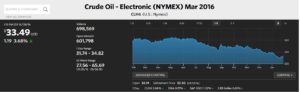

The S&P 500 is now almost perfectly correlated to the price of oil, which is interesting because over the past decade they’ve had virtually no correlation.

Energy only makes up 3% of the economy.

So why the focus?

- Falling prices often signal softness in demand, which precedes an economic slowdown. But, most believe this is a supply glut, not weakened demand

- Cheap oil is causing US Oil production to cool off, hurting energy companies and states heavily dependent on oil

- The threat of Oil Loans imploding (raises the risk in the banking sector

- Russia, Venezuela, Brazil, and others that rely on oil exports could lead to an emerging debt crisis

- Fresh doubt about whether the Federal Reserve will be able to raise interest debt

Click here for the full article