2020 was a rollercoaster of huge declines followed by a huge recovery, with ultimately happy investors at the end of the year. 9 months ago however, we didn’t know this would be the case. We were filled with uncertainty about the global health crisis and the ramifications it would have on financial health. For that reason we talked strategy such as keeping your emotions in check, remaining long term focused, having humility, knowing your bias, et cetera.

Listen as Generosity Wealth Management founder, Michael Brady, compares having a strategic versus tactical look at 2020 and what that means for the new year.

Transcript:

Hi there. Mike Brady with Generosity Wealth Management and I am here to talk about 2020 and looking at 2021. I want to talk more strategic versus tactical today. I want to give some good beliefs that I have that I think are very helpful and really the reason why I talk about strategic versus tactical.

Let’s just talk real briefly about 2020. Personally, I have had some highs and lows. I know after talking with many of you, you had some personal highs and lows, but the markets did as well with investments. If we look back just nine months ago it was significantly double digits, bear market, very sharp, very under water and very pessimistic with a lot of fear going forward. Very few pundits at that point would have said, “Oh yes, it’s going to end the year positive.” But you know what? That’s where the unmanaged stock market index is and the unmanaged bond indexes went as well. When you look at bonds, when you look at stocks they all pretty much from a market index ended the year positive, with some ups and downs. One of the things that we can learn from that, of course, is about ourselves. What is our emotional control? What is our humility and what is our risk and tolerance which I’ll talk about in just a little bit.

I talk an awful lot on these videos strategically. Let me tell you why I do that and how I define strategy versus tactical. Let’s pretend you want to lose some weight. How you view yourself is a strategic decision, but so many people spend all their time on what is exactly the perfect weight loss program. Is it Weight Watcher’s? Is it Jenny Craig? Is it something else? What’s the perfect exercise? I the meantime they have paralysis of analysis and they don’t stick with it. They don’t view, they don’t spend enough time on the strategic where they say I view myself as an athlete. I view myself as someone who doesn’t eat that chocolate cake. It’s not a big twist, not a big struggle to not eat that chocolate cake. It’s hey, that’s incompatible with who I am and the image I have of myself. So the strategic part is incredibly important.

A lot of what I do in these videos is talking about the strategic because I have come to the conclusion that a lot of people spend time on the tactical. And all those pundits on TV are talking about the tactical. This stock, that bond, short-term decision this, short-term decision that. Where 80 percent of reaching your financial goals is clearly defining them and having a plan for how you get there, and keeping certain things in mind as you go along. The tactical decision of your investment strategy is not of zero importance. It is only of lesser importance and not as important as the sum of the strategic decisions that you proactively make every single day. Going forward from day one but, of course, reiterating that to yourself as the years go by.

I want to knock off a couple of them right now. I’ve got a list here. Your attitude and your behavior is incredibly important. Number one, humility will lead to diversification. Humility means that we don’t know the future. You may notice that when I sit here and talk on these videos I’m like, “Well, I believe this and I have a high confidence that this will happen.” But the moment that I ever say, “This is absolutely what’s going to happen,” stop watching and fire me because nobody knows the future and what I have found is that the less data they have it feels like the more confident they are in that prediction going forward. Pundits on TV do that all the time. And what good humility leads to is diversification knowing that you don’t know exactly what the future is so you try to increase your probability of that desired outcome by being under the bell curve. A bell curve looks like this and we want to get right there. We’re not shooting for the stars. We’re certainly trying to not have a disaster. Therefore, we’re shooting for the middle so that we can increase that probability and that leads to diversification.

The second thing that I would like to say as a good strategy, good belief is know your biases. One of the biases I’d like to highlight today – because there’s actually quite a lot of biases – overconfidence, confirmation bias, et cetera. Today what I would like to talk about is all you see is all there is. That’s just not true. If you hear three pieces of facts and say well, it’s all fact based. There it is. That’s the conclusion. You know what? There might be another side of the story to that. Everything coin has two sides and so when we find the conclusion from the facts that are laid before us, we have to continue to look at the facts. We have to look at the other side. If every pundit is saying that it’s going to go up, try to read things that say why it’s going to go down. And, of course, vice versa. Frankly, I find this in discussions that I have with friends and family and things of that nature is listen, just because you’ve just given me some facts there, there might be some extenuating circumstances. What’s the content? What’s the intent of what you’ve just displayed from an argument point of view? That’s the reason why if you ever watch any TV shows or been in court there’s a prosecutor and a defender. The prosecutor lays out facts and then the defendant lays out facts as well. They, of course, have different views on perhaps the exact same facts. It is the same thing when we are looking at our financial plans and, of course, our investment strategy.

