It’s been another tumultuous week with what looked like a healthcare crisis, rapidly bleeding into what could be a serious financial crisis. From our last video not even 7 days ago, things within our economy have come to a screeching halt and rebounding from this could present another challenge in itself. This is what you’ll see me discuss in the latest video in this growing saga:

Transcript

_________________________________________________________________________

Hi there. Mike Brady with Generosity Wealth Management, a comprehensive, full service financial services firm headquartered right here in Boulder, Colorado.

It’s been another tumultuous week. Remember how two or three weeks ago I said that we’d been lulled over the last three to four years with low volatility. We became accustomed to that thinking that was the normal. Frankly, I would love some of those days. Every day is an adventure and a bad adventure at that. I also said in my last video that this is a healthcare crisis and not a financial crisis and I’m here to say that it’s definitely looking more like the healthcare crisis over time could turn into that financial crisis. That’s absolutely disturbing to me just the way that we have stopped. Even from my last video not seven days ago our economy is screeching to a halt. And so to just restart something like that at all levels is going to be very difficult so I want to talk about that here today.

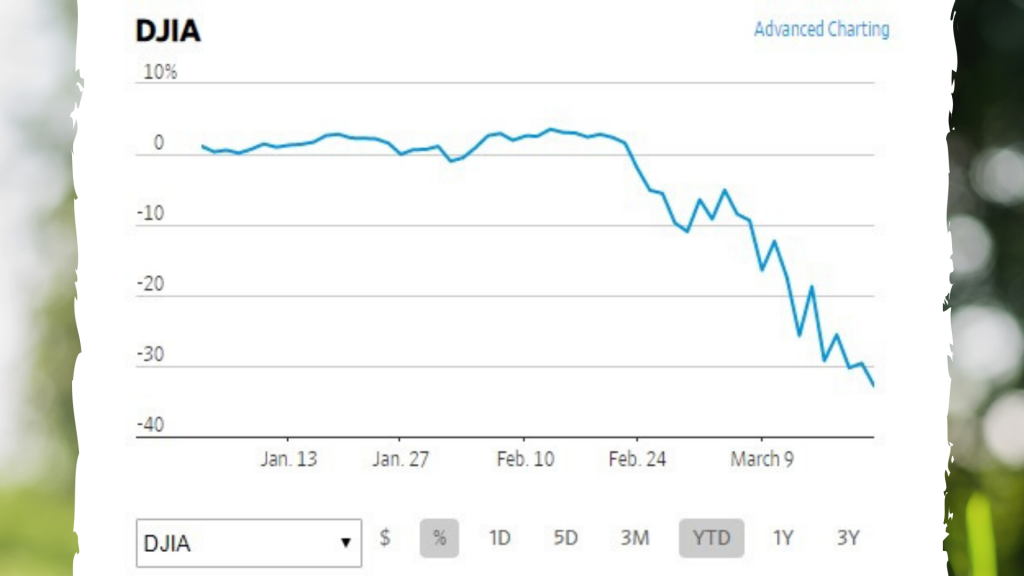

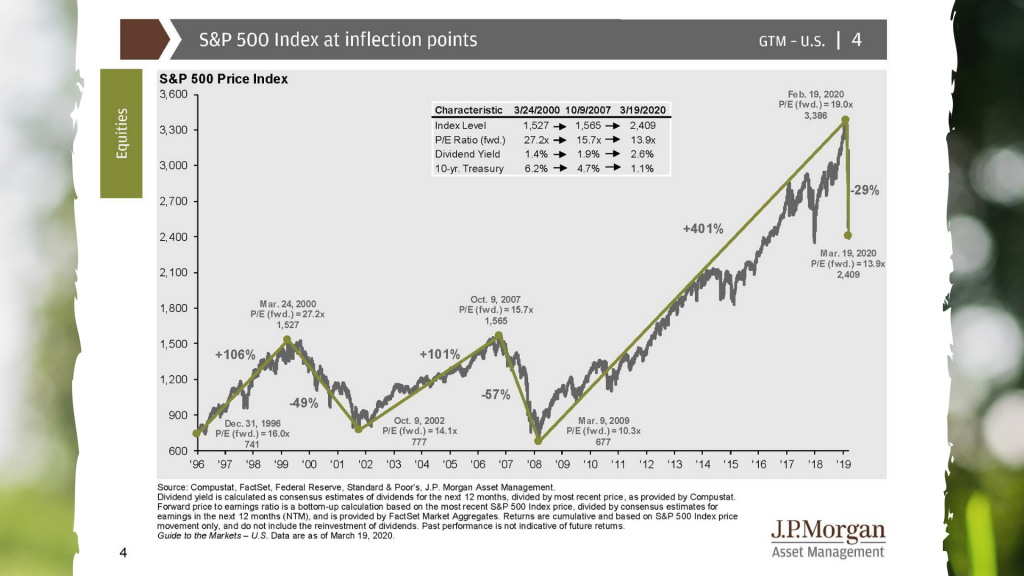

I want to put up on the screen a chart. This is the Dow Jones Industrial Average which is an unmanaged stock market index. You’re going to see that it’s about 30 percent down. I’m going to put another chart up on the screen and this right here is multiple years, multiple decades of the S&P 500. What you’re going to see is we’ve given up a couple of years’ worth of gain that we’ve worked very hard for, very frustratingly, very hard for had been given up in a relatively short amount of time. One thing that you’ll see in that particular chart there are times where it appears like it’s going to continue going up forever or going down forever and neither of them are the truth. It is not a linear equation. Things that go up don’t go up forever. Things that go down don’t go down forever either. That’s why I stress continually the multiple year.

