My mission is to live a generous rewarding and enriched life and to help others do the same. I apply this to so many areas of my life: personal, business and philanthropic. Today I want to focus a little bit more on the financial aspects of this mission and the principles I use to guide my own investments and those of my clients. Even in times of uncertainty, my philosophies remain steadfast.

Watch for more on recent events and how strong principles can help you weather any storm.

Transcript

Hi there. Mike Brady with Generosity Wealth Management, a comprehensive full-service financial services firm headquartered right here in Boulder Colorado. Although you can see from my backdrop I am actually up at my cabin in Dubois Wyoming where I spend every summer, I continue to work here, I have wonderful views, as a matter of fact I was going to record this video outside of our rustic cabin but it was too sunny and I kept squinting. So, I’m going to put up on the screen a couple of photos that I’ve taken this morning so you can get an idea of what I look at when I’m looking outside of the windows of my office up here. It’s wonderful. I hope that you also have an opportunity to get away. Frankly, I was stay at home anyway in Boulder so we may as well do the stay at home here with quick jonts down to Boulder as needed.

Today I want to talk about, of course, the current situation and put that, of course, into context, but I also want to talk about some key principles. Because one of the books that I have really liked over the years was the Millionaire Next Door. And what he talked about in that book is there are certain key, how can I say, attitudes and behaviors of millionaires that we can all learn from. And I’m going to take that and I’m going to take it also kind of on the flipside of some key things that I’ve seen that we should avoid so I’m going to talk about some key principles. I sound like a broken record many times, particularly if you listen to my videos a lot because these key principles sneak into every single one of my videos it feels like because they are foundational and a basis for long-term, in my opinion, getting to where you want to be with your financial goals.

Now, so far this year we’ve had an unbelievably good couple of months. I’m recording this on Thursday I think it’s the 11th or the 12th, I think that’s the 11th, and nobody saw this happening so quickly two months ago. And one of the key principles that I have is humility. It’s amazing to me that when people talk about the future or they hear someone talking about the future they talk with such confidence that they almost believe that it’s going to happen and then when it doesn’t they somehow forget and then the next person around gives them such confidence about what is the future and that’s not very helpful so I’m going to come back to this key principle.

