“Money is only a tool. It will take you wherever you wish, but it will not

replace you as the driver.” -Ayn Rand

From a horrendous 4th quarter in 2018, to a complete 180 in merely the first month of 2019 it’s still important to keep your sights on the big picture.

It’s easy to be optimistic when the market is going up. It’s harder when the market is going down and all those reporters on TV are giving you all the reasons to be negative. That’s why we have to look at the underlying valuations, the underlying data, the money flow, the money velocity, the corporate earnings to look at what’s the real truth here. What’s the true story?

Watch my video and/or read the transcript. It’s a quick one, under 5 minutes and I continue to illustrate why it’s critical to keep your emotions in check.

________________________________________________________________________________________

Transcript

Mike Brady with Generosity Wealth Management, a comprehensive, full-service financial services firm headquartered right here in Boulder, Colorado. Recording this on Wednesday, January 30. It was right here a month ago that I recorded my year end video and at that time I was talking about what a horrendous December and fourth quarter of 2018 we had. I talked about how 2017 had very little volatility and was strongly up for the unmanaged stock market indexes. In contrast it was followed by 2018 which had all kinds of volatility and was negative with, well the fourth quarter in December really going downward very sharply with huge volatility.

1 Year DJIA

So far in 2019 the month of January has shown another reversal. What great examples that every year is different. I’m going to show you a graph that shows the last 12 months and what you’ll see is so far this year we’ve made back much of what we lost in December and the fourth quarter of last year.

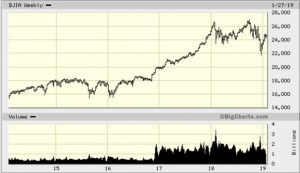

5 Year DJIA

It is important to have a diversified portfolio. It is important to keep the big picture, the long view in mind. Here is a five year graph and you can start to see how one year is not the entire picture. It’s just one piece of the puzzle. And if you only look at the one piece of the puzzle it doesn’t really make sense. Like a mosaic you have to step back and have some perspective for how the pieces, how the years add up toward reaching your 5, 10, 20 year goals.

If you’re older in life you might say wait a second, I don’t have a long view. No, even if you’re retired you don’t want to outlive your money. So whether you’re in the accumulation phase or whether the withdrawal phase of your life with your portfolio having 5, 10 and 20 year points of view is very important.

I believe that there continue to be reasons to be optimistic. It’s easy to be optimistic when the market is going up. It’s harder when the market is going down and all those reporters on TV are giving you all the reasons to be negative. That’s why we have to look at the underlying valuations, the underlying data, the money flow, the money velocity, the corporate earnings to look at what’s the real truth here. What’s the true story?

Let’s say that I am wrong. Let’s say that we continue in the unmanaged stock market indexes to have downward and maybe more volatility as well. That’s the reason why we have diversified portfolios which doesn’t guarantee against losses in declining markets. That’s why we have though a long term view.

So what I would say is let’s get out of our own way. Let’s keep our emotions in check. The mind has a tendency to have a bias toward making patterns where there might not be a bias. We lay on the grass on a nice summer day, look up at the clouds and we’re finding hey, there’s a dog, there’s a building, there’s this famous person right there in the clouds and we are certain that’s what it looks like when, in fact, our mind is creating patterns where there is no pattern. Let’s not do the same thing in other areas of our lives including our portfolios and in the markets.

Mike Brady, Generosity Wealth Management, 303-747-6455. Call me at any time. I’m here to talk about how this is relevant to what you’re doing in your specific financial goals. Here at any time. Thank you. Bye bye.