The market has gone down even into bear territory for this year, 2022. Painful. It’s just matter of fact, there is no way to deny how crummy it has been to watch. As humans, we’re both logical and emotional – for some the news may cause instant panic. However, rationally we need to look at the data and look at our portfolios and continue to make rational choices based on the long-term plan, not short-term discomfort.

Remaining diversified is really important. Going back over 100 years every single time 100% of the time when it has gone down, it has come back over time – 100% of the time. That’s not the case for non-diversified issues they might have whether that’s real estate, whether that is a business deal, whether or not that’s an individual stock or an individual bond. That’s the reason why you have a huge, diversified portfolio.

Let’s dig a little deeper at the data and importance of balance between your logical and emotional brain.

Watch my latest video update for more on what we’re seeing.

Transcript

Mike Brady with Generosity Wealth Management, a comprehensive financial services firm headquartered in Boulder, Colorado, although I am recording this video from our Wyoming cabin where I work during the day and help restore this cabin in the evenings. Just real quick before I get down to business. These windows were all brand new last year. This window over here, a brand new stove that goes up to a brand new roof. All this cladding my wife has done. It’s something that we’re very passionate about. This is a 50-year-old cabin that’s been in my wife’s family and I’m so blessed that I get to work during the day with you clients and prospective clients and work on this beautiful cabin in the Wyoming woods and mountains in the evenings.

I want to start off by talking about human emotions. It is okay as a human being as part of the experience to sometimes have conflicting emotions. To have happiness and sadness at the same time. When your son or daughter got married you probably were sad that they were leaving the fold but happy that they were starting their lives and very happy for them that they found the right person. You jump out of a plane with a parachute. You’re feeling very fearful but you might be feeling alive, maybe conflicting emotions. It is also okay to feel calm but disappointed. I bring that up because I’ve been doing this for 31 years and a friend who is also a client said last week, “Mike, you’re so calm. Aren’t you excited and aren’t you disappointed.” The answer is I can have all of these emotions at the same time. I’m not sure how not being calm helps in any way.

Since I started back in 1991, I’ve seen well over 200 market days a year for 31 years. I’ve seen ups and downs. I have seen it all, and I take it in stride. I’m a big fan of Warren Buffett and Warren Buffett I remember in the late 1990s, he was made fun of for being an old fuddy duddy. Oh, you need to get on all these tech stocks. You need to get on all this new information superhighway. And he was like, “Hey, I’m going to continue with what I do which are good value companies.” He has always talked about avoiding expensive and exotic hedge funds. He didn’t really understand some of the bond offerings and wrappers and products by the various companies in the 2000s, leading up to 2008. Most recently he has been made fun of for badmouthing cryptocurrencies.

Sometimes sticking to the tried and true is the best thing that you can do and that’s something that I believe in very strongly. Staying diversified is absolutely essential. Staying in control of your emotions is essential. And knowing what your time horizon and your duration is, is absolutely essential.

The market has gone down even into bear territory for this year, 2022. Painful. I do not want to give you the impression that it hasn’t been painful. As a matter of fact, I was with a couple of financial planner friends earlier in the week and it was like oh my god, just give us an up day, give us an up week. This is just so painful to watch. We have logic and then we’re emotional human beings as well. The difference is that we acknowledge that as professionals and say, “Okay, great. I’m just going to compartmentalize this over here because that part doesn’t help me.”

Remaining diversified is really important and all I can really say is going back over 100 years every single time 100% of the time when it has gone down, it has come back over time – 100% of the time. That’s not the case for non-diversified issues they might have whether that’s real estate, whether that is a business deal, whether or not that’s an individual stock or an individual bond. That’s the reason why you have a huge, diversified portfolio. I have said in the past that over time – when you look back the last ten years – those of you who have said, “Hey, I can take a high risk tolerance level,” are those that usually, in my opinion going forward, not guaranteed, will have the higher rate of return over a long time horizon even if in the short term it might be more volatile than what you like. It is not a guarantee of losses along the way, but that is why you keep the duration into consideration.

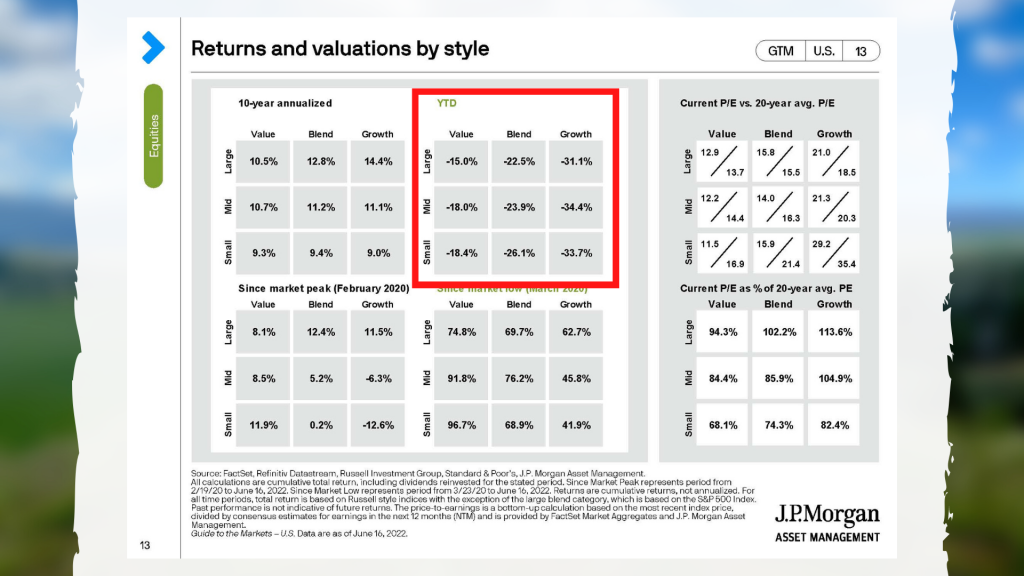

This has been real bad. I’m going to put up on the screen and circle there – it’s going to be in a box actually – that’s what the stock market has done so far this year. Not good at all. Every sector has looked very poorly or performed very poorly and very consistently.

