“The dangers of life are infinite, and among them is safety.” — Goethe

Life is full of risks. Every time we get in the car, there is that slim possibility that something could happen. Same when we fly, though the odds are smaller, there is always a chance that tragedy could strike. So, do we just stay home? Well, aside from our current unique stay-at-home orders, most of us would say there are actions we can take to minimize the travel risks, thus the overall risk is low, so let’s get to where we want to go.

Then how do we take these particular lessons into our investing? I found that people don’t talk about risk very much unless there’s lots of volatility on the downside. Nobody ever minds making money quickly. It’s only losing money quickly that people seem to have a problem with, which is natural. The question is “do you not invest because you’re worried about the downside?” I would say no, you don’t. You do everything you can to try to reduce the probability of that happening and prepare yourself for it.

Transcript

Hi there. Mike Brady with Generosity Wealth Management, a comprehensive, full service financial services firm headquartered right here in Boulder, Colorado.

Today I want to talk about risk – mitigation, elimination, what risk do we want to take on, et cetera. Let me start off by saying that life is full of risks. When I leave the house and I get into my car I assume the risk that I could be involved in a car accident and the absolute worst could happen which is I die. Now, that probability is very small and I go through a very fruitful life taking that risk on. I do everything I can to minimize that risk, but that’s a risk that’s greater than zero. It’s the same thing with getting into a plane. I have a very good life. I go and visit family. I go and travel the world, but I take the risk that the plane could have a problem and crash in a spectacular fashion. I’ve decided that I’ll take that risk because it’s a very small probability.

Well, how do we take these particular lessons into our investing? I found that people don’t talk about risk very much unless there’s lots of volatility on the downside. Nobody ever minds making money quickly. It’s only losing money quickly that people seem to have a problem with which is true. I mean me too. I’m no different.

The question is “do you not invest because you’re worried about the downside?” I would say no, you don’t. You do everything you can to try to reduce the probability of that happening or prepare yourself for it’s a part of it but yet is the probability much greater that the desired outcome that I want will be there for me. In my example of the car of course you put your seatbelt on and you have the airbags. You drive at a reasonable speed. These dramatically reduce the probability of that really horrible outcome.

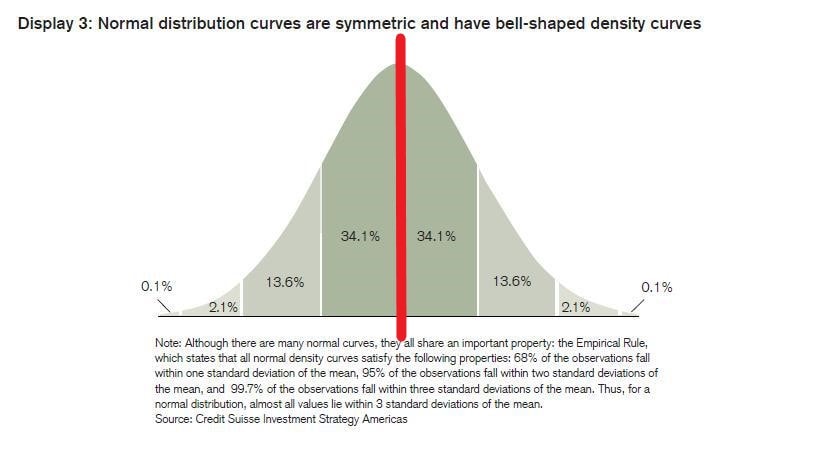

I’m going to put a chart up on the screen, kind of a graph up on the screen and what you’re going to see is what we call a probability bell curve. You can see that it looks like a bell and the vast majority of the events happen right there in the middle. I’m going to put a red line in the middle and that is the breakeven. Half are to the right and half are to the left. Way out on the far right and far left are what we call tail events. That means that not very many instances happen there on the right and the left. When you’re listening to the news or reading the news and they talk about tail events that means that they’re very infrequent but perhaps very big events that happen.

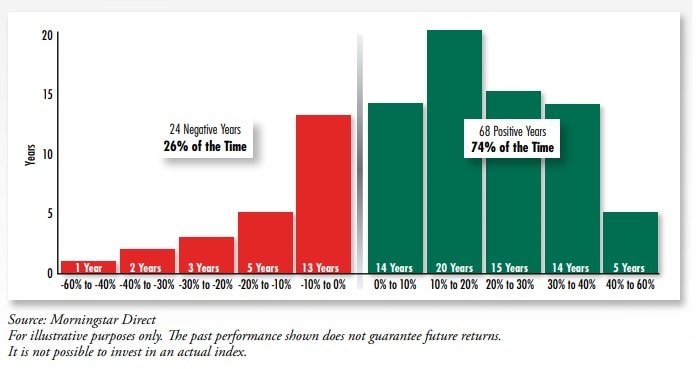

I’m going to put another graph or chart up on the screen and this is going all the way back to 1926 through 2017. What you’re going to see is on the right hand side are the number of positive years. On the left hand side are the negative years for the unmanaged stock market index. You’re going to see that unlike the first graph I showed where it was very evenly distributed of 50 percent to the right and 50 percent to the left, it’s actually 75 percent, about three out of four on the right which is positive. Only one out of four is on the left. You’ll see that the far left there’s only been a couple of years of more than 50 percent or greater which is just absolutely horrible. The real tail event. We didn’t even reach this particular year although it was very quick, a very bad month, a very bad quarter in the stock markets and all the investments, but it’s very infrequent that it happens.

