“The goal isn’t more money. The goal is living life on your terms.” – Chris Brogan

Amidst dynamic market shifts, we remain focused on long-term investment goals. Over the past years, we tackled volatility, geopolitical tensions, and economic disruptions by adhering to a broad-minded and long-term approach. By embracing the power of long-term investing and recognizing our biases, we’ve weathered storms and continued to make sound choices that reflect life goals. While we cannot predict the future with certainty, I am confident that our diligent research, robust risk management practices, and unwavering focus on your long-term goals will continue to guide us through both favorable and challenging market conditions.

As we move into the second half of 2023, I invite your engagement, if you have any topics you’d like me to address or concepts you’d like to understand better please let me know! Together, let’s navigate the journey ahead and seize opportunities to be generous with yourself, your loved ones, and your community!

Transcript

Hi there. Mike Brady, Generosity Wealth Management, a comprehensive, full-service financial services firm headquartered here in Boulder, Colorado. It’s now the middle of the summer, at the end of June, or kind of the beginning. I just wanted to do a recap of not only this year but also maybe the last two to three years to bring us up to where we are now so we can put it into a larger perspective.

So, 2019 was a good year for the unmanaged stock market index. As 2020 hit, we had a huge decline once the COVID shutdowns hit. We dumped a lot of money in as a government, as a world, and gosh darn it, 2020 was a great year. Go figure. In 2021 we threw more money in, trillions of dollars, and that started to have an inflationary impact. We had a good year in 2019, a good year in 2020 as well as a good year in 2021.

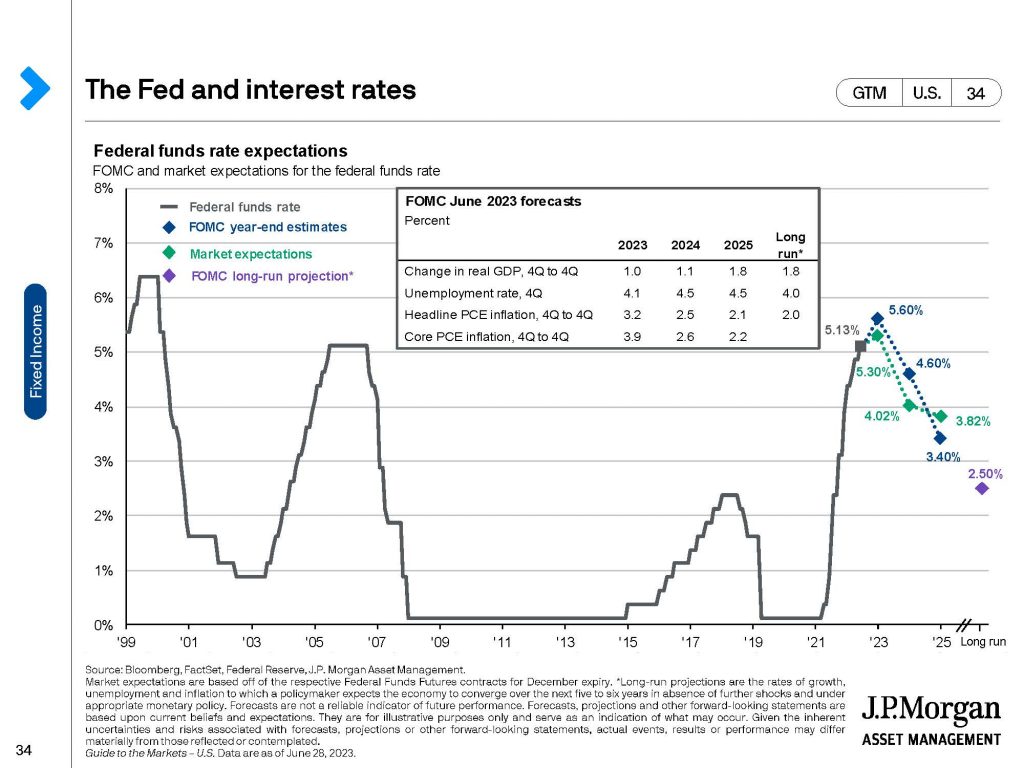

In 2022 we started off the year – that was last year, and the Fed said hey, we’ve got these inflation problems. We’re going to start raising interest rates very quickly which is what they did. There’s a huge shock to the system, but I would also argue that we threw a lot of money into the system in 2020 to paper over some of the issues. You can’t just slow down a huge economy, a world economy, and expect positive returns. In 2021 we dumped a lot of money in when we created demand, but the supply chain issues were not resolved. So, we had restricted supply. That led to some of the inflation, which then was sharply addressed in 2022. Then in 2023 we’re still addressing that, but not in the same way that we did in 2022. The first nine months, three-quarters of last year in 2022, were sharply negative. It was not fun at all. You know this.

