“Life can only be understood backwards; but it must be lived forwards.” ―

The financial market landscape has been more than rocky lately, but how did we get here? There are always reasons to be pessimistic, just the same as there are always reasons to be optimistic. Looking back a couple of years we are going to assess supply and demand, inflation, real estate investment, stocks, bonds and the overarching US fiscal policy. We will highlight the trends seen from some pretty historical moments experienced between 2019-2022. We don’t know what the future holds. Even the best data from the past cannot predict what is about to happen, so save any prognostication and stay focused on your horizon. The market will go up and down with current events, the best we can all do is stay focused on the big picture and our long-term goals to make the best decisions for ourselves.

Transcript

Hi there. Mike Brady with Generosity Wealth Management, a comprehensive, full-service financial services firm headquartered in Boulder, Colorado.

Today I want to talk a little bit more technical than usual. I want to talk about how did we get to where we are right now–the present. What’s happened over the last couple of years? What has transpired? In order to get us now to the present it’s so clear to us. That’s what it feels like. Hindsight is 20/20, but now what does this mean for us going forward, and there are reasons to be both optimistic and pessimistic. It could go either way so let’s figure out where we are and what led us to where we are now.

By the way, let me just tell you that it is complex. The United States is the largest economy in the world. About $22 trillion. The next closest to us is China which is in zero COVID tolerance. They’re closed down. And then after that it’s the eurozone and then everybody else is distant fourth, fifth and all the way down. The big behemoth is the United States and we are the reserve currency for the world because of our size. Many countries decide to peg many of their decisions to the U.S. currency but just by the fact that through the trade balance everyone’s got a lot of dollars. We’re buying things. And so we are the reserve currency. What we do matters in the world. But geopolitical issues are also important.

Let’s start talking about how some of these factors came together. About two years ago we’re starting to get out of COVID. We have supply chain issues, reduces of supply and demand. People are now getting out of their homes, they want to drive again, they want to go on vacation, they want to travel. Demand is high. So, right now we have an imbalance. We have high demand, we have low supply. That right there is a problem.

At the same time we’ve got some cash being thrown around. We’ve got some fiscal policy that over ten years the Congressional budget office has said that it will cost $4 trillion. It might have been well intentioned. It doesn’t matter. We’ve got lots of cash, lots of liquidity and people had saved a significant amount. When we look at the savings rates during COVID while everybody was stuck in their house, people now have cash. More and more people with more and more cash chasing less and less things. And, of course, if you want it then you bid up the price. That’s how inflation starts.

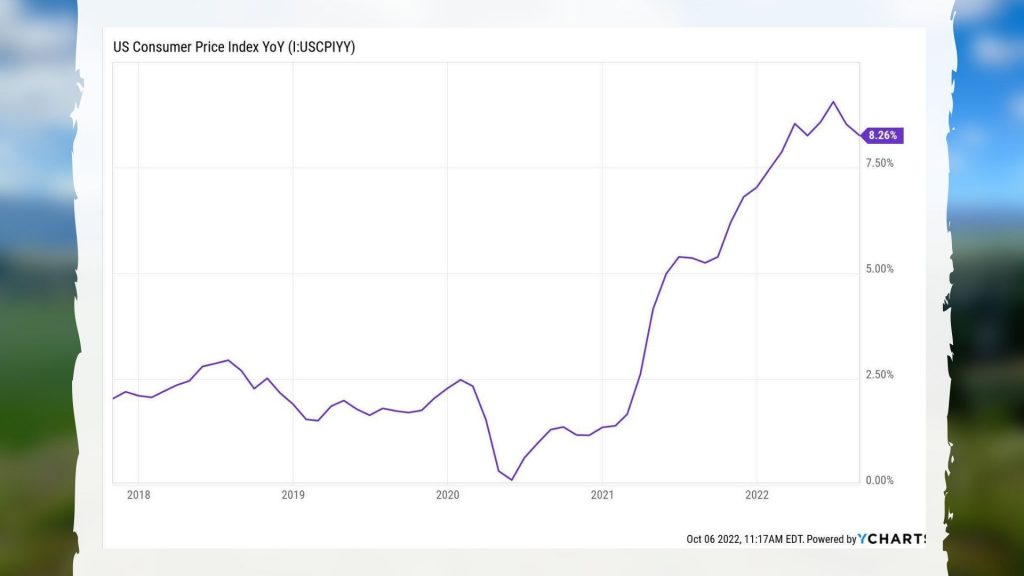

Inflation happened. I’m going to put up on the screen there and you’re going to see how it went from about 1% at the beginning of 2021 all the way up to almost 7.5% in one year. That is huge. During all that time we kept being told well, this is transitory and this is going to be temporary, et cetera. It continued up and up and up.