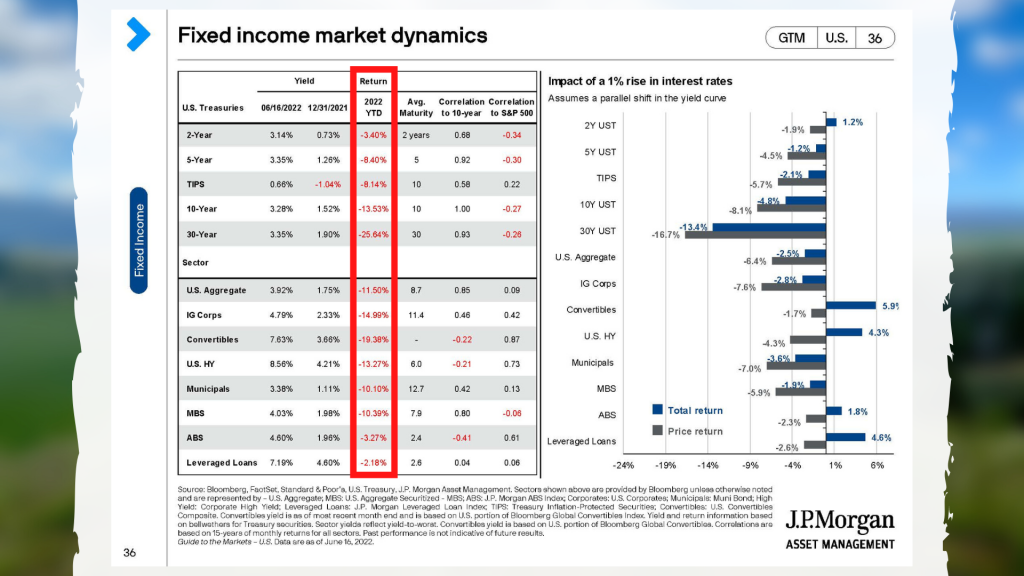

This next sheet that I put up on the screen are bonds which is unique that bond funds have also done very poorly in general, the unmanaged bond market indexes. When interest rates go up, bonds go down in general. That’s the thing. However, in my opinion both with stocks and with bonds it’s oversold. You’ve heard me say that before in previous either corrections or bear markets. I’m saying it again now. That’s just my opinion that it’s oversold.

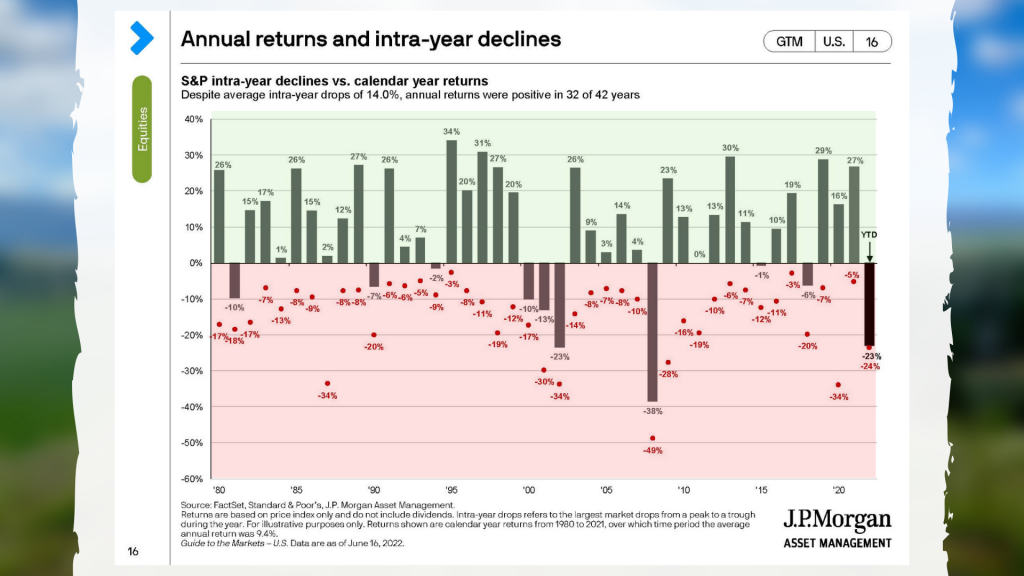

This third chart that I’m going to put up on the screen, you’ve seen me use this. It’s 40 years’ worth of data, 42 years – since 1980. I’m going to highlight the bottom half. It’s normal for there to be declines. It doesn’t mean the top half there – that’s what the year ends. Three out of four years are positive, ends positive, but almost every year there are declines throughout the year. It doesn’t mean that’s how the year ends. But I want to bring it back to 100% of the time a diversified portfolio of the unmanaged stock market indexes, unmanaged bond indexes have recovered – 100% of the time. That’s what I’m going to do. Could the future be different? Absolutely. I don’t know the future anymore than you. However, that’s something that I’m willing to invest with from a philosophy point of view.

Keeping cash, keeping money in a bank account after inflation is going to be a loser. Inflation, depending on which index you want to look at – 6%, 7%, 8%. If you look at energy it’s even 30% on energy just in that particular segment. Food is also double digit inflation. You’re going to lose money on your cash after inflation because the banks aren’t paying anything and you’re going to lose principle power on that cash.