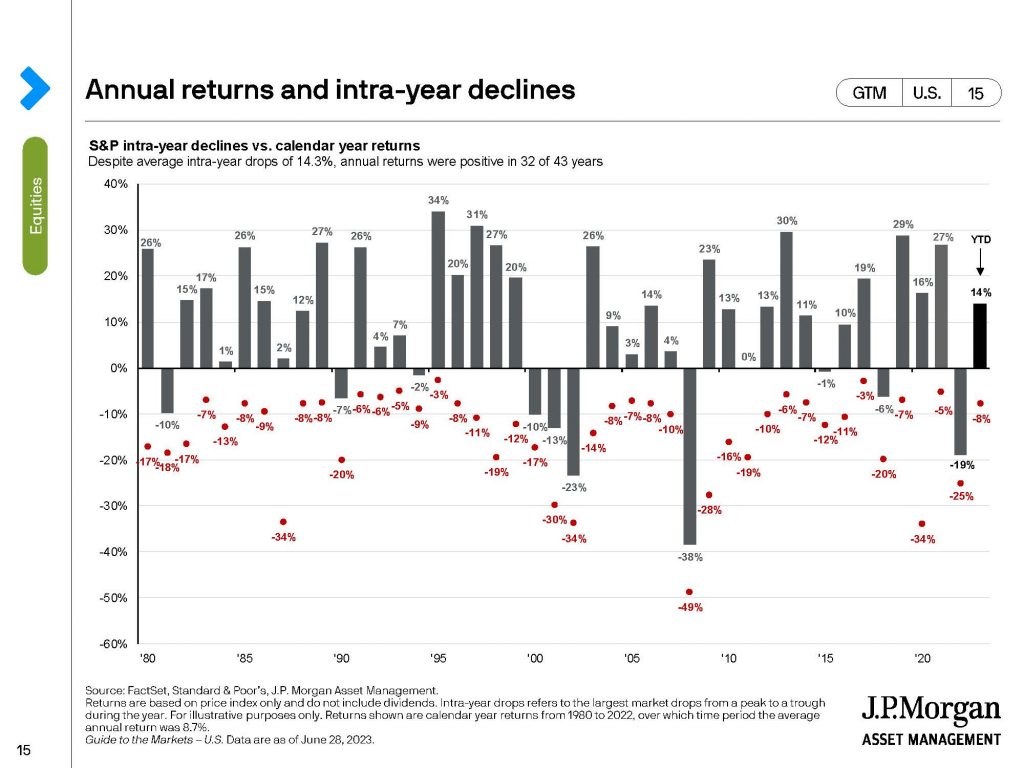

If you look back at my quarterly saying hey listen, these things happen every once in a while, and this too will pass. At a certain point, this is an overreaction, and I believe that the first three quarters of 2022 was giving up what we shouldn’t have gotten in 2020 and 2021 which we papered over. We put a bandaid on with a bunch of money flowing in which had its own repercussions. Since the fourth quarter of 2022, positive for the unmanaged stock market indexes. The first quarter of 2023, this last quarter of 2023 as well, the second quarter, was a positive one. That’s nice. We’ve got three quarters in a row of positive returns.

Up on the screen you’re going to see a longer period. Depending on the unmanaged stock market indexes and what someone’s portfolio looks like, it’s one-third to one-half of what was given up in last year 2022.

When we look at the unmanaged bond indexes they have not come back quite as quickly which is very frustrating. It’s unique that bonds and stocks go down at the same time in the same year and 2022 was that perfect storm. They haven’t come back quite as nicely because interest rates haven’t gone down quite as nicely as we would like.

When you look up on that screen what you’re going to see is interest rates are projected to decrease over the coming months. Yes, there might be another increase or two, but pretty much everyone and some other comments from the Fed have led us to believe that the opposite of what led to such a bad outcome in 2022 will be a good income in 2023 and 2024 as interest rates then go down.