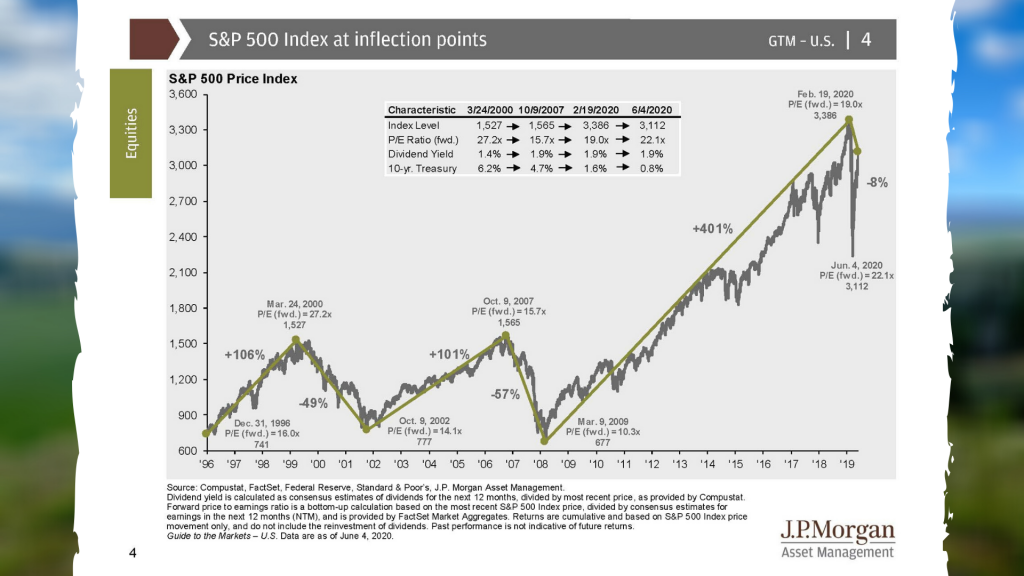

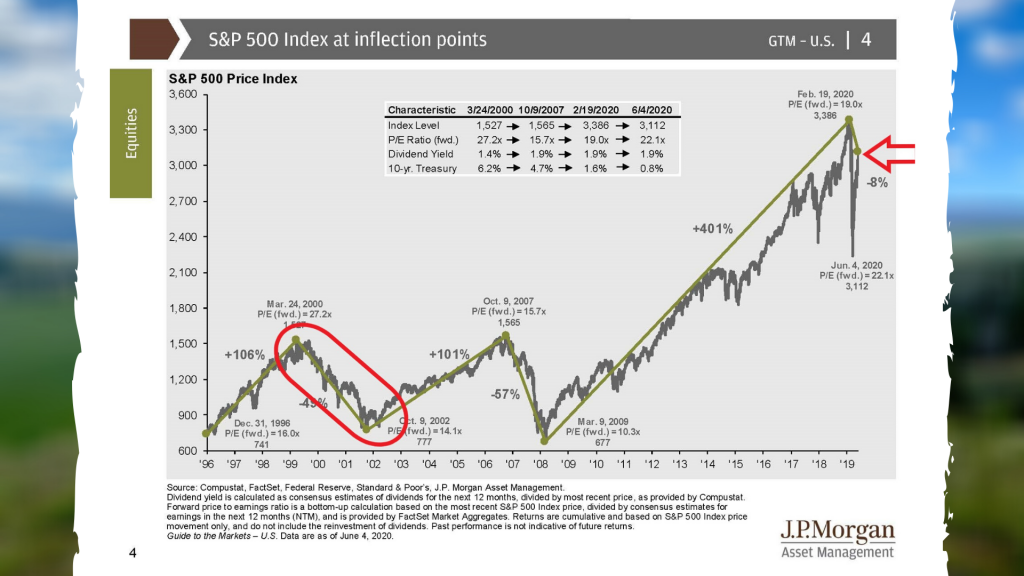

Up on the screen I have shown over the last 25 years the ups and downs in the S&P 500, which is an unmanaged Stock market index.

Now, while we have gone through a couple of really difficult times like 2008 and of this year, which was very sharp, very painful in a very short amount of time, I would argue that someone who has been around for 30 years doing this professionally working with clients, et cetera, is 2000, 2001 and 2002 were some of the most difficult years, not because they were the lowest but because it was one year followed by another by another. Duration and losing the faith after a while is what really dooms many people in my experience. Those people who lost the faith and then went in to go into money market or CDs around 2002/2003 did not see the nice upswings that happen over the next ten or 15 years. Up on the screen you’re going to see an arrow next to where we are now.

I think nobody foresaw the sharp upswing in the stock market over the last two, two and a half months or so. I’m recording this on Thursday and so yes today is a down day, yes it’s going to get lots of good news coverage and very newsworthy. There’s an old adage that the stock market takes the stairs up and the elevator down and that just means that it’s kind of 200, 300 points et cetera, et cetera, and then it gives it up very quickly. One of my key principles, which I’m going to get to in a minute, is being overly optimistic or being overly pessimistic. If only you look at the negatives you’re doing yourself a disservice and I think that you’re going to be unhappy along this path.