The third thing is emotional control. If that wasn’t tested this year I don’t know what was. I am very pleased that the people that I associate with the most had a great emotion between the greed and the fear that is natural as human beings. Those people who do the middle way as I like to say it. They don’t get too excited one way. They don’t get too depressed the other way. They understand that emotions sometimes lead us to do things that are not in our best interest. It is emotional control. And hopefully when you talk with me, when you meet with me, when you watch these videos you can understand that while I have enthusiasm, I’m an emotional guy. I like to hug people. I’m by no means a robot. I certainly don’t let myself get caught up in the moment and I don’t let myself be controlled by my emotions. Acknowledging that I have them, but not being controlled is the path that I believe.

The next thing I have is being default aggressive. That is a military term. When you don’t know what to do, do something. A good plan today is better than a great plan forever in the future which may be never. Not forever but never, and so default aggressive. That means something different for everybody. What I mean is if you don’t know what to do, doing nothing might not be the right thing. Moving to cash is probably not the right approach for most people. That’s doing nothing. That’s when you don’t know what to do. History has shown that over a long time horizon one of the best things to be is to be in the market and to be invested, fully invested at all times. And so it’s important keeping in mind that you’ve got the emotions as well. You’ve got to find the one that is right for you. Of course, you can’t be too aggressive, but you can’t be too passive. Everybody has their special place on that spectrum from conservative to aggressive, but you’ve got to do something and that’s just one of my beliefs.

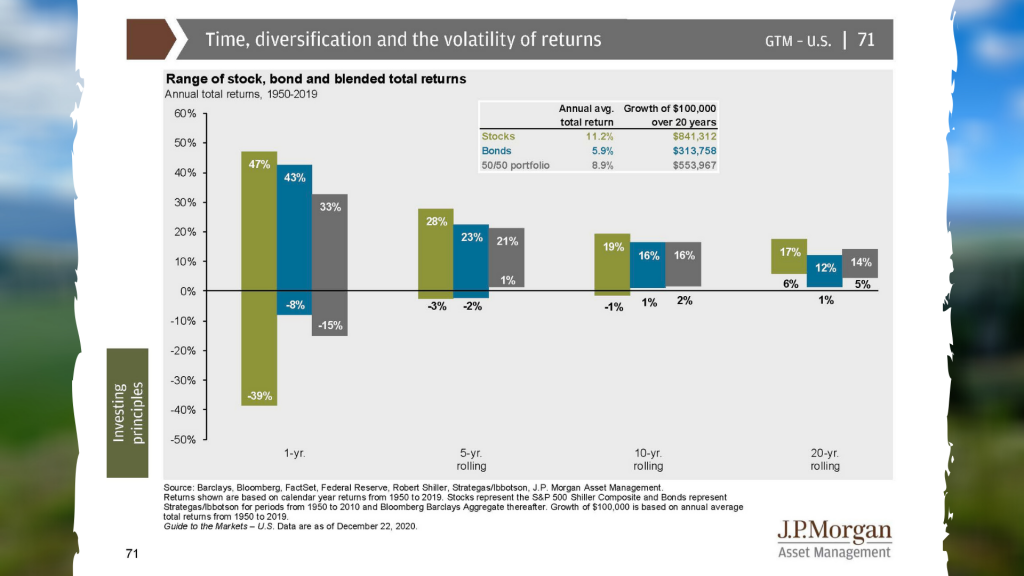

The very last piece of advice I have is to think long term. You don’t let short-term decisions dictate long-term decisions and plans, et cetera. If you are 70 years old I hope that you’re going to live many five and ten year periods between now and when you leave this Earth. If you’re 80 years old, the same thing. If you’re retiring, if you’re in your 40s and 50s, historically the longer you wait – I’m going to put a chart up there a little bit later in this video. The longer that you are invested you have a higher probability of having that desired outcome. I’m going to put that up in a chart. You’ve got to have control of your emotions. You’ve got to think long term along the way. And, of course, the news I’ve got to just tell you – I don’t watch news and CNBC and all those things. It’s just my opinion because do you leave that hour program or whatever it is that you’re doing more informed or emotionally charged one way or the other? If you’re watching the evening news or during the day 24/7, do you leave charge because they’ve reached your emotions or have they reached your intellect? And I certainly will say it’s probably the former. Are they there to inform you or to get you emotional and to elicit some kind of a response. I find it not helpful whatsoever.