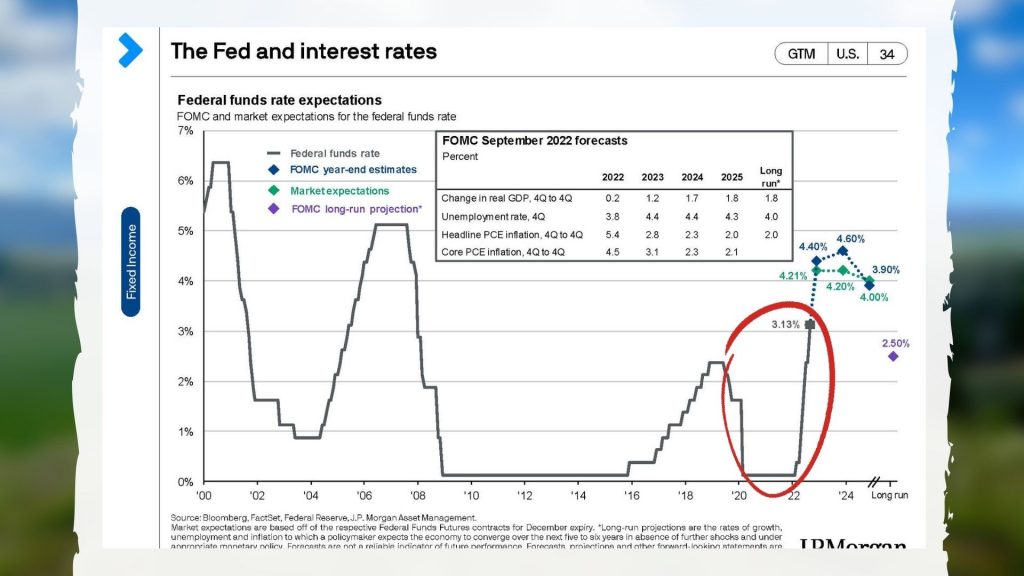

Now, one of the problems is as you can see here on the second sheet – and I’m going to circle when the Fed started to increase interest rates. Increasing interest rates slows down the economy. It starts to take money out of the money supply. They didn’t start until the beginning of 2022.

Let’s imagine that you have a picture up on the wall. You can take a hammer and you can real gently nudge it, nudge it, nudge it until it’s straight, or you can take a huge whack and things are going to break. Well, essentially for an entire year the Fed did nothing and now they’re trying to make up for it by whacking it. Not nudge, nudge, nudge. They’re whacking it and that’s what has happened in 2022.

What is interesting is 2021 the stock market and unmanaged stock market indexes continued to go up even though the inflation rate was going up as well. Anyone who says that they said they completely called it that it was going to go up as much as this is really fooling you. Yes, there were some indications it was going to go up, but almost every single expert was surprised by how much inflation has gone up. Now the Fed is trying to make up for it.

