According to Lou Barnes, a local mortgage broker who is frequently quo

Right now, the 10 year treasury is around 2.775%, up about 1.1% in just a few months. However, it has stabilized.

The big question those in the investing world are asking is whether the yield will continue up, or go back down.

If you watch my video, you’ll see that I believe the yield will go back down.

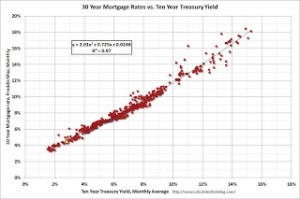

But, as Lou points out, the correlation between the 10 year yield and 30 year mortgages is very clear.