So, one thing that I want to talk about is every once in a while I hear someone say well, the market, the Dow Jones which is an unmanaged stock market index, it’s obviously at a high. My answer is obviously? I mean what does that mean? Yes, it is obviously at a high compared to where it was five years ago. That is a true statement. It is not necessarily obviously at a high from where it will be five years from now which is all I care about. If I wasn’t invested five years ago and I’m only now deciding whether to invest, it doesn’t matter where it was five years ago. It only matters what it will be in the future. And so if you believe long term that the market is going to be lower – and long term is multiple years then yes, you should not have investments that are at risk in any way from a volatility point of view. But if you’re long term the only thing that matters that’s obvious is that where it was in the past, in the future it is unknown. And I will be very confident in my own thinking – and history has shown this – it is good to have investments for the long term. I’m now reaching my thirtieth year of meeting with clients. I got my license in 1991 and now it’s 2021. When it was 5,000 on the Dow people said it’s obviously a high. And then it was 10,000. Well, when it hits 10,000 that’s a real emotional mark. It’s going to have a hard time going above that. And then it was 15,000 and then it was 20,000 and then it was 25,000. Then 30,000. Now it’s over 30,000 and so why would we say it’s obviously at a high.

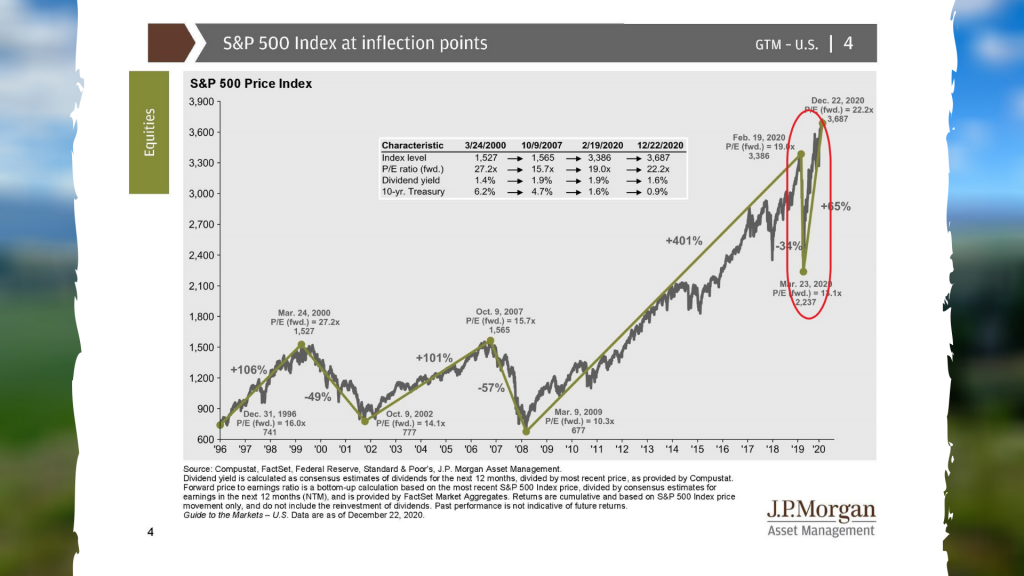

So, just one or two more things and I know this is a long video but we have a lot to do and I think it’s important because of the incredible year that we’ve just had. Up on the screen is the S&P 500 which is an unmanaged stock market index. You’re going to see and I’ve just put a circle around it, that’s what happened last year. A huge decline, huge recovery, everybody’s happy at the end of the year. Nobody was happy nine months ago. It’s just that simple. It is the reason why we keep in mind many of those strategic beliefs that I have been talking about for the last 11 minutes about keeping your emotions in check, keeping long term, having humility, know your bias, et cetera.