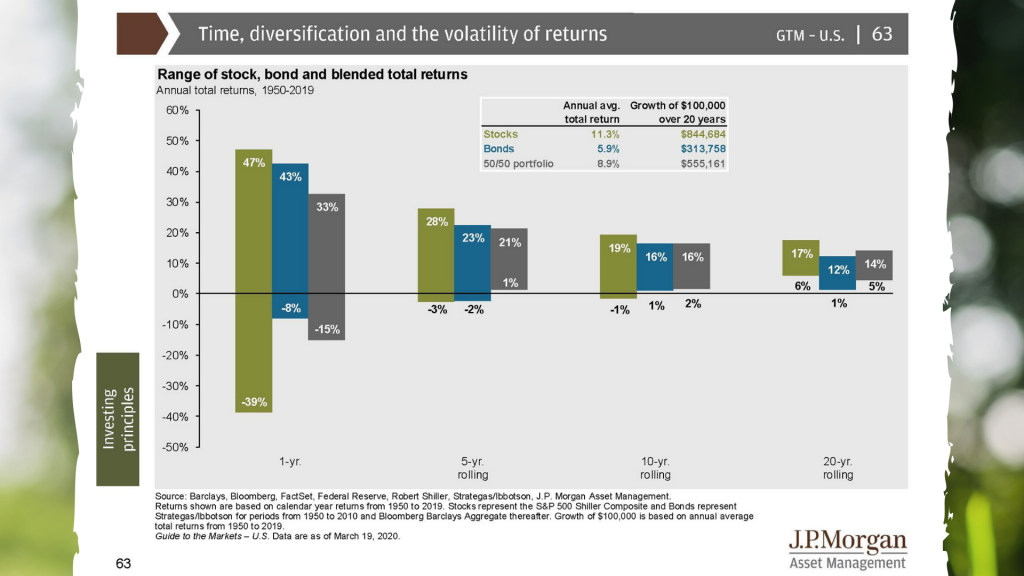

I’m going to put up on the screen a chart that you’ve seen from me before. What you’re going to see on the first three bars there are one year since 1950. That’s 70 years’ worth of an unmanaged stock market index, an unmanaged bond index and then a combination of the two. The first year you can see huge ups and huge downs as we go out 5 years, 10, years, 20 years the lows get closer to the breakeven point. The highs come down as well. Those are rolling like a rolling five year, like the very best and the very worst five years and that range in between.

What you’re gong to see is a diversified portfolio has actually never lost money although it could in the future. That’s one of the reasons why we have a diversified portfolio that although it does not guarantee against market declines I believe that a diversified portfolio makes sense because it might increase our probability of what you’re seeing right there which is what has happened over the last 70 years.

Five, 10, 20, if you were in your 60s or 70s I’m hoping that you’re going to live, statistically speaking you’re going to live more than five years, hopefully even more than ten years and even into the 15 and the 20. It’s not just you but it’s also your significant other, your spouse or whoever that significant other might be. We think that we might have a short time horizon and yes, as we get older our life expectancy naturally through the natural process of aging and mortality does get shorter, but it is still not like hey, my timeframe is next year. If that’s the case you should never have any money in the markets and you’ve heard that from me time and time again and every time you ever talked on the phone about additional money.

