Time well-spent results in more money to spend, more money to save, and more time to vacation. – Zig Ziglar

In our latest financial market update, unravel the financial landscape of 2023 and hear a balanced perspective amidst the market’s ups and downs. Despite recent losses, the market has experienced impressive growth over longer time frames, reminding investors of the significance of perspective and patience. Dive deep into the impacts of the Fed’s decisions on the bond and stock markets and explore the ripple effects on the real estate industry.

While we can’t control global events or federal decisions, we have complete autonomy over our financial strategies and emotional responses to market fluctuations. Explore the power of perspective and the journey to financial resilience, even in a world of uncertainties. Blend wealth management’s macro and micro-elements in a space where clarity and strategy turn market turbulence into opportunities for long-term growth.

Transcript

Hi there. Mike Brady with Generosity Wealth Management, a comprehensive, full-service financial services firm headquartered here in Boulder, Colorado.

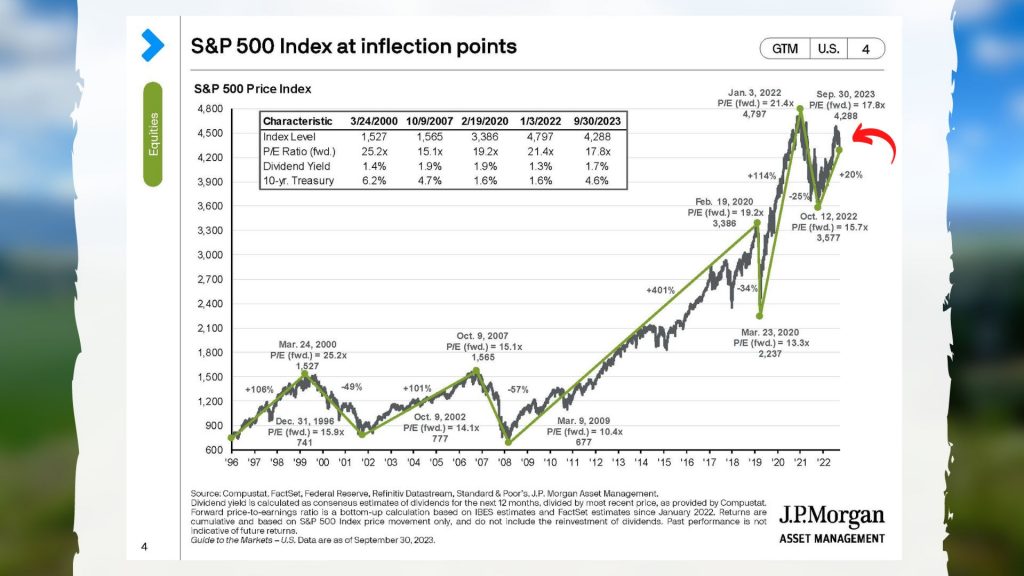

I’m recording this the first week of October and we now have three quarters of 2023 under our belt. Frankly, it was great until about two weeks ago, three weeks ago when we really started to give up much of the gain that we had made in July. July was a good month and then August was kind of a muted month, and September has not been good and so far this first week of October has not been good as well. It’s important for us to remember it’s our timeframe. Are we down from where we were in July? Yes. Are we up from where we were at the beginning of the year? The answer is yes. From a year ago, 12 months ago we’re actually dramatically up. Are we down from where we were at the beginning of 2022, which was pretty much the high, about January 3, 2022, for the unmanaged stock market index, the S&P 500. The answer is yes. But when we go back out that’s about a year, almost two years ago.When we go out three years, four years, five years, ten years are we dramatically up?

The answer is yes on the unmanaged stock market indexes whether it’s the Dow, whether it’s the S&P, et cetera. That’s why we kind of look at it. People are like oh my gosh, it’s down. The answer is yes, it depends on your timeframe, and it’s important for us to always keep the proper timeframe. Is it down for the week and for the month? Yes. Down for the quarter? Yes, maybe. But then we’re looking at years – a year, two years, five years and then even ten years. If you need the money in the short term it’s absolutely relevant, but as we get a longer and farther time horizon the less the gyrations on a daily, weekly and monthly basis have meaning to you. Unfortunately, we have a 24/7 news cycle so it is important for them to excite your emotions on a daily basis – daily, if not hourly.

Up on the screen I’ve put the S&P 500 which is an unmanaged stock market index and you’re going to see where I put an arrow next to the “you are here” and that’s where we are. The Dow Jones which is not reflected on this chart is another unmanaged stock market index and it has actually turned negative for the year. The S&P is positive for the year, Dow is slightly negative.

