“Worry does not empty tomorrow of its sorrow, it empties today of its strength.” – Corrie Ten Boom

There’s an old adage that says that the market takes the stairs up and the elevator down. And what that means is that there are sometimes in history spectacular events that have become noticeable that become memorable like this past week or so when we’ve seen some double digit declines. But stay calm, your long-term investment strategy should remain unshakeable.

Check out my full thoughts:

________________________________________________________________________________________

Transcript

Hi there. Mike Brady with Generosity Wealth Management; a comprehensive full service financial services firm headquartered right here in Boulder Colorado. I’m recording this Friday afternoon after a pretty eventful week. A very interesting week hence the reason why I’m doing this video. If you look at the background it’s not my normal one, I happen to be at a conference so this is my hotel room, but it was so important I felt to get to you as quickly as possible that I decided to do it right here in my hotel room. Fortunately, the way I look at it I’m never working and I’m always working. When you love what you do you never work a day so I love what I do.

So, there’s an old adage that says that the market takes the stairs up and the elevator down. And what that means is that there are sometimes in history spectacular events that have become noticeable that become memorable like this past week or so. The market has pretty much every day this week had very memorable, you know, the Dow, which is an unmanaged stock market index, decline of the hundreds if not even over a thousand points. And what that has done is brought us back to where we were eight months ago. I mean let’s remember that this doesn’t mean you lose all your money that you can market has gone down to nothing, this is back to the beginning of June.

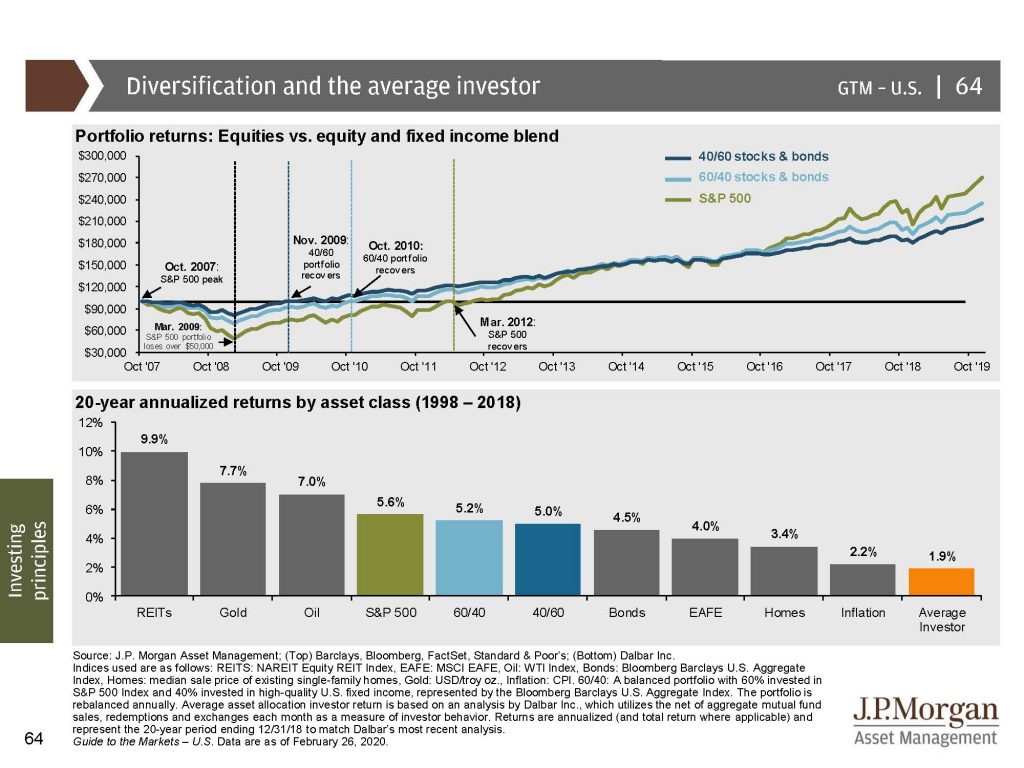

If someone is only now paying attention that’s less helpful. There’s another adage that says that worry doesn’t change the future and worries the present and so that’s not very helpful. The reason why we continually talk about in our professional meetings and conversations hopefully if we’re talking to ourselves as investors is hey I’ve got this point in the future that I need to go to and that I want to get to for my financial goals and it’s not next week, it’s not hopefully today. If so you’ve certainly shouldn’t of had any money in the market.

