I’ve heard all the arguments (“it’s a hedge against inflation”, “it lowers the volatility”, it’s real versus paper”), and I discount every one of them.

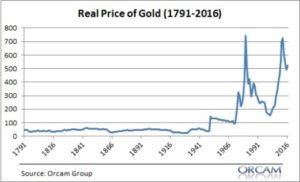

The problem with Gold is that it is unpredictable, and for every instance where it does what you think it should do, I can find an instance where it does the opposite.

Here’s a good blog talking about this more in detail