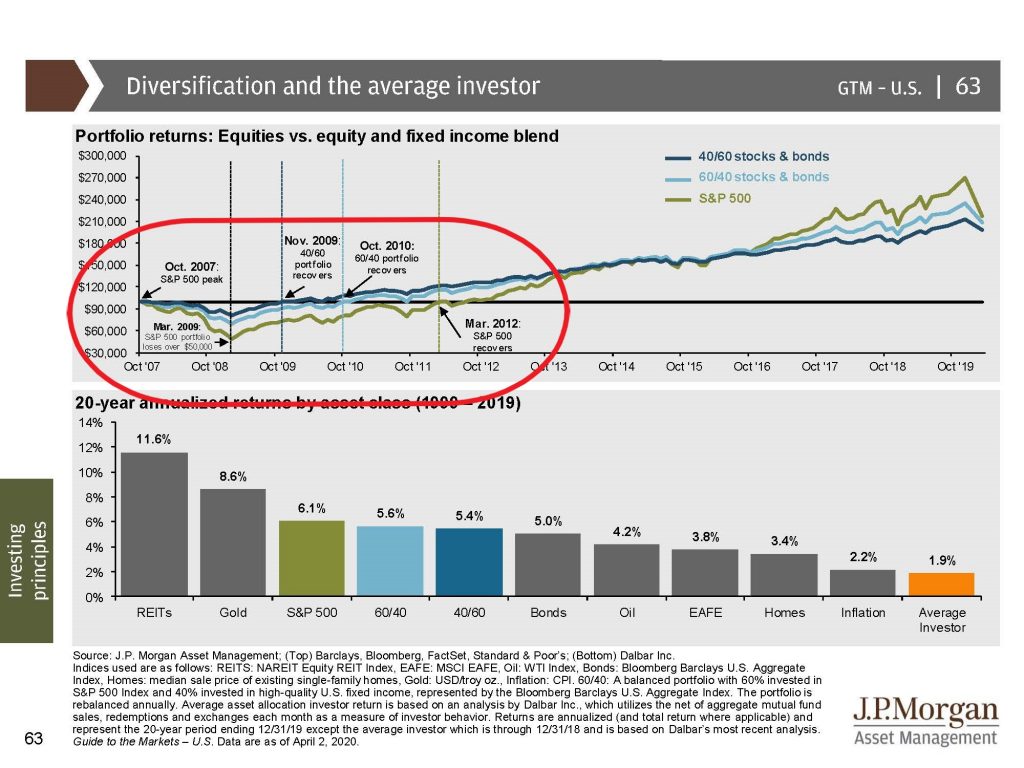

The question is how much energy do we put and how much money do we put towards avoiding something that is very infrequent which I’m going to put another chart up on the screen. You’ve seen this before because I use it all the time which depending on whether or not you have stocks or bonds or equities your breakeven at least from the last big tail event was a breakeven of two to five years.

How much effort and energy do you put toward something that is from a long term point of view relatively short and very infrequent? I would argue that you shouldn’t spend too much time. There’s some people who say yes, you should. You should always do what you can. When I go out in my car I should go out in a tank because that is the way that I can really make sure that nothing bad happens to me and that I’m able to walk away from it. Well, there’s some disadvantage to that of course. Only an unreasonable person thinks that there are no disadvantages to it. It’ll be slow, it’ll be heavy, it’ll be costly. Lots of things, but you’re almost guaranteed that you’ll be able to walk away from it.

In this particular case we’ve had a very bad incident happen in the markets in the last month or two, and I’m going to talk about the economy in just a second. Very infrequent, very painful, but in my opinion very recoverable. The question is when will it be recoverable and that will be still to see. In the last 40-50 years we’ve had four events like this so about one every ten years give or take something like this happens. If you have a diversified portfolio it has recovered within five years.

What are the things we could do? What’s our seatbelt? One of them is to not invest in individual stocks. They sometimes go down and never recover. That absolutely happens. So being diversified is very, very important. Having the right time horizon is very, very important. Even if you’re 60, 70, almost 80 hopefully your time horizon is long. Because going from Point A to Point B, Point B is not retirement. Point B is not outliving your money. It just happens if you retire in between there happens to be another point in there. That’s an event along the line from Point A to Point B. It’s important for us to know what are the risks that we’re willing to take and what can we do to mitigate those particular risks.

I’m very concerned about the economy. You’ve heard me and I highly recommend you look at the last two, three, four videos. I’ve done nine I the last eight to nine weeks because it’s so very important to communicate with you. I’m concerned with the long lasting impact to our national and our global economy and we don’t really know the impact of that even as we’re here in the first week of April. All of the unemployment, all of the small businesses. This is going to be impactful for a very long time. However, as I’ve made the argument in my videos the investments and the economy are not necessarily the same. The question is how much have we already priced in forward looking into the economy. That’s a big question that I still think is out there. I think we have some volatile times ahead of us, but I also think that at least from the stock market point of view, from the unmanaged indexes and things of that nature I think that we’re going to particularly over the next year or two get out of the big shock to the system that nobody really saw even two, three months ago.

My name is Mike Brady, Generosity Wealth Management, 303-747-6455. Give me a call at any time. I’m here at my home office as you can see. I’m staying at home like everybody else but I’m always working. You have a great week, a great weekend. I’m doing this on Sunday so I’m not sure when I’m going to get it out but nonetheless have a great day. Bye bye.