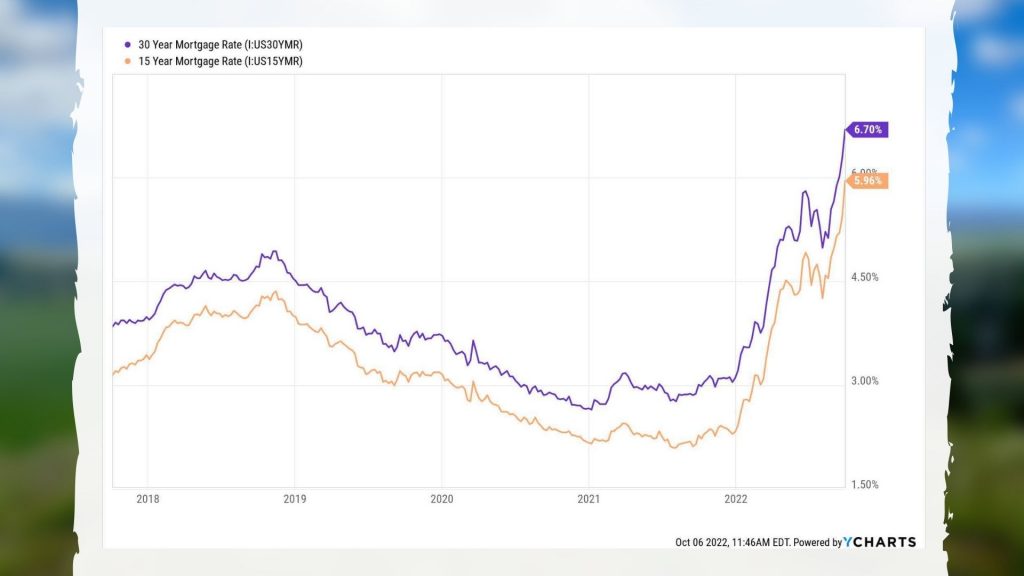

Now up on the screen I have put the huge increase in both – the top line is a 30 year mortgage which is now as of the beginning of October at 6.7% and almost 6% so 5.96% on the 15 year. That in my opinion puts a screeching halt on a lot of the transactions in the real estate market. We’ve had a huge increase in housing prices when interest rates get higher, when someone wants to buy a house they might second guess it. This is something that I think we need to really watch out for as the unprecedented, really unbelievably sharp increase by the Fed in their monetary policy is putting the brakes on the economy big time. The odds of a recession is going up very high.

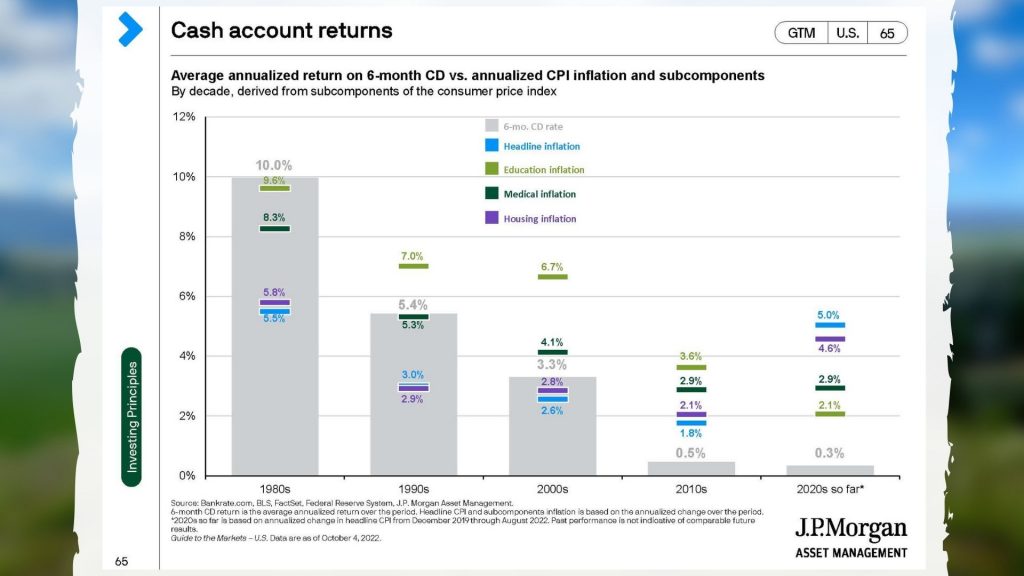

When we look at cash, look up here on the screen. There’s a lot going on here in this chart, but on the left hand side the CD rate for the average of the 1980s was 10%, but the inflation was about 5.5% on average. In the 2000s you had your CD rates of about 3.3% on average and inflation was less than that. The headline inflation was less than that. In the 2010s and in so far right now inflation is significantly higher than what you’re getting in CDs for a six month rate. Cash really is a great place not to lose money. It’s not really a great place to make money from a purchasing point of view. Bonds as well. It’s a complicated situation but bonds have had one of their worst years ever in decades this year because of the incredibly sharp increase in the Fed Fund Rate from the Fed.

