Jan 12, 2011 | Market Commentary

S&P 500 +15.06%

DJIA + 11.0%

First 4 months were up and down but the trend was generally up, followed by a horrible May and June, July and August up and down , with the last 4 months of the year making it a nice year end.

CLICK FOR FULL ARTICLE

See my video in the next post for more information.

Jan 12, 2011 | Market Commentary

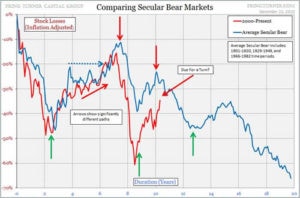

This article states what I feel, which is that we’re in a long term bear market, but we’ll have years that are good (like 2009 and 2010).

Secular bears end when the excesses that caused the prior bull are extinguished.

I’m not convinced we’ve addressed the excesses yet.

CLICK FOR FULL ARTICLE – IS THIS YOUR AVERAGE SECULAR BEAR?

Jan 12, 2011 | Europe , Market Commentary

Europe will be big news in the coming years and because of its economic size, it will impact the rest of the world, including the US.

In 2011 I’ll keep you informed.

CLICK FOR FULL ARTICLE – EURO HAS 1 IN 5 CHANGE OF LASTING THE DECADE

Dec 29, 2010 | Market Commentary , Videos

It’s almost the end of the year and next week I’ll have the year end summary and (more importantly) the year preview.

How good did Generosity Wealth Management do in last year’s preview? I’ll talk about that, but here’s a rerun in case you just can’t wait.

VIDEO

Dec 29, 2010 | Market Commentary

I just said I’d recap next week, but in the meantime I like this chart. It’s just fun, and well, it’s my blog

Dec 29, 2010 | Market Commentary

Don’t be that person.

I continue to use the VIX as just one of many indicators to upcoming trends and sentiment in the market.

CLICK FOR FULL ARTICLE