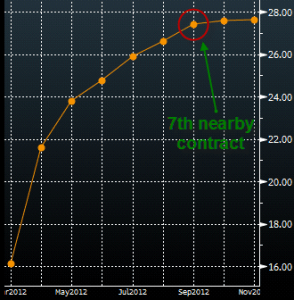

The 7th contract (6 months out) is significantly higher than current implied volatility.

What does this mean?

It simply means that the market is pricing in risks of a correction later on in the year.

Will it happen? Nothing is for certain, and if you have a long term diversified strategy (which hopefully you do) then this may just be a bump in the road