Right here on this chart is the S&P 500 when we look at it standing back with multiple years. You’re going to see that in the last year or so we’ve given up a couple of years’ worth of growth. Very irritating, especially if you’re withdrawing money. That being said the upward trend has always been over many years upwardly mobile. You’ve heard me say this before in about three out of four years our positive one year is negative. This has a tendency to be the negative year and it’s an unpleasant. Every quarter this year has been negative.

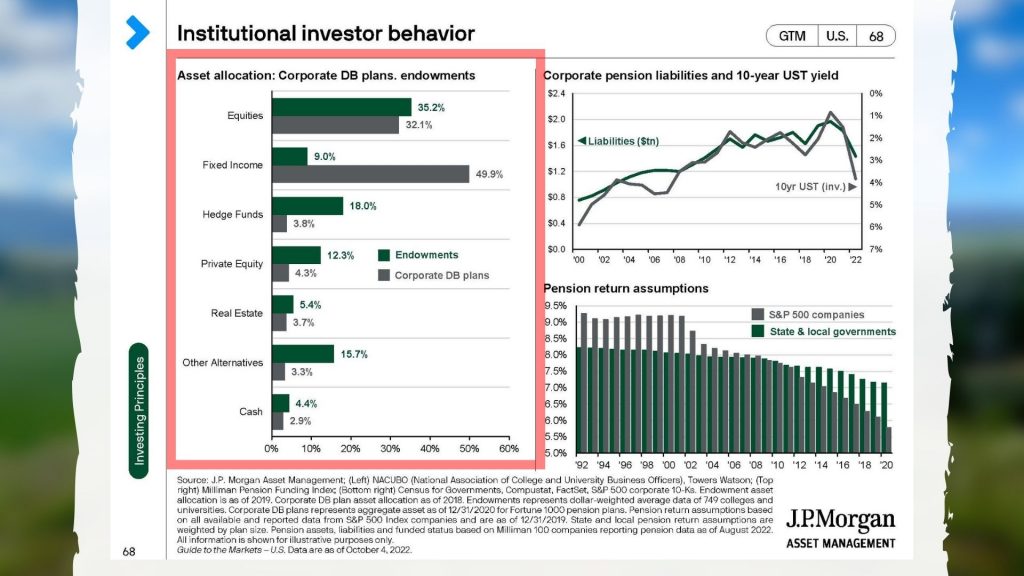

What are investors doing? I’m just going to put up here on the screen there corporate defined benefit plans, endowments, university endowments, et cetera. We have a tendency to put money into fixed income. They do equities, they do fixed incomes as well. A lot of private equity, some alternatives. What I recommend for clients in general is very similar to what some of the biggest endowments at colleges and at universities do in defined benefit plans.

Some reasons to be optimistic. The more things go down, the more they go up. That’s the thing. We could absolutely six months from now, a year from now be lower than what we are right now. We’re going to talk a little bit about the reasons why that might be. When we look out one year, two years, three years, five years the odds historically have always come in our favor that when things go down they come back up. When things go up, at some point they’re going to turn around and we always forget that. We have to understand that it’s both ups and downs.