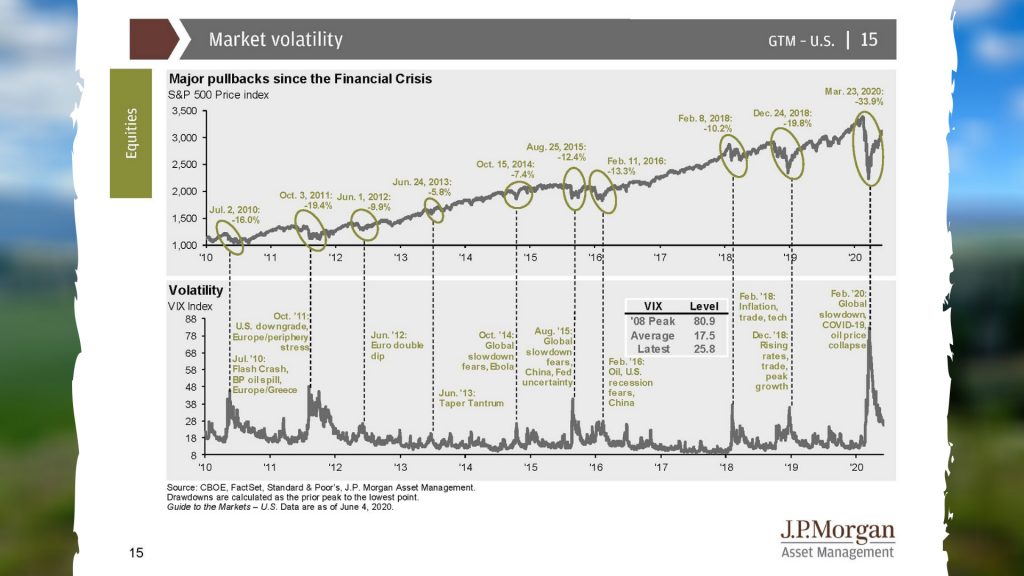

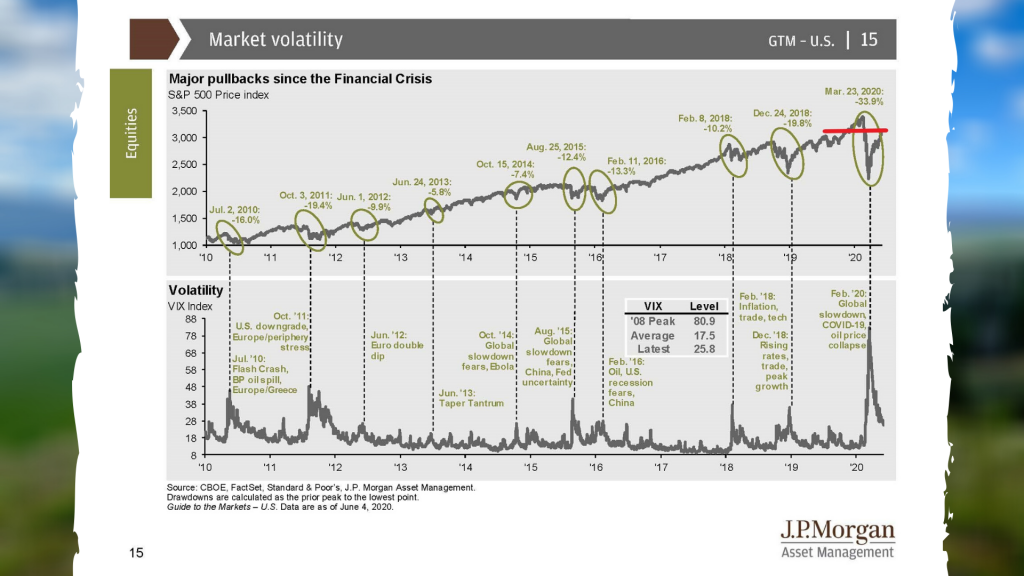

Let’s go to another chart.

This is a chart that shows since the last major financial crisis in 2008. And there were ten major pullbacks along that, ten major pull backs of which the worst one was this last March. It is important for us to remember that it is a long-term strategy, you don’t take short-term events and extrapolate them into long-term decisions if your goals are long-term. Now, one thing that people periodically say to me is hey I’m 70 years old, maybe I’m 75 years old I’m always looking short-term. I remember my grandmother she was in her 80s and she was very feisty and she says Mike, I’m not buying green bananas, which I always thought was very funny and I still do. You still have a long time horizon I would argue because you don’t want to outlive your money and unless you know you’re going to die in the next six to 12 months let’s all hope that you’re living five, ten, 20 plus years even if you are of course retired and living off your money. Most people that I meet with don’t want to outlive their money and they want to pass on the most that they can to the charities they care about or their heirs. And so, we can still invest for a multiple year time horizon therefore we should not allow our emotions to be controlled on a daily, weekly or even a monthly basis so it just is not helpful to you and it’s going to make you very unhappy.