So, the question is how do short-term events impact long-term strategy? And the answer should be not at all. That’s why you do it in advance. That’s why my example of perhaps a fire in a house that’s why you have fire drills in a school, in a house, in a building beforehand because if fire is actually happening it’s too late. And so, we hit certain themes, we being financial advisers, me as your financial advisor, the professionals who was doing this for years and for decades of experiences of seeing this we say this is going to happen.

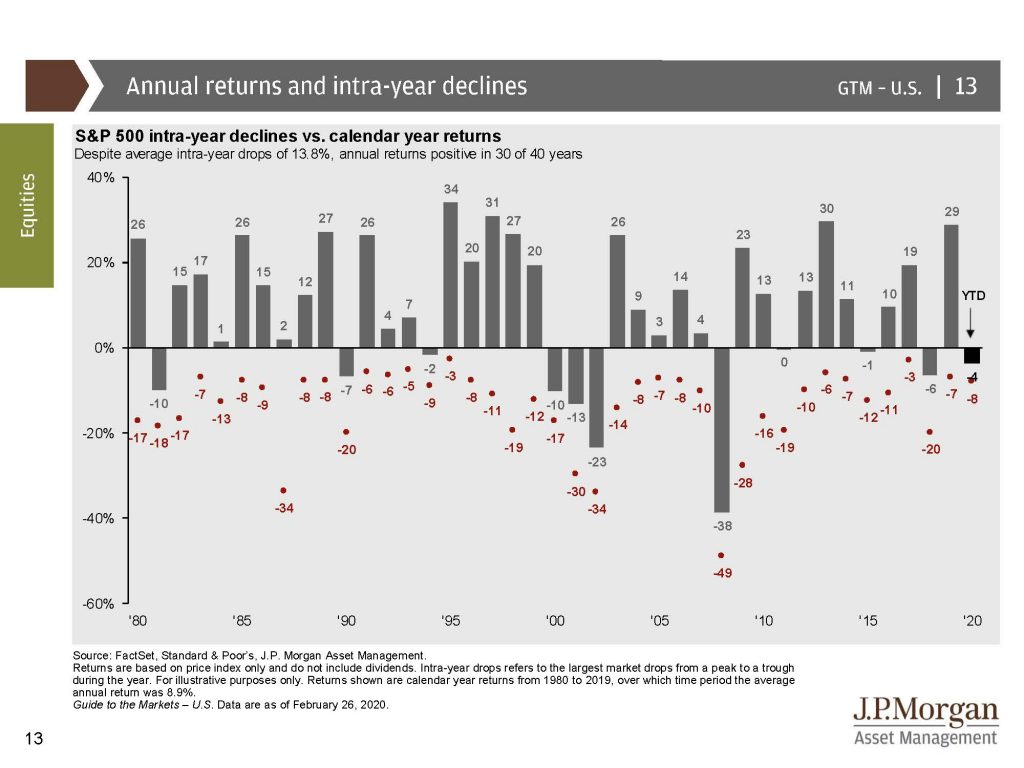

I’m going to put a chart up on the screen.What you’re going to see is those numbers, double-digit declines, are the normal. The actual unique event is that we haven’t really had many of them in the last two, three, four years. Now, it usually doesn’t happen in one week. That’s interesting. That’s a very newsworthy event, but that’s actually the normal is for there to be double-digit declines intra-year within the year. So, what we’re seeing here I don’t know what next week will bring, but I do know that the strategies that were sound two weeks ago are still ones that are sound today. And so, rest easy knowing that we’re here on this path of two steps forward maybe one step back, but we don’t have the two step forward without periodically having the steps back as well.

Mike Brady; Generosity Wealth Management; 303-747-6455. Have a great weekend. Bye bye.