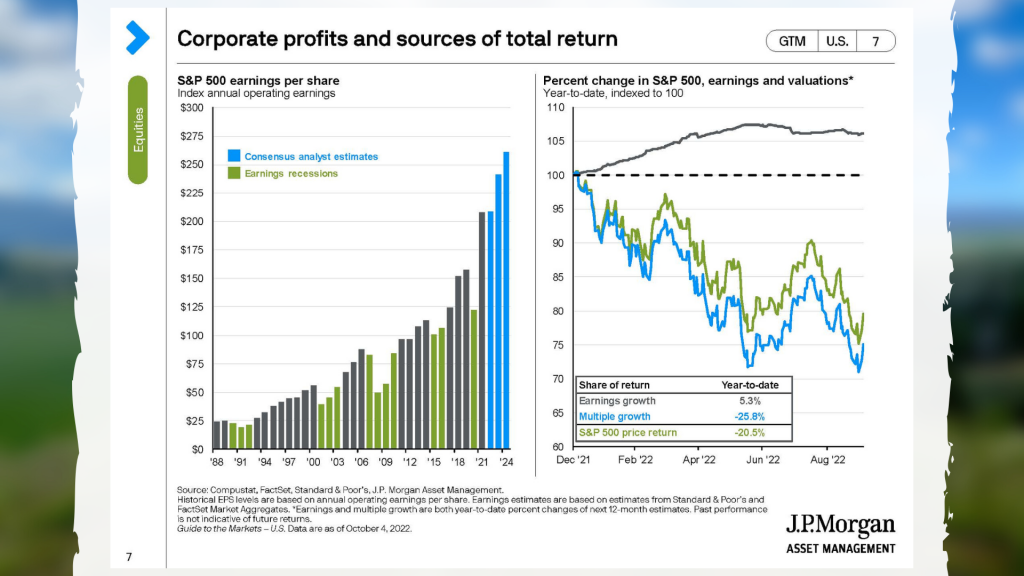

Up on the screen on the left hand side you’re going to see the consensus analyst estimates for S&P 500 earnings per share. The companies are still profitable. It’s that simple. Yes, some of them are laying off workers. We’ve had an unbelievably low unemployment rate and it’s been coming down over the last two years to historic lows again. As a matte of fact, we’ve been talking about the great resignation where people don’t want to go to work. Well, some of those people who have jobs are being let go in order to increase the earnings per share and they maintain it with some belt tightening. As an investor this is good for us. This is very good for us.

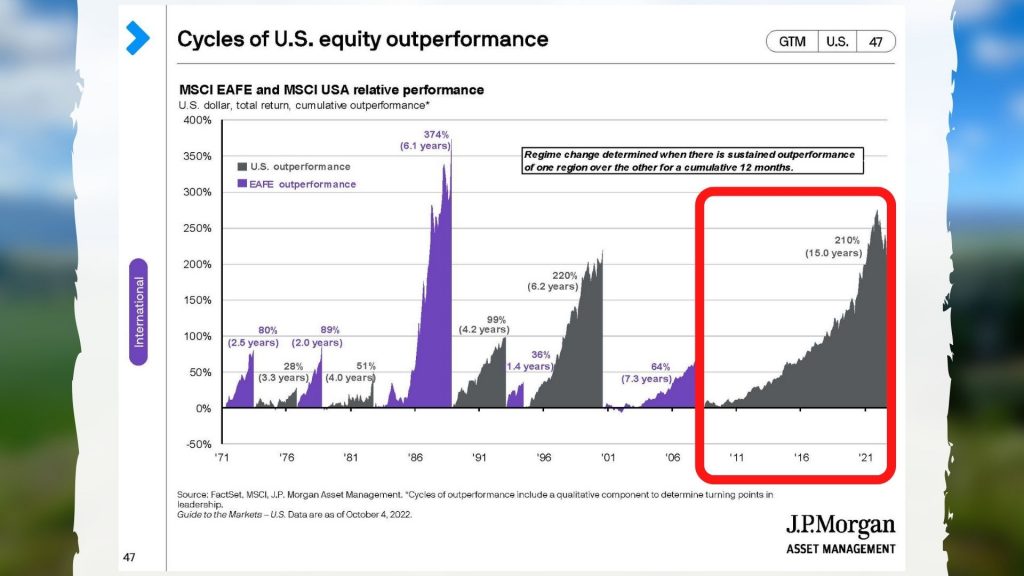

Here on the next screen you’re going to see the cycles of U.S. equity performance, and I’ve just circled right there. For the last 15 years the United States from an unmanaged stock market index has outperformed most of the world. There’s one index, the EAFE, and so we’ve outperformed that for the last 15 years. In my opinion that’s going to continue. When we look at all the different places that we can invest, the United States is the best horse in the glue factory here. Europe has made some unwise, in my opinion, decisions from a fiscal point of view. Germany in particular is in a world of hurt. Their whole business model is based on selling stuff to China with cheap energy and neither of them are really working. They’ve really got to rethink things in much of Europe. This is going to be a tough winter and the energy prices not only for the end consumer but also for all of their industrial base. They’re in a world of hurt.