On the screen though I am showing where we are right now.

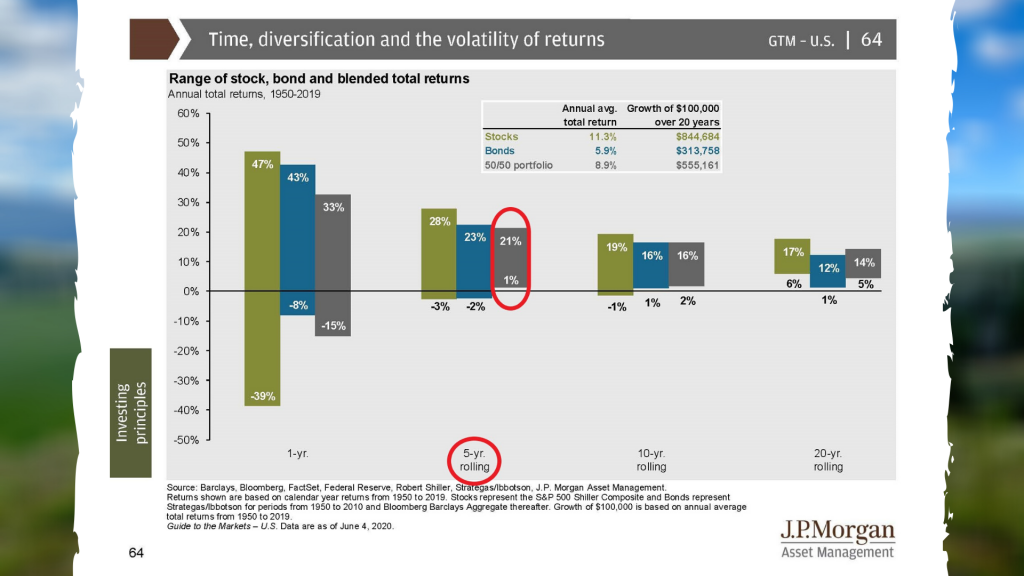

Nobody saw two/three months ago what we have now and so now I’m going to start pivoting over to some key principles, which is the first one of humility. Anyone who talks absolutely about the future is crazy or a fool and I don’t want you to be that person if you’re listening to them. We can say hey I think this is what’s gonna happen, I want to increase my probability of the desired outcome that I have in the future so I do everything I can in order to situate in a certain way, but there’s no guarantees absolutely about the future in any aspect of our lives and finances are no different. So, humility is the first one. The second is having to understand everything. I don’t know about you but every day there’s always a reason why the market goes up or down and it vasawaits [ph] every day, the market is up it’s renewed optimism, the next day its down it’s real new pessimism about deaths, I mean all in 24 hours? That’s crazy. The mind is very logical and patternmaking and we look up at the clouds when we’re on a wonderful pasture and we see patterns. Our mind put together that that cloud is absolutely a sheep or a car or whatever it might be when of course our logical brains tell us that’s not the case. And so, many times our brain also starts to control the emotions and things that are going up we believe will always go up or things that are going down will always go down even if we look at the history of the unmanaged stock market indexes, unmanaged bond indexes that are diversified and that’s never always been the case. As a matter of fact, I’m going to put a chart up there, you’ve seen this before from me; a 50-50, and I’m circling it right now, a 50-50 stock and bond going back to 1950 has a 100 percent break even over five years. Yes a loss in one year, yes a loss in two or three years, but over five years a 50 percent of the S&P 500 and 50 percent of a bond index, which you should always be diversified and it was probably a bumpy ride along the way, is a 100 percent breakeven, although the future could be different. I have that humility as well that no one knows the future, but you know what, that’s something that I’m very interested in and when you find yourself being overly fearful or overly pessimistic it’s good to remember that and that’s why we have diversified portfolios.