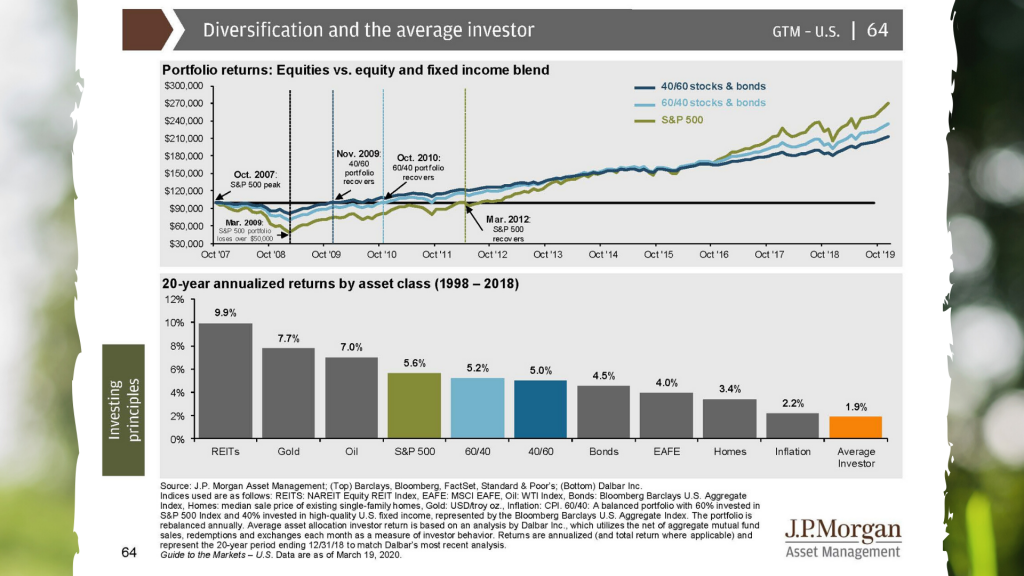

I’m going to put another chart up on the screen. What you’re going to see is 2008. You’re going to see there was a 50 percent decline give or take a few percent back in 2008. So we are not at that. Also, after that decline to all the way back up to breakeven was about five years for the S&P 500. It was about two or three years if you had a diversified portfolio. Of course you didn’t go down like the 50 percent either. So it was a lower down and a quicker back up. That’s one of the reasons why you have a diversified portfolio.

You’ve heard me talk for many years about the completely logical and rational response to 2008 that are big companies. And when I say big companies, big public companies. They kept lots of cash on their books. They would from some people’s point of view hoard it. Why don’t they distribute it to us. As an example when Apple gets over $100 billion or other companies have billions and billions of dollars in cash. They were fortifying themselves from an absolutely horrible situation so that they did not get into a cash crunch like they did 12 years ago.

A week ago I mentioned at the beginning of this video that it was a financial crisis 12 years ago where the banks were in trouble. Today they’re coming into to a month ago in good financial situation. Big companies are still in a good financial situation. It’s only been a relatively short amount of time. But that doesn’t mean that it’s going to stay that way. The people that they sell their goods and services to might be okay for the first week or two. It’s almost like a vacation. This goes on for a month, two through the rest of the year which there are ranges all over the place about how long this could last. That’s a problem and it’s a problem long term. Nobody, me included, knows exactly what the impact of that will be.

What do we do here as investors? What do we do? Many of the managers have increased their cash over the number of weeks. However, I would say almost everybody has been negatively impacted by this and so whether it’s in your personal life, in your financial life, in so many different areas this has not been a good time whatsoever.

One of the things that you’ve heard me say before is it’s easy to be – I use a friendship as a great example. It’s easy when things are going well and easy to remain friends. A true friend and you know the depth of their conviction, the depth of their values as a person and their principles is when things are rocky who’s standing right there next to you.

I used an analogy about week and a half ago about an airplane ride. You’re going from Point A to Point B and you’re inside that plane. Now, of course, if it was a really short ride you shouldn’t be in the plan to begin with. That’s why you drive the car or you walk or you take a bicycle. But you’re in a plane and you’re going from Point A to Point B and it’s very rare in today’s world for there to be huge turbulence, not like there was 50 years ago in different types of planes. Technology allows us to have lower turbulence, but it sometimes happens. You don’t get out of the plane. You stay in the plane until you land at Point B. And so the way that we approach our particular financial goals is no different. We’re going from Point A to Point B. We have unexpected, unpleasant turbulence that we wish that we did not have. And if we could wish it away we would. But it’s there, nonetheless. What do we do? Do we scream? Do we shout? No, we sit right there, wait for it to get over so that we can get to our Point B.

Mike Brady, Generosity Wealth Management, 303-747-6455. I’ll check in with you again later this week or frankly, more often if something big is happening I’m here to communicate with you. Thank you. Bye bye.