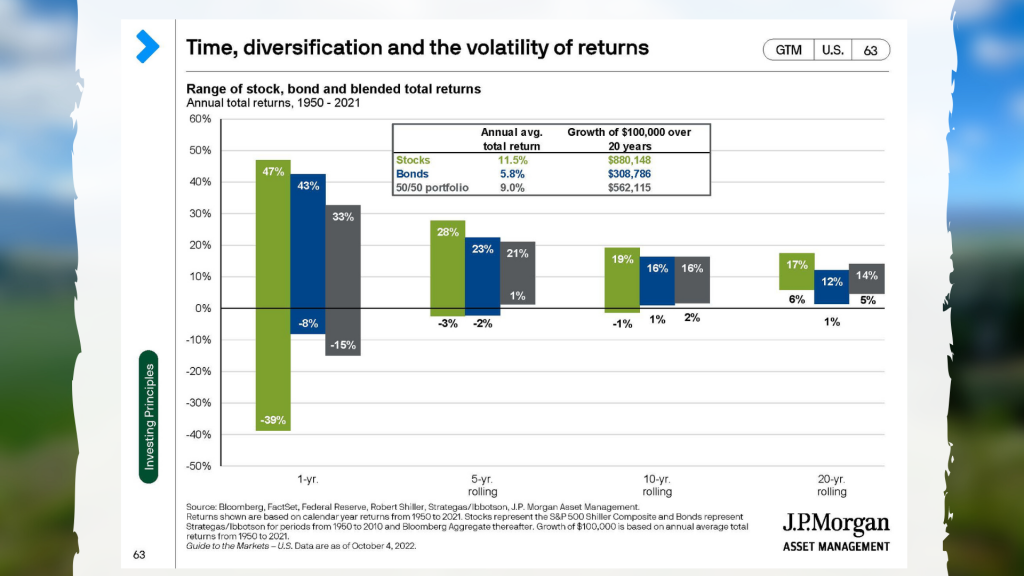

Let’s look up here on the screen. Let’s pretend like we don’t know what the future holds which, of course, we don’t. Historically going back 70 years there’s actually never been, the sixth bar over there, the one that says 21 and 1. Over a five year time horizon if you’ve got a diversified portfolio that includes some of the unmanaged bonds that we’re talking about right now, you actually never lost money over a five year time horizon and you’ve done as well as 21% per year. And so that’s the range when we look back over a 70 year time horizon.

You can see the first three bars on the left hand side, a huge range for the equity which is that left bar. A huge range for the bonds. You put them together and it’s a slightly lower range, but it really starts to play out – and this is the way we put portfolios together when we’re looking at 5, 10 and 20 years.

For people who are retired hey, let’s look at that five year. I’m hoping you’re not going to die in the next year or two. It could happen. We could die tomorrow. None of us know when we’re going to die, but we do want to keep the timeframe in consideration, and always know that that there’s good years and there are bad years. Good years are not necessarily followed by bad and bad is not necessarily followed by good. We’ve got a good, strong S&P earnings outlook. We have pessimism at an all time low frankly. I mean it’s very low. It hasn’t been this low since 2008, and 2008 was followed by an incredible rally that lasted many, many years. I happen to be a contrarian at heart. I believe that our emotions and our actions are messing with the portfolio has a tendency to do us more harm than good. You’ve heard me say many a time on these videos and in my newsletters that if you pick the aggressive level that you can stick with, but you don’t bail on. You might not be happy year to year, but over a five and ten year time horizon historically and what I believe your return is going to be that as volatility goes up and so does the return as time goes on. That’s why you create something and you sit back and you try not to tinker with it too much even though we’re always watching within the portfolio hey, maybe we need to increase our equity allocation, our bond allocation, our cash allocation, et cetera, within the portfolio. That’s one of the reasons why I believe in good, third-party management. We’ve got great people working really hard in a tough volatile situation.

That’s what’s led us to where we are. There have been some fiscal issues. There have been some major policy issues on the Fed side. They have said that they’re going to continue to increase rates. At some point that is going to stop and that’s going to be very good for the markets when they stop. And even when their expected increases have already been priced into the market is also good for the markets. And then we just have this supply chain problem which is getting better. It is actually getting better although it was very bad earlier in the year and at the end of 2021.

Those are some of my thoughts. Give me a call if you’d like to talk about them further. 303-747-6455. You have a wonderful day. Thanks. See you. Bye.