Don’t let your long-term financial investment strategy be distracted by short-term events like the debt ceiling debacle. Is it annoying? Yes. Do we know what the ramifications will be? Not exactly. So, the best bet in this scenario is to look at that focal point on the horizon and ride it out. Don’t do anything.

Here’s why:

Transcript

**Recorded May 25, 2023**

Mike Brady, Generosity Wealth Management, a comprehensive, full-service financial services firm headquartered here in Boulder, Colorado. Although I’m talking to you from Generosity Wealth North Headquarters which is in Dubois, Wyoming. I come up here every summer. It is wonderful to get away and get my mind in gear. Where are things going and look at the big picture without having to get so much into the details. I’m available via phone and Zoom and email. Of course, I go down to Boulder for things that have to be handled in person. I am here recording this video and writing this newsletter from my cabin in Dubois.

I would love to talk about investments or this company or that company, this bond, whatever it might be about their future earnings and whether we should invest in it. That’s what I’d love to talk to you about. Or I would love to talk to you about all the other variables in your financial equation that could help you reach your financial goals. Isn’t that a great productive way of using our time?

But instead I’m talking about an irritating government potential shutdown due to the debt ceiling. I don’t venture into politics hardly at all. Why? Because I want to serve both sides of the aisle. I want to have people feel comfortable sharing with me their fears, and I have found that people have different fears depending on how you view the world. I’m here to help people reach their goals no matter what. I’m also not interested in only working with people who might think just like me. I’m a better person when I interact with all types of people.

This is manufactured drama that just absolutely irritates me.

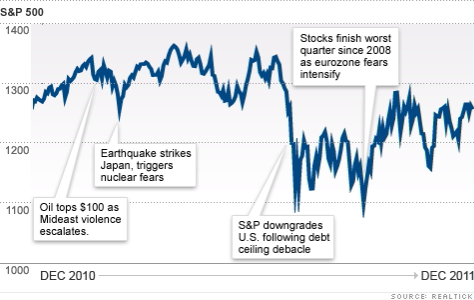

The last time that this happened in any substantive way was in 2011. Do you remember what happened in 2011? Let’s go back and talk about that. There was a lot going on in 2011. We had all of the European debt crises. Remember Portugal and Italy and Greece and Spain. They weren’t able to make their debt payments. I mean in 2008 they took on a lot of debts and now they weren’t able to do it. That was the underlying backdrop to which the summer of 2011 had where the debt ceiling was finally resolved around August 2. They actually kicked the can down the road and they said it’s good for right now if we do this thing in the next year or two which fell apart. But that’s beside the point.

August 2011 the market had been up for the year and then it went down about 19 percent. The S&P and Moody’s and the rating agencies had downgraded the U.S. Government from the highest rating to the second highest. Now, the fourth quarter of that year it recovered. What a lot of people don’t remember is that the unmanaged stock market indexes were basically flat for 2011 or positive depending on which one you want to look at. It wasn’t some huge decline for the entire year although it did give up some of the gain that had been acquired the first half of 2011.

So all 2012, 2013, 2014 all positive years. In a long term multiple year strategy, 2011 – especially the third quarter of 2011 was not attractive, wasn’t fun whatsoever. But when we look at the bigger picture, it was just a blip.

I have no idea what’s going to happen with the debt ceiling conversations that are happening right now. I do know that if you’re looking for something to be negative about, this is a great thing to be negative about. It’s just so irritating if we had a corporation with a board of directors and a CEO that ran its company like this country is being run, at least the federal government is being run, we would have a real problem and we would say that’s malfeasance and it’s really quite frustrating. It’s kind of a Rorschach test. Depending on what side of the aisle is who you blame. I don’t want to really get into that. I don’t know if it’s Congress’s fault of if it’s the President’s fault. It doesn’t really matter. It is here and it’s what we have to deal with.

I have to say that a frustrating thing and I have to admit I don’t really have a solution to is just how much the government and the federal reserve is having on our investments. I mean you’ve heard me already say that it’s in my opinion that much of 2022 was a correction of 2020 and 2021 when the markets went up and they shouldn’t have. We closed the world economy and we dump a lot of money in which is basically borrow from the future in order to prop up companies and the stock market and it goes up 2020 and 2021 of which we gave it all up in 2022. It certainly from my point if view it would have been better if we’d been zero percent and zero percent and zero percent instead of up, up and then give it all up in last year, the third year.

So far this year we’ve had a positive in the unmanaged stock market indexes. I don’t know how the end of the year is going to unfold, but companies when you look at their profitability, when you’re looking at the efficiency that they’re having, absent government influence, absent the emotions that come with the federal government having their particular issues there’s a lot to be positive about, especially when we look at where it came from which was seven-eight months ago.

I mean when we look at October, remember how I keep saying that we had a fourth quarter of last year was positive. The first quarter of this year was positive. I don’t know about the second quarter. I mean we’re going to see. But what we don’t want to do is have a long-term strategy dictated by short-term events and those short-term events are what the federal government is going to do. Just give me something that I absolutely can’t guess at.

It does have a huge impact. I don’t want to minimize that, but I want to go forward with those things that I do know, that I can control – the variables in my life. Do I have the right allocation? Am I saving enough money? Do I have proper insurance if unforeseen things happen like the death of a spouse or loss of the ability to work or have to go into a nursing home. Those are things that I can control, and I can have the investments with a long-term strategy in order to overcome the speed bumps that will always happen. It will always, always happen. Every year there is something that is big and it feels catastrophic and somehow and magically the stock market and the bond market, especially when you mix them together, perseveres over a number of years.

So, don’t do anything. We have a long-term strategy. That’s what I talk with clients about all the time, and I don’t want to be distracted even if there’s something really big like now, it’s a big distraction by the short-term events. I certainly hope that we don’t have a decline and we give up what we earned so far this year. I want 2023 to be the year where we really start to make big inroads into that which was lost in 2022. And when you consider that 2020, 2021 and 2022 and really add all those things together, it’s about flat. I want to start moving forward to where we were back in 2019. We had some great years leading up to 2020, but really up until the last two-three years when we had positive year, positive year, negative year.

I don’t think there’s anything that we should do or could do or plan to do for this thing that is unfolding, this latest drama. We’ve got to keep our eyes on the big picture and that is having great investments, having a great allocation in the country that I still believe is the greatest country out there, especially from an investment point of view when we look at all of the others that are out there. Absolutely not perfect. I hope you’re never hearing that from me, but this is where the wealth, the innovation, all the creativity happens and I’m happy to be a part of that.

Mike Brady, Generosity Wealth Management, 303-747-6455. Thank you.