2025 reminded us of something easy to forget in noisy markets: certainty is an illusion. With 24/7 news, constant opinions, and confident predictions everywhere, it’s tempting to believe someone knows exactly what comes next.

They don’t.

At Generosity Wealth Management, we believe the real value isn’t prediction — it’s perspective.

Transcript

Hi there. Mike Brady with Generosity Wealth Management, a comprehensive, full-service financial services firm headquartered right here in Boulder, Colorado. It is the end of 2025. So this is my 2025 review, and I would say it’s more lessons learned, because you can have all the technical information about 2025. You can read it, you can watch it on TV. I mean, when I started in this industry 34 years ago, you know, it was hard to find that information. People genuinely didn’t know. Now we have 24/7 news and the Internet, and I’m just telling you, you can read more analytical stuff than I can provide you in this particular video and this newsletter. So I want to do it at a high level, but I also want to do the 2026 preview, which is very light because I don’t believe in that. I believe that the future is inherently unknown. And so we’d better have some conviction, some foundation, some base that is, you know, key that we need to remind ourselves about. And that’s more important to spend that money than trying to guess what 2026 is. Because frankly, I could flip a coin, you could flip a coin, and one of us is going to be right. I mean, it’s that simple.

The problem with many pundits is that they are trying to be very exact about something impossible to be exact about. The way I like to think of it is the economy and the stock market. It’s not math, it’s not physics. It’s more like biology. Math is A plus B equals C. Physics is, hey, these are the rules of physics. Biology, that’s the economy, and that’s the investments. You know, even the smartest doctor is not quite sure what’s going to happen because it’s so complex. There’s so many variables. Well, wow, the other people I gave this poison to, they died, but you’re doing okay. Or the other way around. An antidote that might work for you doesn’t work with somebody else. And side effects and counteracting. That’s why anesthesiologists get paid so much money, is they have to keep all these different—you know, this thing helps and this thing hurts—and you know, on balance, this is the way, you know, hit these dials to help a client out.

So, you know, the economy, the investments, they’re like biology. It’s like a body. It’s a very complex system. And so, I’m hoping that one thing that we will take away from 2025 is some humility up on the screen.

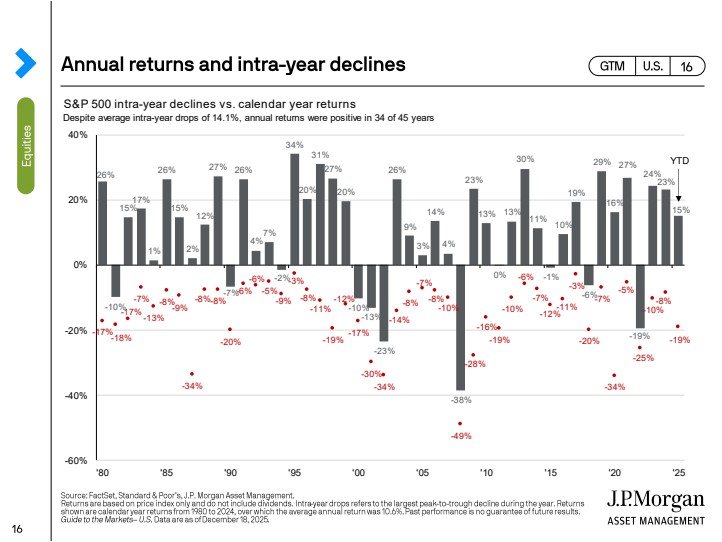

I have shown the intra-year, and I’ve just circled it: all those red numbers, that’s how much a decline was within that year. And you’ll see that it is normal for there to be a decline of over 10%. Double-digit declines. That’s normal. And this year was no different. The S&P 500, which is an unmanaged stock market index, was down 19% at one point this year, but the year did not end with a negative 19%. You can see throughout the graph that, on average, three out of four years are positive, and one is negative. Okay, sometimes they’re strung together, you know, negative, negative, and then positive, positive. There’s a whole number of different ways that it can play out. But on average, when you hold it for a long time, three out of four are positive, and one out of four are negative. But almost every year has a negative decline throughout the year, so we shouldn’t be surprised when it happens. What’s very frustrating about this year is that the sky-is-falling crowd comes out, as it did in March and in April, but with so much confidence. Not the, well, I think this is going to happen, I think this is going to be the impact—it’s definitive statements of it will, and that’s just not true. I hope that we take away from this year that that which you hold with such conviction is sometimes wrong.

I have humility in what I do with clients all the time. Now, I might hide it. Okay, I mean, those of you who know me well saying, wow, he talks with a lot of confidence. Well, I talk with some confidence because I’ve seen it, 15,000 trading days since I started. When I started back in 1991, in August of 1991, the Dow was at 3,000. And then I heard people say, wow, it could never get above 5,000, never get above 10,000, 20,000, 30,000, 40,000. I mean, every single time it’s obviously at a high; well, it obviously can’t get any higher. Well, you know what, I’ve heard that my entire career as it went from 3,000 to 5 to 10 to 15 to 20, all the way up to where we are today. The Dow Jones, which is an unmanaged stock market index. This year, almost every one of those unmanaged stock market indexes were positive across the board—S&P 500, bond indexes, international, you name it. It was a very good year, despite what all those people on TV and all—if you’re doom scrolling on your Internet news feed—say how everything is going to be absolutely horrible. Many of those same people might be saying the same thing in 2026. They’re just trying to be right. Oh my gosh, I can’t say that I was wrong, it just hasn’t happened yet. Well, whatever.