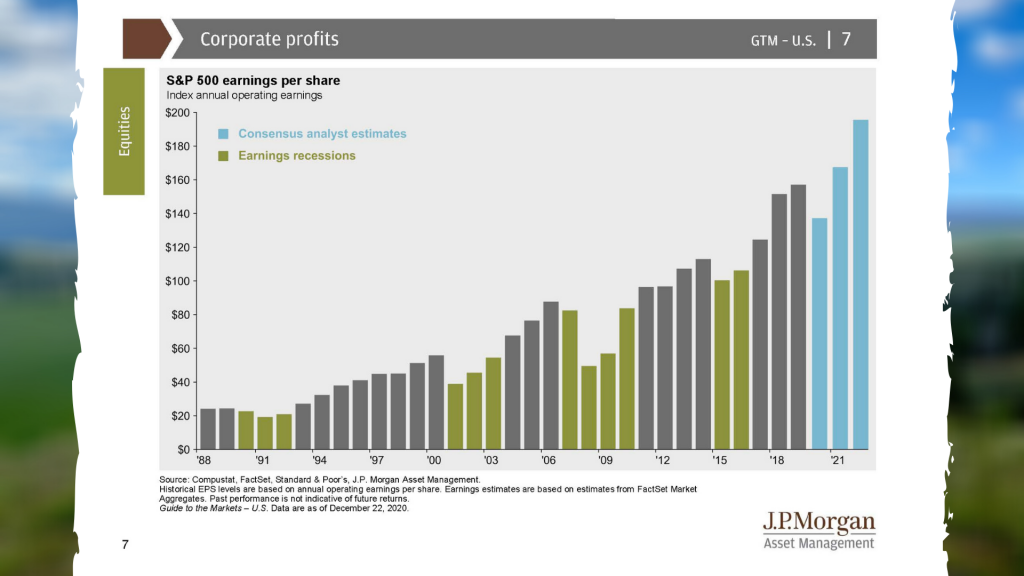

The next thing I put up on the screen is corporate profits, up on the right-hand side, all those blue ones. That’s 2020, 2021, 2022. They’re all positive. I think that’s a good thing.

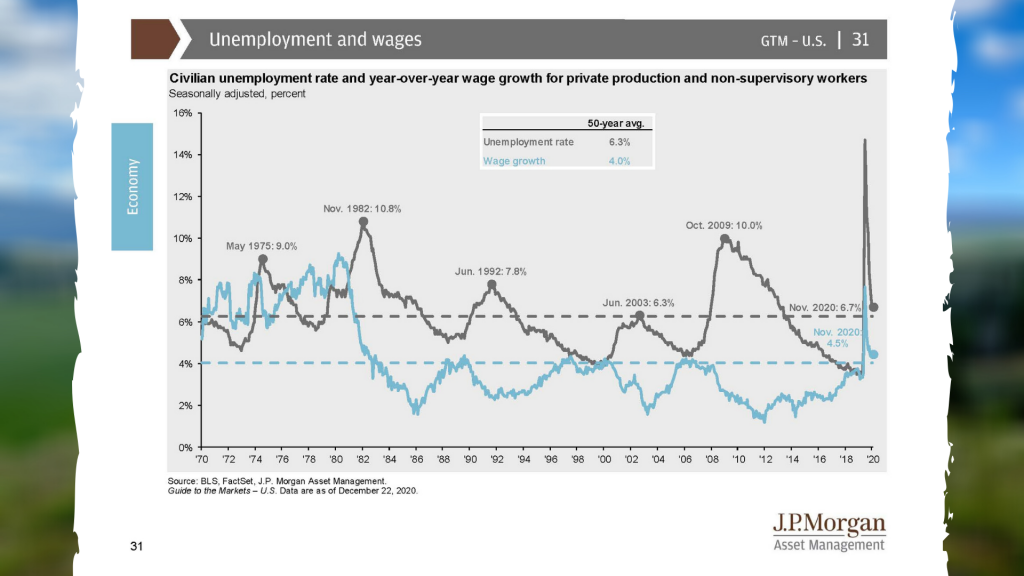

The next thing is unemployment. You’re going to see that we are now back after that huge spike in the second quarter of this year. We’re back to the 50 year average for unemployment. Now is it where it was a year ago? No, it’s not. Is it an absolute disaster? No, it’s not. Could it be in the next year or two as various stimulus plans go away? Yes, it could. It doesn’t mean that we don’t go forward with our particular investment strategy.

The last thing I want to point out on the screen and I alluded to it earlier in the video which is this chart right there. Time diversification of volatility of returns. There’s a bunch of different graphs there. It’s three bars together, that’s one year. The next grouping is five years, ten and 20. What that means is the first of those three bars is 100 percent stock market index. The next middle one is 100 percent unmanaged bond index and the next is a blend, 50-50 of the two. When you look at the second setting of the five year rolling there going back 70 years to 1950, we never had a time horizon when a 50-50 stock and bonds has lost money over five years. Could it in the future? Absolutely. Nobody knows the future. But you know what? I feel good about that. I feel that of all the choices available to me, perhaps that’s one that’s worth exploring very deeply.

Mike Brady, Generosity Wealth Management. A little bit longer video than normal but I had a great time doing it and hopefully you had a good time listening to it. I’m always here to answer anything. Thank you for being my friend, my client and you have a wonderful day. Bye-bye now.