“Perpetual optimism is a force multiplier.” – Colin Powell

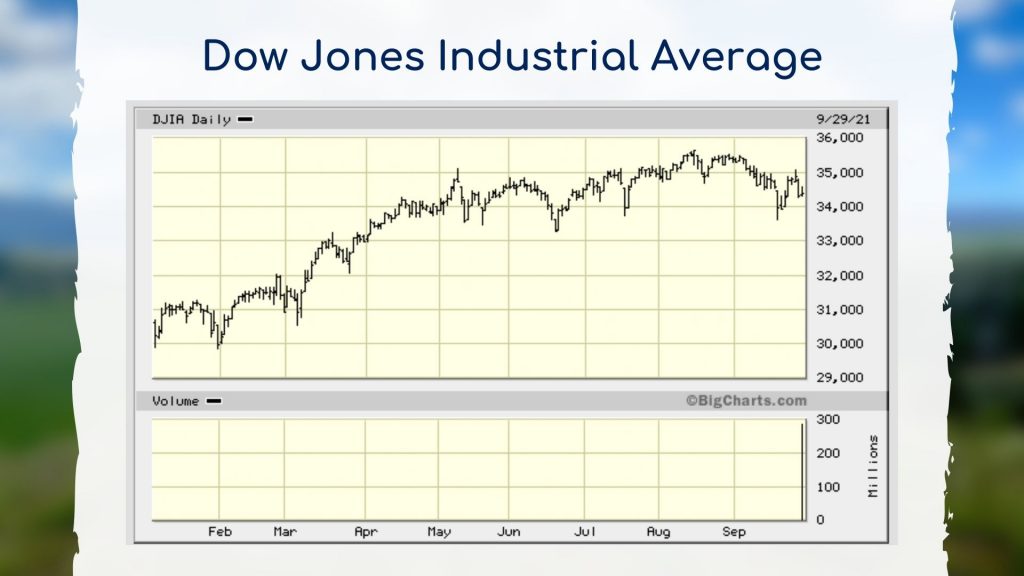

It’s important to keep the big picture in mind when looking at your financial investment portfolio performance. The first 6 months of 2021 were good, the last 3 have been pretty much break even and the final 3 months of the year have yet to be determined. While things are positive in the unmanaged stock market index and bonds and zero in the cash/CDs, when we look at the big picture we see that we need to stay the course and remain confident in our long-term plan.

Every year there is a reason for there to be pessimism, if pessimism is what you’re looking for, conversely the same is true for positivity. The future is unknown, however our attitude and resolve doesn’t have to be.

If you have short-term needs to prepare for, of course it’s beneficial to set aside money now. Connect with Generosity Wealth Management founder, Michael Brady today if you have a situation requiring specific assistance.

Transcript

Hi there. Mike Brady with Generosity Wealth Management, a comprehensive, financial services firm headquartered in Boulder, Colorado.

This is the last day, sadly for me up here at my cabin in Wyoming. This has been a magical summer once again. Many of you I’ve had Zoom meetings with and emails and phone calls, so there’s zero interruption in the business, but it certainly does enrich my life, the ability to spend a lot of time up here doing outdoorsy things. If you get me on the phone I’ll tell you all the things that I did this past summer to improve our place. But I also think that it’s great to get away, to get some perspective, to get outside of your bubble, to look at things in a new way. Some things will be different, some will be the same, but I think that it is important to proactively do that with your own thinking.

So, 2021. We’ve got three quarters down. I’m recording this on September 29, which is Wednesday. You’re probably getting this the first week of October, and by the time you get this you probably have your end-of-the-quarter statement if you’re my client.

What we’re going to see so far this year is that nice run-up for six months, and then the last three months has been about a breakeven. The unmanaged stock market indexes are positive, high single digits or low double digits depending on what index you want to look at. Bonds are positive as well in the low single digits. Cash whether that’s CDs or money market, et cetera, frankly almost zero. I was looking at some CD rates and some money market rates for a client a couple of weeks ago as he had an extremely short-term liquidity need, and it was very, very low – almost zero.

I think that it’s really important for us to keep the big picture in mind. You’ve heard this from me over the years. I’m like a broken record, but I believe that is one of the keys going forward, the duration. One of the things you might ask yourself is, are there any short-term needs that you have over the next year or two that you need to prepare for. Because, if so, then we should set that money aside because that’s a short duration need.

Now, if we go back to 1980, what you’re going to see is 31 out of those 41 years were positive for the unmanaged stock market index, the S&P 500. Three out of four years. When we actually go back – I’ve seen another study going back to 1929, same thing. Three out of four years, and in that case I think it was 73 percent were positive. So, this is a good thing. When you flip a coin, 50-50 is tails and 50-50 is heads. And when you do 1,000 of those flips, you should have 500 heads and 500 tails. Some of the distribution of it as you look at it though, they’ll be runs. They’ll be head, head, head, head, head, head, head or tails, tails, tails, tails, tails, tails. The stock market is very similar in that there will be some distributions where some years will be positive, positive, positive, negative, negative, negative. But as we look back 41 years, three out of four of those years are positive.

I’ve been doing this for 30 years since I graduated college in the early 90s, 1991. I was 22 years old, and I’m now 52 years old. During that time I have to tell you that every year inflation’s about to rear its ugly head. Every year the other political party is going to ruin this country. It flips, of course, depending on who’s in power. Every year there’s a reason for there to be pessimism if pessimism is what you’re looking for.

I hear pretty much every year from some people saying I’ve just got a feeling. I’ve got a feeling that we’re about to have a correction. I want to tell you that corrections are normal. Of course, like a broken clock, you’re right twice a day. Yes, there are always corrections. Double-digit declines are actually the normal within a year with some of the unmanaged stock market indexes. However, my experience has been that we forget the times that we thought there was going to be a correction and there wasn’t. The amount of money that would have been lost through the opportunity gain if you move to cash and then the market continues to go up is kind of an abstract loss. Whereas, just staying invested, keeping it for the long term, you can see in the short term that there’s an actual loss there. Hey, I used to have $100,000, now it’s worth $90,000 or $85,000. But over time that’s the reason why we keep the long-term vision in place is that it comes back, and it has historically. The future is always uncertain.

However, you know what. I think that’s the best for you, for your health, for your portfolio, for your peace of mind is not to try to decide exactly when and in and buys and sells and things of that nature. It is to be diversified because different areas of the market also do different things. Last year, 2020, value section of the market didn’t do so well. This year it’s near the top. And fixed income, same thing. So far this year, high yield has been the winner. Last year it was not. Last year it was TIPS, Treasury Inflation Protected Securities.

Even within the stock market, the bond market, different areas of it go in and out of favor year by year. That’s why we have a little bit of all of it because it’s difficult. Only in hindsight is it perfect. In the future, it’s always unknown and you can kill yourself, you can really cause yourself a lot of discomfort by always trying to guess what it is going forward.

I have no huge changes that I would recommend for my clients, for you if you’re not a client. Stay calm. Corrections are normal. We should always be looking at the duration of what our needs are for our cash, and the longer that we can keep it invested, the happier we will probably be. That was true 30 years ago, and it’s true today.

Mike Brady, Generosity Wealth Management, 303-747-6455. You have a wonderful day. Thanks. Bye-bye.