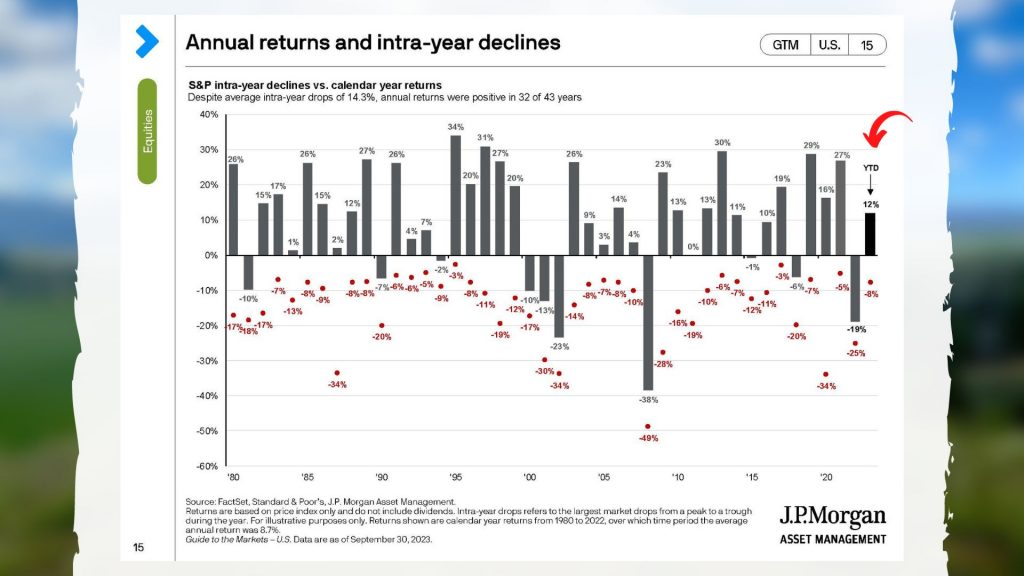

The second chart are annual returns and intra-year declines. You’re going to see that year-to-date number is positive for the S&P 500. The red numbers are during the year how much is given up from the top to the bottom within the year, so it’s called an intra-year decline. It is normal. You look at all those red numbers down there and you’ll see that it’s normal for there to be ups and downs within the year. When it happens, let’s not freak out. It’s normal. It’s always difficult as a human being to not extrapolate out. If everything is going up, you feel that it’s going to go up forever. If it goes down you feel like it’s going to go down forever. We look for patterns and we look at the clouds in the sky and we’re looking for little puppies and other things in the clouds when really there’s nothing like that. We see patterns but we can’t create patterns that might not be there.

