Every single year there is some kind of market volatility. It is normal for there to be ups and downs. Therefore, preparing ourselves for it early on is the key. We know it’s going to happen, so we will have a multiple year strategy in mind at all times. And if there are any concerns, of course, you’ll call your favorite financial advisor Mike Brady!

Check out my full thoughts:

________________________________________________________________________________________

Transcript

Hi there. Mike Brady with Generosity Wealth Management, a comprehensive, full-service financial services firm headquartered right here in Boulder, Colorado.

Last month I did the year end review and it was a little bit longer so this time I thought I would talk shortly about a topic that I know is going to happen in 2020 which is volatility. I’m big into setting up expectations. I’m big into controlling our emotions and having a plan. The reason why I bring that up is in 2020 like every single year there is some kind of volatility. It is normal for there to be drops in the market. There are ups, there are downs.

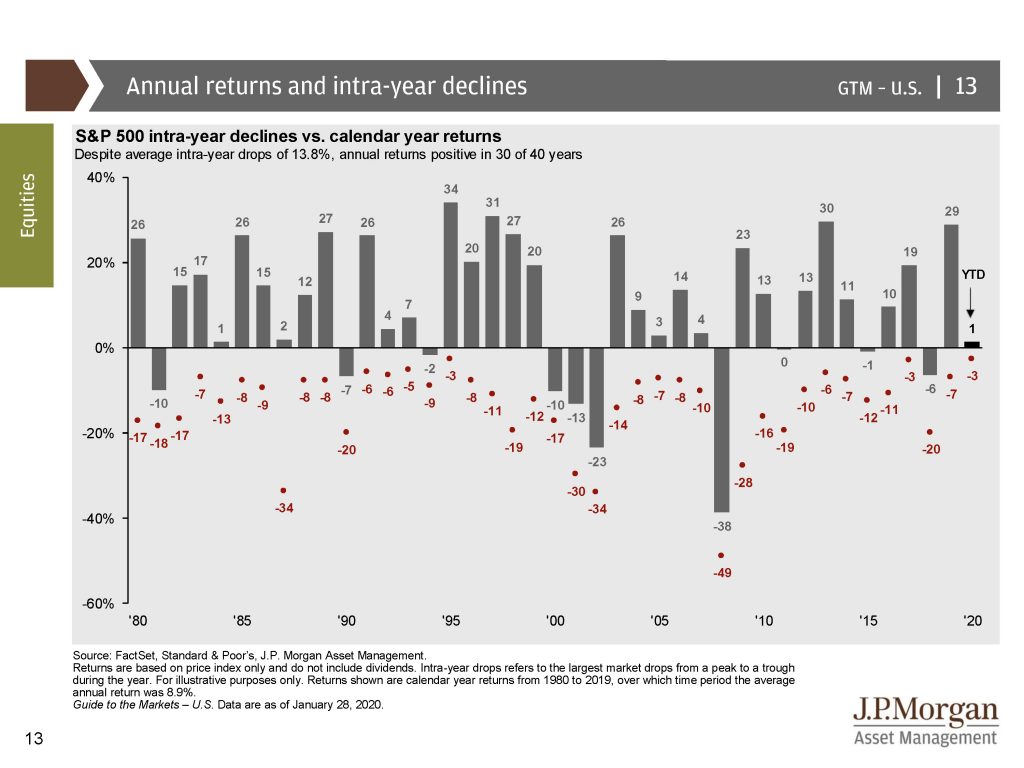

I’m going to put a chart up on the screen which shows the market going back decades, and you’ll see on the bottom below the axis there are red numbers. Those are the intra-year declines and it is normal for there to be intra-year, within the year, declines in the stock market, the unmanaged stock market indexes, of double digits or more, 10 percent or more.

I’m recording this at the very end of January and, of course, you’ll get it the first part of February and nothing has happened so far this year. However, we have 11 more months. We have an election. We have many different things. We have a global economy that’s very complex. But one thing that I can almost guarantee is that the market will go up and down at various times. And our reaction to it is going to be much more impactful to reaching our financial goals than that actual event of the ups and the downs. That’s my opinion at least.

Therefore, setting ourselves up now and saying okay, great. I know it’s going to happen. I’m going to be cool. I’m going to have my multiple year strategy in my mind at all times. And if I ever have any concerns, of course, I’ll call my favorite financial advisor Mike Brady.

That’s what I want to talk about this year so when it happens don’t be surprised. With the market as high as it is right now, hundreds of points on the unmanaged stock market index, the Dow Jones Industrial Average doesn’t mean as much as it used to frankly, 5, 10 and 20, 30 years ago. We look at the percentages, we know it’s going to happen but we keep the long term vision in mind. What I believe is one of the key ingredients to long term success is keeping our emotions in check, keeping the big picture in mind and really looking at how are we going to reach our financial goals not only with our investments but with all the financial decisions that are going on in our lives.

Mike Brady, Generosity Wealth Management, 303-747-6455. Thanks. Bye bye. Have a wonderful week, a wonderful month. We’ll talk to you in a month. Bye bye.