“Set your course by the stars, not by the lights of every passing ship.” – Susan Blankston

The first quarter of 2023 has been marked by mixed financial market activity but has overall been a positive correction of the losses in 2022. The volatility and banking issues have further highlighted the importance of duration. Bad risk management on the bank’s part with incompatible duration led to issues as their long-term investments and short-term liabilities created a run on the bank. This serves as a good reminder to investors to assess their time-horizon and what the need for cash will be as they make decisions.

Let’s take a closer look at the first quarter of 2023 and what we’ve seen so far in relation to duration.

TRANSCRIPT

Mike Brady with Generosity Wealth Management, a comprehensive full service financial services firm headquartered here in Boulder, Colorado.

Before I jump into the first quarter review, many of you have asked how my knee surgery went. On March 1 I had a full knee replacement so good titanium in my knee now and it’s gone great. I have kind of a dull ache even a month later but I have to tell you that my flexibility is great, the pain never was very bad and if you’re ever looking for a great surgeon I love mine. It’s worked out well but I’m still in the rehab doing the PT and all of that. Thank you for all of your concern on my behalf.

Let’s talk about the first quarter. The first three quarters of 2022, a year ago, were absolutely horrible. The declines of 2022 really occurred in the first nine months of last year. The last quarter of last year when you look at the unmanaged stock and bond indexes was actually slightly positive. January of this year was highly positive which is great both for the unmanaged stock market indexes and for the bond indexes. February and March was really more static and sideways. We’ve got the fourth quarter of 2022 followed by the first quarter of 2023, both of them positive and starting to dig ourselves out of the horrible hole that the first three quarters of 2022 gave us.

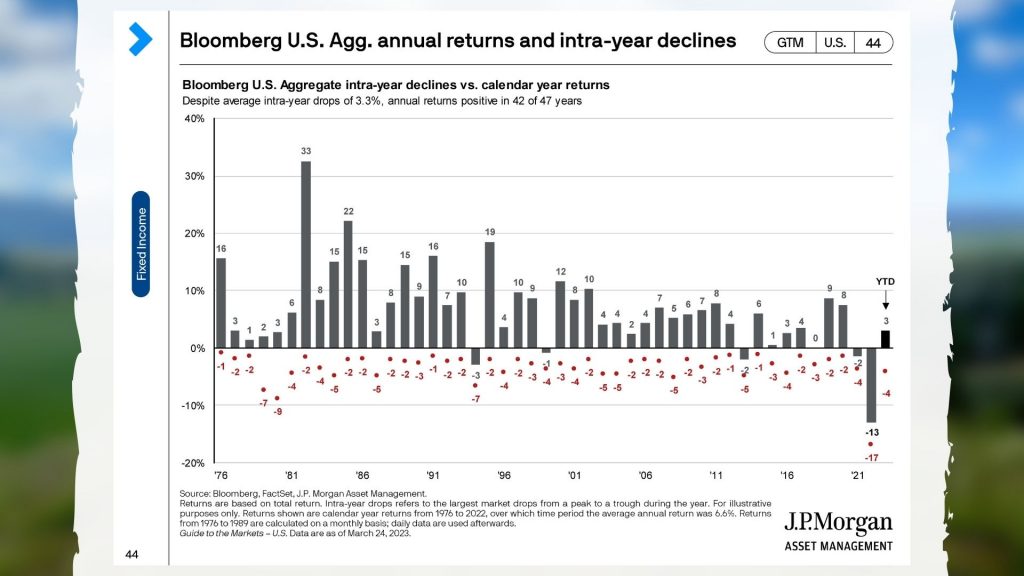

I’m going to put up on the screen unmanaged bond indexes. You can see that last year was negative. So far this year it’s positive. When interest rates come down, bonds have a tendency to go up and the yields go down and stuff. I just want you to understand how that has an inverse relationship. What was so unique about 2022 is that not only did the unmanaged stock indexes go down, historically about one out of four years are negative, but bonds as well because of the incredibly quick rate with which the Fed increased the interest rates.

