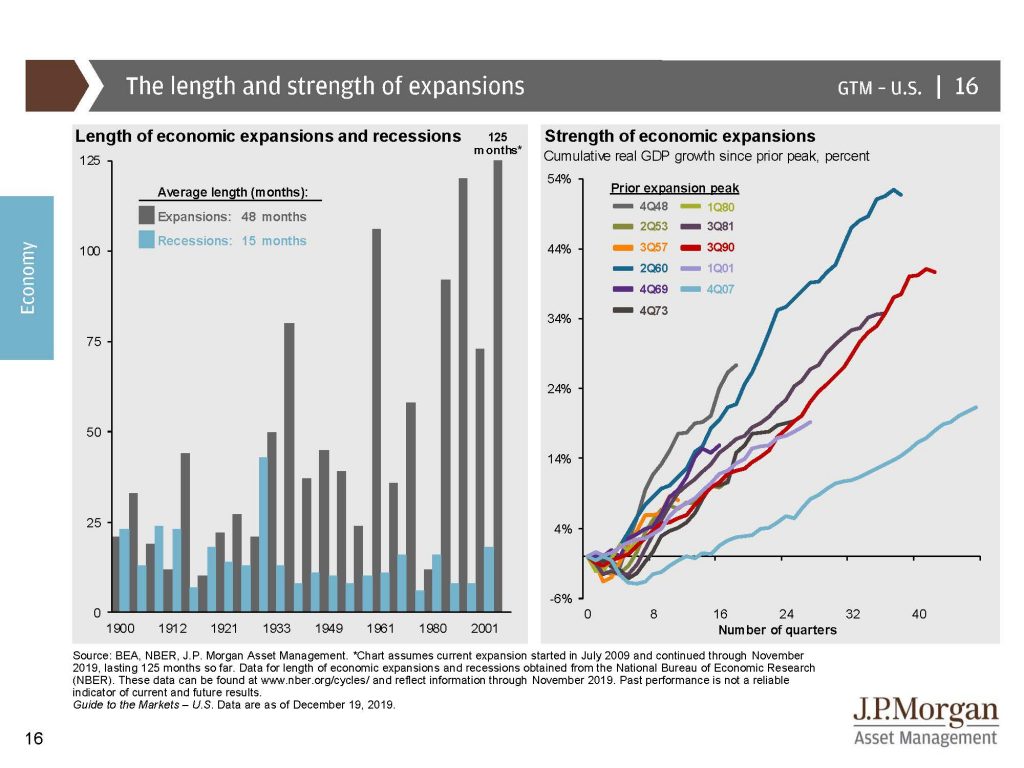

The next graph I’m going to throw up on there is on the right-hand side you’re going to see that bottom line there. That shows our current economic expansion after a recession compared to many, many different recessions going back 60, 70, 80 years. What it shows is that we’ve had in comparison to other recessions since 2008 a relatively mediocre recovery from an economy point of view even though we’ve had a great stock market. The economy is not the stock market. I’ve made that argument in previous videos but from an economy point of view it has been relatively mediocre, not quite as hot as previous recoveries but it has been longer than the other ones as well.

So, maybe that’s better. I mean frankly when we add it all up when we have a recession in the future we’ll look at it and historians will say wow, it was warm but much longer, twice as long. Maybe that’s better than having it super-hot for a shorter amount of time. Only time will tell but that’s what we have right now and have had for the last 11 or 12 years or so.