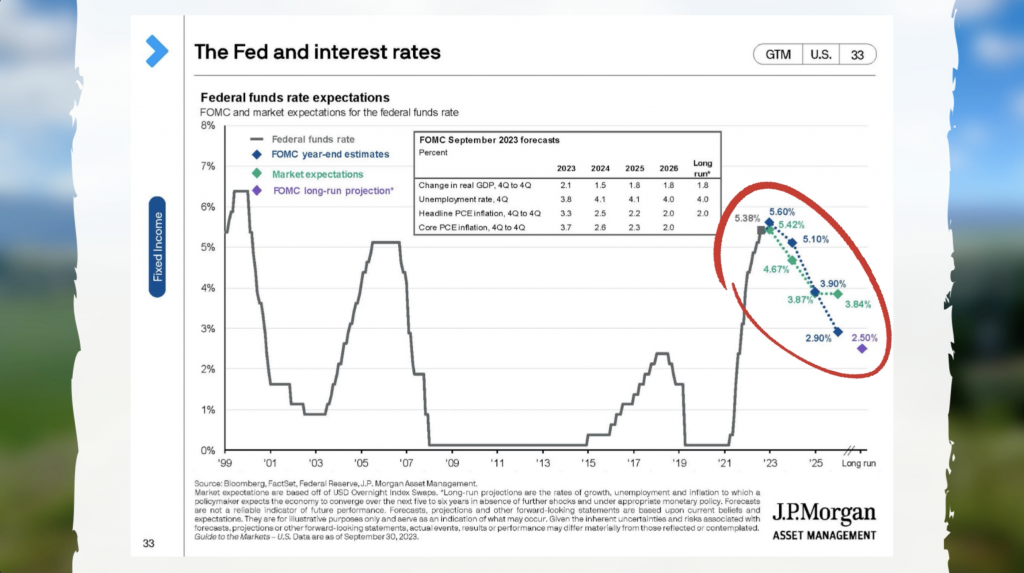

I think the big thing to watch out for is the Fed. I’m pretty irritated at the Fed. I’m by no means the only person. They waited too long to do something until they woke up some morning in the beginning of 2022 and said, “Oh, we should do something.” And then they overreacted all through 2022, in my humble opinion. Everyone’s got an opinion and people always say in hindsight it’s 20/20. Well, go back and look at all the videos. While it was happening, I was saying, and many others were saying, this is just way too much of an overreaction. You should not try to shove in one year, which is 2022, all the interest rate increases that you should have done over a longer time horizon. That has a huge impact on the economy and, of course, on the subsequent bond markets and stock markets as well. My concern is that they’re going to wait too long in order to reverse that trend. Right now, they’re in a holding pattern.

Up on the screen, you’re going to see what the expectations are. I’ve put a circle around it. There’s an expectation that it might go up just a little bit more but then it will decline. So, the most recent decline, in my opinion again, is due to the expectation they would start that reversal immediately, and now they’re in a holding pattern saying no, we’re not going to do something. We’re not going to do anything at this point. That’s frustrating, that’s irritating. Especially when we look at the unmanaged bond indexes. They have been impacted because the pricing of bonds is dependent upon the interest rates that are out there. Until the interest rates are reversed, bonds are going to stay suppressed and perhaps even go down, which is what’s happened most recently because people had an expectation of lower interest rates which really hasn’t happened.

This also has an impact, of course, for any of you who have a house that you’re trying to sell or a house you’re trying to buy. Any real estate is frustratingly very expensive. A mortgage at 3% is a lot cheaper than a mortgage at 7.5% or 8%. And so that has a real crippling effect on the number of transactions, the price of the properties, the inventory, things of that nature. This is not just for residential home properties, we’re talking commercial as well. Loans, home equity loans, commercial and business loans. That’s a real dampening impact on the economy which has me concerned.

They’ve said that if everything is a priority, nothing is a priority. If everything is important, nothing is important. It’s good to know what you should really be focused on. In my opinion, it is the impact of the Fed both on the bond portion of a portfolio but also the impact, the spillover into the stock portion, the equity portion of the portfolio as well. So, it’s very frustrating.

What can you and I do about the Fed interest rate? Nothing. That’s outside of our control, but that does not mean we’re completely powerless, so let’s talk about that.

I was talking with a good friend of mine the other day and we had this realization of two different views of the world. He has a tendency to look from a global point of view. He would love to sit here and talk for 15-30 minutes about the Ukraine and the Russian situation and whether we should provide more aid or less aid. Just really talking about these global issues which is fun and interesting over a cup of coffee. However, I’m less interested in that because whether he and I agree or disagree or we solve the problem, nobody cares what Mike Brady thinks. I’m not going to impact that, or if I do, it’s going to be very minimal by the people that I might elect into Congress which then will make Congress or the President of a political office who then will make the decision.

Instead, many of you may or may not know, but I went to Ukraine in August to help out. I’m the treasurer of the Board for an international adoption and hosting organization. There I helped out with 300 kids who are stuck in Kiev and in central and eastern Ukraine. They came over to western Ukraine and I was able to help them deal with their trauma. It was only a week but it made a huge impact as we had this camp, Camp Say Yes we call it. That was very impactful. Can I impact the big global? The answer is no, but what I can wrap my hands around, my mind around is that there are some kids who have some trauma that need some assistance and I can provide some of that support.

When I take that same philosophy to finances and to wealth management it’s “can I impact the Fed?” No, I can’t. What I can do is keep my emotions in check. I can make sure that long term my portfolio is the appropriate percentage of both the equity portion in the stock, the right balance in my portfolio. I can keep track of those other aspects that can derail me from my long-term financial plan. There are lots of decisions that I can make to shore up what I believe will increase my probability of meeting my financial goals and reaching those goals long term.

I think that having that long-term vision, I think that understanding what it is that I can control and impact, and make sure that I’m as solid as I can as I go through the future which is always inherently unknown. We have to remember that. There’s always government politics and government craziness, at least in my 54 years it’s always been a part of that. What I can do is to know those things that I can control and try to do the best in order to be prepared for all that.

Mike Brady, Generosity Wealth Management. 303-747-6455. We’ve got one more quarter in 2023. Let’s hope the Fed cooperates with us, but if they don’t let’s keep our eyes on the long-term goals.

Thank you.