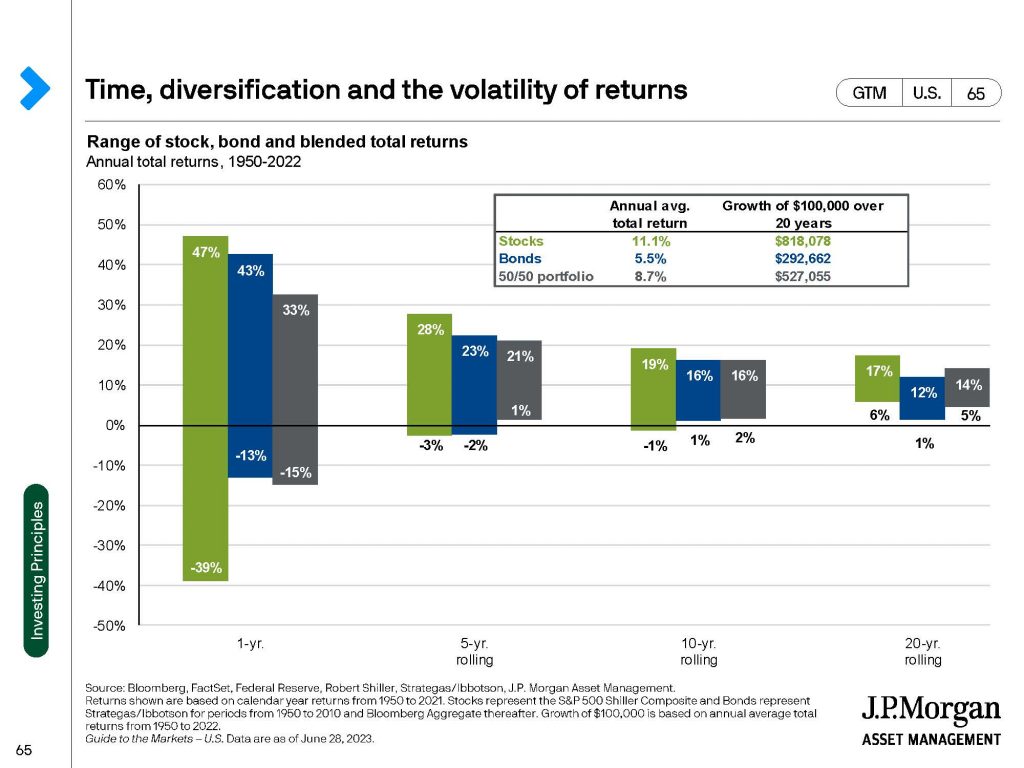

When we look up at the screen, you’re going to see one, five, ten, and twenty years mixed mash of stocks by themselves is that bar on the left-hand side, bonds by themselves, and then the third bar in each one of those categories is a mix of stocks and bonds, unmanaged bond indexes and stock indexes. What you’ll see is over five years, there’s actually never been a five-year time horizon where a mix and match of stocks and bonds hasn’t at least broken even or made just a little bit of money. So, one year absolutely. Two years, definitely. Once we go out from a three, a five, a ten or twenty year time horizon historically what has happened as the negatives have been offset by the positive with the positive winning out.

When I showed you that first screen – I’m going to put it up here again, three out of four years are positive, one out of four are negative. That’s just the way it happens. Sometimes it’s two years in a row that are negative. Sometimes it’s not three years positive, it’s six years positive. Great. Wonderful. When we start adding them all together, that’s when we get into historically up three out of four years.