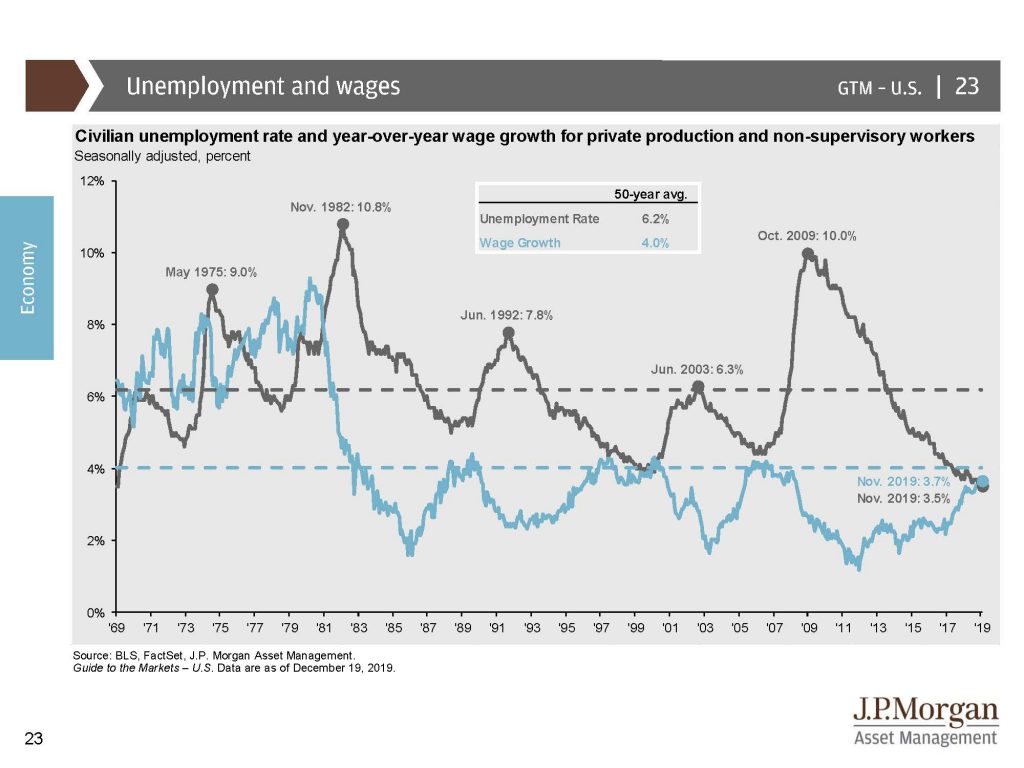

Right now look at this next chart. You’re going to see unemployment and wages on the far right-hand side. We are at a historically very low unemployment which is a great thing. Just a decade ago we were at ten percent unemployment and now we’re at two or three percent. This is a great thing. And over the last seven or eight years or so we have had wage growth increase, particularly in the last two or three years. That’s just kind of the way it works out. I definitely don’t give any party in power all that credit. It just doesn’t work out that way.