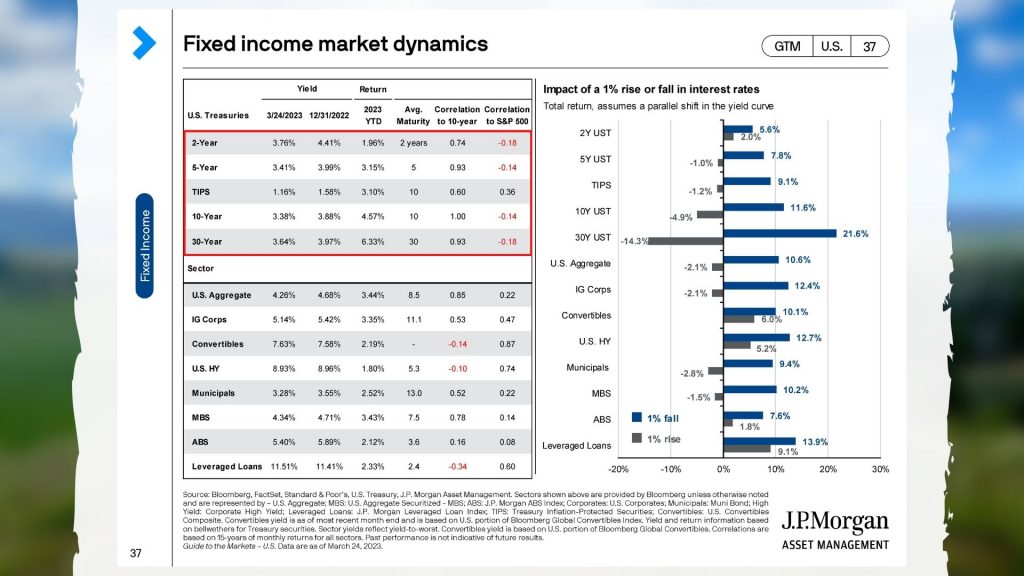

So far this year, 2023, things have eased up. The bond prices are increasing which is a good thing. I’m going to put this up on the screen and you can see how even the different durations from two years to 30 years, the prices have increased for this particular year, but they’re talking about slowing down the interest rates. The whole reason that the bonds took a huge hit last year, 2022, if it plays out in 2023 that actually will be to our advantage. Very unique last year both the unmanaged stocks and unmanaged bond indexes both went negative. So far they’re in recovery in 2023.

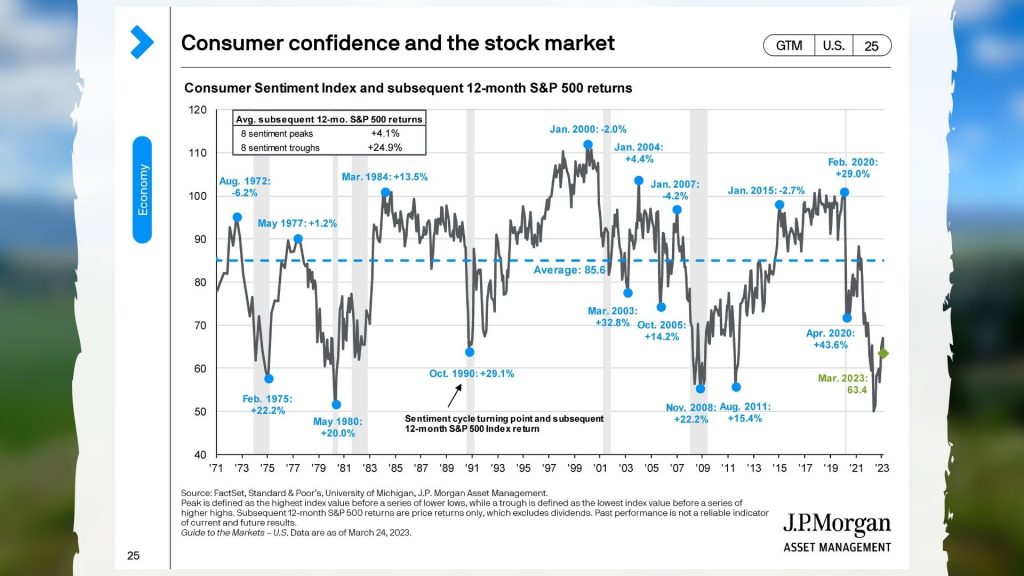

It’s important for us to remember that and I will also say that sentiment is not a very good indicator of what’s going to happen. When people are at their most positive, the next 12 months usually aren’t looking very good. When people are at their most negative and when they’re like well, I’ve just got wait for this to play out, is usually the next 12 months very, very positive.

I’m going to throw up a chart that shows something like that. Here we are and we’ve got two positive quarters in a row. I don’t know what the rest of the year is but I will tell you, I’m going to put up on the chart what they’re anticipating some of the interest rates amount to be from the Fed, and also some of the profitability going forward. It’s reasons to be positive, to dig ourselves out of it. Nobody knows what the future holds and that’s why duration – your time horizon is absolutely essential.

When we talk about the banks, some of the regional banks, let’s get the right lesson from them. They had bad risk management inside with incompatible durations. Investments were long term and their liabilities were short term and they had a run on the bank. It’s important for us as investors with our own portfolios to day hey, what’s my duration? What’s my need for cash? When will I need this? I might be in my 70s but hopefully I’m going to live another 20 years. So, making sure that the investments that I have are, of course, for the right duration for not running out of money for the rest of my life or moving towards retirement, whatever your specific goal might be.

Anyway, I’m always here to have these conversations with you and to ensure that what we’re doing on your behalf is consistent with what you want to do in your financial goals in your life.

Michael Brady, Generosity Wealth Management, 303-747-6455. Thank you.