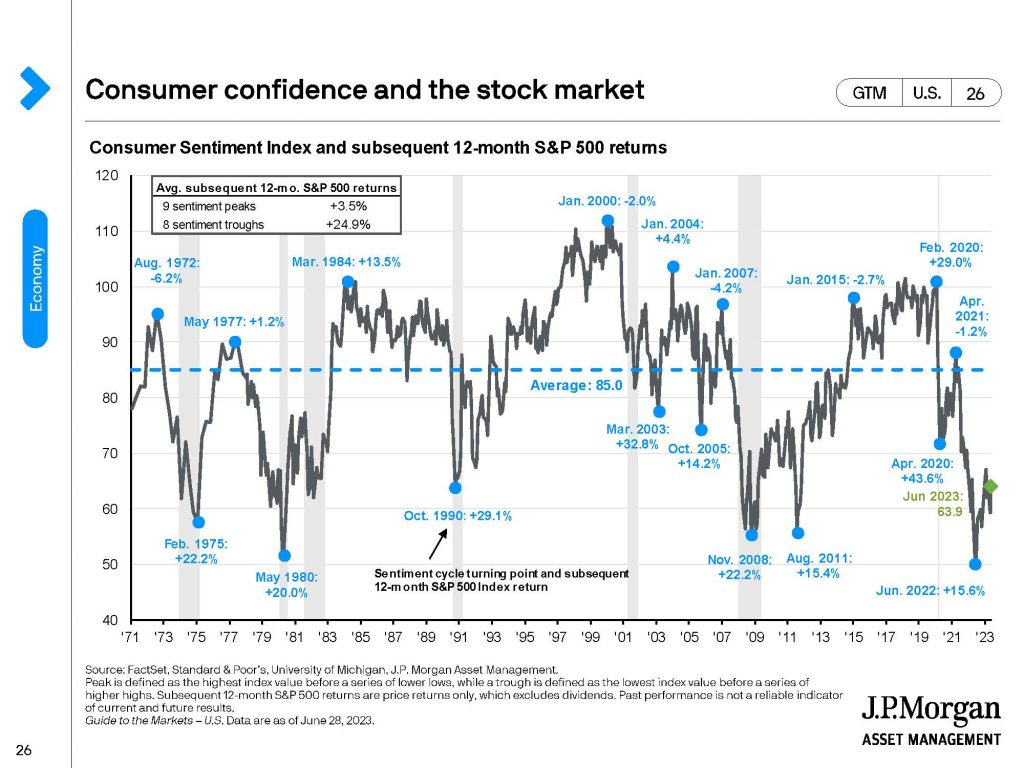

Here up on the screen, we’ve got some consumer confidence starting to rebound. I put a circle around it. The thing that we as investors have to remember is when everyone is feeling great, that’s when you maybe need to worry. When people’s enthusiasm is at its lowest, it’s counterintuitive but that’s when we want to buy. That’s when it might be the best opportunity for us to have that extra investment or to hold tight because maybe the recovery is right around the corner.

Think back over the last year-and-a-half or so, nine months ago. Were you like “god, I wish I had more money I could throw in.” Maybe, maybe not. You’ve got to be in control of your own emotions and understand that when it feels the most uncomfortable is often the time when the recover is right around the corner. That’s historically then the case. Consumer confidence is what we call a lagging indicator. Not a leading one, but a lagging one, meaning that once things are looking great, then everyone feels good. That’s too late. Once everyone feels bad, it’s already gone down so that’s too late as well. The emotions do not lead us to the right outcome or the right path that we want. The first advice that I would give is to be aware of that and to think about it for yourself and many times be contrarian to what your emotions are telling you and give me a call and we can talk it through.

One thing I would like to share, though, as we’re in the middle of the year is I have done for some clients some research on some of the big banks – the savings and checking account rates, and they’re still pretty pathetic, I mean almost zero. If you’ve got a lot of money in a bank it behooves you to do some research. There are CDs, there are money markets, there are treasuries. There are a lot of different strategies and you’ve got to pick the one that’s right for you. You’ve got to do your research, talk with me. I’m just telling you that there’s a lot of different things that are out there that you should explore. A little bit of work can dramatically increase just the cash that is risk-free or practically risk-free.

Normally going from one cash to another cash equivalent, it’s not that big of a deal, a tenth of a percent, maybe a fifth of a percent. Now we’re talking about big variances of a few percent, and that can make a big impact for cash that maybe you want to keep safe, you want to keep on the sidelines. Maybe you’re going to need it in a year or six months or for whatever purposes you might need. You may as well maximize it and especially in the short term. These rates are high right now, but if the interest rates start to go down they will go down as well.

Start to think about your cash and are you maximizing the interest rates on your cash? Of course, you should be maximizing your total return from a long-term point of view as well. That’s what you hear me say every time I put out a video saying we’ve got to have some long-term vision of multiple years, where’s the path we’re going towards, and how are we going to get there.

That’s it. Things are looking good for 2023. The fourth quarter of 2022 was good, and the first and second quarter of 2023 was good. We still have a ways to go to completely wipe away what happened in 2022 and get back to where we were in 2021. Given some time, I feel confident that we’ll be there before we know it.

Mike Brady, Generosity Wealth Management, 303-747-6455. You have a great day, a great summer. Bye-bye.