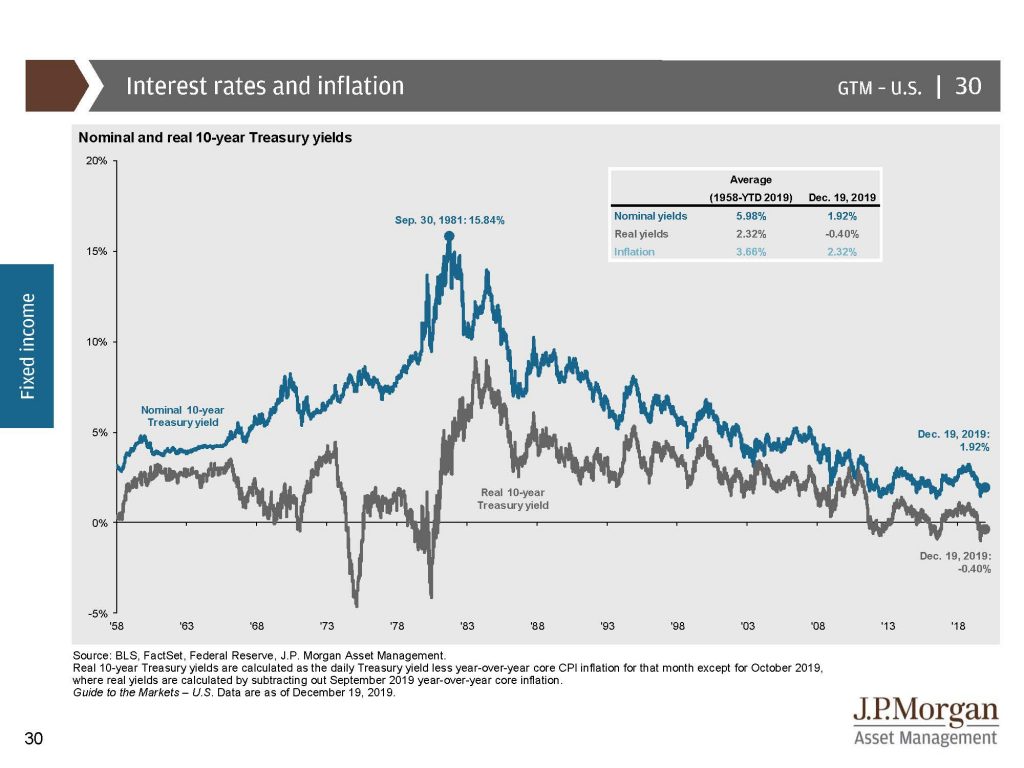

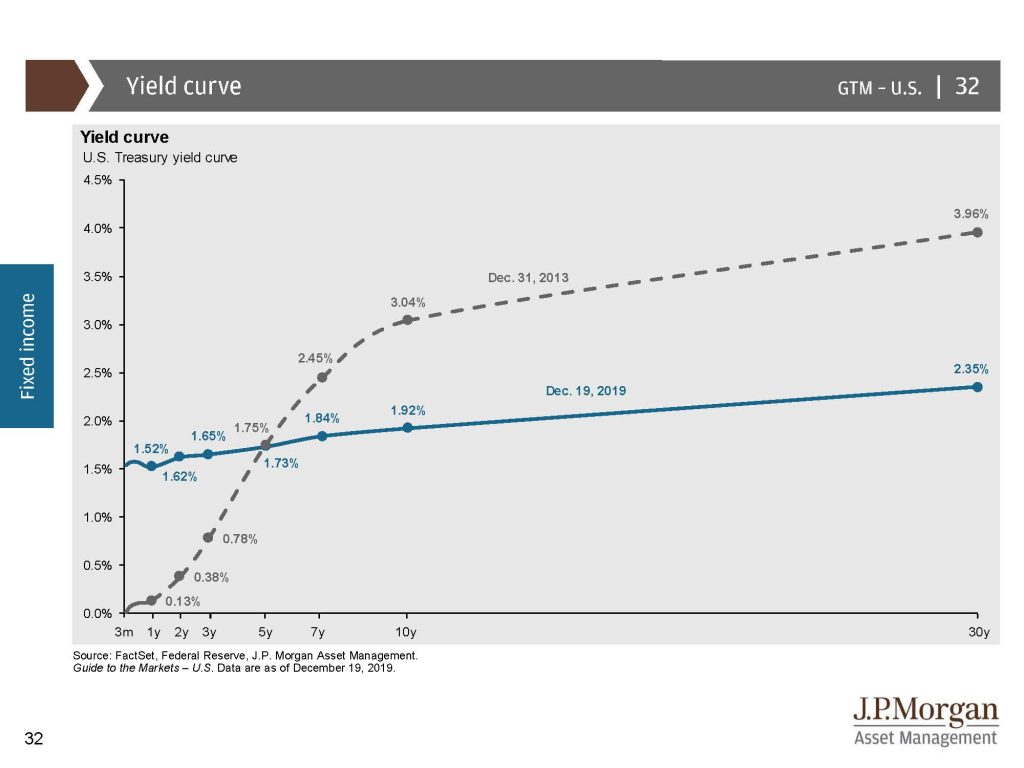

The next chart up there I want to talk about is the interest rates and inflation. You’re going to basically see that we have inflation at incredible lows right now which is a good thing. And the last thing that I want to show before I get into a little bit of analysis is the yield curve. The reason why I want to show this yield curve to you is all summer for two months all we heard about is a yield curve and how the sky is falling and how it’s the most important thing in the world. And when is the last time you’ve heard someone talk about the yield curve? It’s quite frustrating from my point of view at times when I hear these pundits or when I hear people talk about the pundits is that they’re always coming up with predictions and many of them are wrong, and yet people still listen to these particular pundits.

One of my colleagues said something I thought was pretty funny the other day. He said yes, sometimes they’re right, sometimes they’re wrong but they’re always certain. And that’s so true. They’re always so confident in their prediction where I believe the long term from an investing point of view and reaching your financial goals you need to have some humility. Hey, I believe this is what’s going to happen. There’s lots of different variables in the equation but you know what? Maybe I’m wrong. That’s the point.

Getting back to long-term success, it’s not just one year. I mean while this is my 2019 year end review listen, we’re not investing for a year. We’re investing for multiple years. I don’t care if you’re in your 70s or 80s. Hopefully you’re not going to die in the next year. I mean you still have to ensure that you don’t outlive your money. So we have long-term strategies and you’ve got to look at it that particular way as well. Here we are talking about one year but goodness, it needs to fit into a whole strategy.

One of the things that I do for all my clients is a financial plan. Where are we going? How are we going to get there? What are the variables we can control and what are the variables that we think we can control but we really can’t. A great example would be we can control how much we save. We can control when we retire. We can control on what income we retire at that point. How much we want to draw out in the future, what kind of a lifestyle.

Things that we don’t control are when we’re going to die. We think we’re going to maybe live 15 and we live 25. We think we’re going to live 25 and we live 15. We don’t know that. While we try to control the rate of return and there’s so much focus on it, that is something that we don’t have control over. We can try to control the band, the upper limit, the lower limit. We’re going to try to control that with various risk levels and investments and a balanced portfolio, et cetera. But that’s something that we just don’t have control over.

I like to focus clients – and I’m going to continue this next year on focusing on what are the variables that we have control over to increase the probability that we’re going to meet our particular financial goals whatever they might be. That’s it.

One thing you’ll notice is that I’m not giving any prediction about 2020. The one thing I’m going to give a prediction on is sometimes the market will go up and sometimes it will go down. We’re going to talk about politics all year long and half of America is going to be happy at the end of the year and half are not. That’s about as close to predictions as I can give this year. I don’t believe that it’s in your best interest to become – I could sit here and give a falsely positive of course it’s going to go up and this is the reason why. And that might be what you want to hear, but I would be disingenuous if I did that. I could be very negative this year but why would I want to do that. Three out of four years historically have been positive. I could be negative. I could get you fearful. I could get you in defensive strategies and things of that nature. But you know what. I don’t know the future any more than you do. The best thing that I can do is counsel you on how can we increase that probability. How can we set things up to take advantage of things. The favorable conditions if they’re forward, watching and keeping control of our emotions if they’re not.

Mike Brady, Generosity Wealth Management, 303-747-6455. You have a wonderful day and a wonderful 2020 year. Bye bye now.