I believe that if you don’t think that five years from now the market is going to be higher than it is today, why would you have any investments? If you don’t believe that, move it in cash, for goodness sakes. Okay? So I don’t know if this next year, 2026, will be negative. I don’t know if 2027 will be negative. But I feel with high confidence—but no guarantee—and I feel with high confidence through my experience and the experience of others over a hundred years that it’s a good bet that I will win on that if I have investments properly matched to me and my emotional level, my goals, okay, my risk level, that five years from now it’ll be higher. Whatever mix that I do, why else would I have investments? Let’s keep our eye on the ball. What happens in a month and a quarter doesn’t really matter. We keep our eye on that ball.

So one of the things that I recommend and I repeat over and over again is emotional control. If you don’t have emotional control, I don’t know what to tell you. People are going to whisper in this ear, and they’re going to whisper in that ear, and you’re going to move this and this and this, and you’re going to be so flexible that you’re really bendable, and you’re not going to be happy. The way I like to describe it is, you know, one person worried every day throughout the year, another person didn’t. The returns are exactly the same. One person just had a very poor journey, the other one believed in the system, had their thing, and executed it. So knowing what your purpose is—I mean, Generosity Wealth Management, I want to be very clear on this: we align wealth with purpose and possibility. What that means is we use wealth to help you. What is your purpose? What do you need today? What do you want to have happen so that you can be generous with yourself? What’s your purpose with your family? What’s your purpose in your community? What’s your purpose maybe in the future, but what’s also possible that you haven’t even imagined yet? Okay, so let’s have that conversation. That’s what the value is of Generosity Wealth Management. We help explore that and bring alignment of wealth with purpose and possibility, and we do that in a number of different ways.

I want to talk about one of some of the things I’m very proud of in 2025 is we really upped our game as it relates to retirement analysis. You need to know what your number is. You need to know how these balls in the air come down into an equation that leads to the outcome you want. And hopefully it’s positive; let’s try to avoid the negative. But what can happen proactively so that’s not just chance? What are the things that we can control? What are the things that we can’t control? And the wisdom to know the difference. We really upped our game as it relates to tax planning so that we can provide you with our thoughts, some talking points that you could have with your tax professional. I’m not a CPA. But I work and brainstorm at a very high level with you and with your CPA, because I believe that this is something—it’s most people’s single biggest expense: taxes. So you’ve got to be an expert in it. Retirement accounts outside of your house—it’s most people’s single biggest asset. I have to be an expert in it. I joined the Ed Slott Elite Advisors, and I’m very proud of that. My knowledge has dramatically increased. And of course, you’re the benefactor of it. And I want you to ask me tough questions. I want you to talk about me with your friends and work colleagues so that they know that they’ve got an expert that they can come to. I work with business owners, I work with people who are retired and not retired. I want to work with good people who I like, like you, if you’re my client already. Because I got to tell you, this is the truth: there’s not a single client that I have that I don’t like, that I don’t kind of look—and there’s no client that is like, oh God, I got to pick up the phone, or I got to give them a call. No. Okay, they weed themselves out. I spend a lot of time at the beginning of a relationship to find the people that maybe were not a right fit, and that’s okay. I want to attract the right people. I don’t chase people, I attract the right people, and then we kind of date. We decide we’re going to be right for each other, but if for some reason we screwed up, I kind of help you find that, or you find out on your own that maybe we’re not right for each other. So I want to work with people that I have lots of chemistry with, they have problems that I can help, that I can provide value to you first, so that of course, you can see the value in what I’m bringing as well.

2026 I want to summarize. I don’t know if it’s going to be up or down for the unmanaged stock market indexes, but I do know the value of diversification. Knowing what your purpose is and what the duration of your money is, is important. I know that discipline, okay, whatever that discipline, and emotional control, I know that these things—every year, I could say 2026 or I could say 2023 or the year 2000—they’re the same throughout the years of my career. These things I keep coming back to, and also, of course, humility. Hey, we don’t know everything, so let’s do the best job that we can and keep control of our emotions as we move forward.

I do want to have more clients. So if you—my client, who I love, all right, who I am willing to jump on a phone call and a Zoom with and give you the best advice that I can, and the experience of what has worked and not worked with other people—if you know friends, family, work colleagues that are just like you, I want to replicate you. Then have them contact me, and we’ll determine independently if it works out. I am going to expand my business. We’ll talk about it—not today—but I have new and fun and cool things that are in the pipeline that you will hopefully see, and I’ll roll out to you in 2026 and even into 2027, and that is all in service of the client, because when the client sees the value, if I make you a raving fan, then you will talk to other people, and that’s how my business grows. And of course, as I bring in other junior advisors and replicate some of the knowledge that’s in my head with them, to serve you continually, that’s how we can be of benefit to the community. And you’re part of the Generosity Wealth Management community. Felicia and I, Sarah Cassidy, we thank you for being our clients, and we just really want to have a wonderful 2026, and we’re glad that we’re doing that together. So, Mike Brady, 303-747-6455.

You have a wonderful 2026. Thanks. Bye bye.