The third thing is what is your conviction? That is a key principle. Are you invested for the long-term or the short-term? And it’s okay to be invested for the short-term, you just got to know which one it is. And if you are invested for the long-term, and in my mind I think of long-term of being two, three, five, ten years. If you are invested for the long-term then you’ve got to believe that the market is going to be higher over that long-term timeframe or otherwise why do you have any investments? I mean that makes no sense. Why would you invest in something if you truly believe that in a longer timeframe it’s going to be negative, you should just put that in your mattress or a safe or something some safety deposit box. So, what is your convection and stick to it; very important. Number four is being overly optimistic overly pessimistic. Bull markets many times turn into bubbles and add are people who are being overly optimistic. On the flipside there are overly pessimistic individuals as well and you take three steps forward two steps back, all they talk about are the two steps back. That’s not the full picture, that’s not the context and if we’re going to use logic and we’re going to use some rational thinking in approaching the problems that you have then you’ve got to be aware of the two, find something in between. That’s why I try to not be overly emotional in these videos. Every once in a while someone will come to me and say gosh this big event just happened one way or the other and you were so even keeled. And the answer is well yeah. One, I’ve seen pretty much, it feels like I’ve seen everything of the last 30 years so it’s hard to surprise me anymore. But even then I’m approaching things from a rational point of view in order to get to that end result. I see variables in an equation and I am focused on what is the solution that we want and I have yet to find that being emotional about it helps me with any of those variables and getting to the solution.

And then kind of the last thing is overly complicated and looking for quick and easy solutions. What do I mean by that? Have you ever found someone who wants to lose weight or get in shape and they have this really complicated system, they’re going from one diet to the next diet to the third diet and they just won’t stick with it or they’re looking for some get thin quick scheme, whether it’s this pill or that liposuction or something that’s ThighMaster whatever it might be they over complicate it, burn more calories than what you take in. Exercise X number of minutes, you know, 45 minutes every day or three times a week, do something that works for you but also don’t over complicate it. I had a situation where someone was referred to me, and by the way you should always refer people to me even if we’re not right for each other long-term, that’s for us to determine, but I always try to give them complementary advice and point them in the right direction. And this was actually someone who had been referred to me a long time ago and it’s very painful because they just can’t seem to make good decisions. Like the millionaire next-door they’re the opposite. There is something that this person brings that is really holding them back and I try to point that out to them. I’m sure that we all know someone who has just been unlucky in love and maybe they’re your best friend from when you were five years old and you look back at their life and like yeah he or she always seems to pick the wrong guy or gal and they just can’t quite, you know, there’s a behavior, there’s an attitude that they bring that’s obvious to you that might not be obvious to them. And what I find is many times people who are later on in life, they have certain habits or attitudes that are holding them back and so one of the purposes of my videos here is to talk about what is that bias? What is that attitude and behavior that might be holding us back and how does that apply in a logical format? Being emotional, having biases, all that absolutely common to being a human being and I would want it no other way, but it doesn’t mean it’s got to rule our lives and not everyone can do that.

There’s not necessarily easy answers, I mean there are different types of people. Some people have a wonderful experience at the grocery store, they get up, they pay for their food, they get in line and then they leave and they say wow that was really fun. Other people go and get their groceries and they’re obsessing of which line to get into, they’re swapping lines, they’re going from this one to that one to this one. I have to tell you I watch people sometimes at the TSA getting through the conveyor belt deal and some people are swapping from line to line to try to find the absolute best and others are just totally chill just waiting their turn and going right through. Everybody gets to the plane at the same time. I mean at the end of the day one person had a good experience, one person had a stressful experience. They might have gotten to the same spot two different experiences.

That’s it. That’s all I’ve got for today. I’m going to have another video coming out to you by the end of the month all ready for July 1 the end of the quarter. Between now and the end of the quarter if something huge happens of course I’ll get one out even quicker to you. Volatility has not gone away even if it’s gone to bed for a little while, let’s keep our eye on the big picture. Just because it’s giving up some in one day or maybe two days or a week I don’t know what it’s going to do at this point, it’s a good thing that I don’t need the money tomorrow or you don’t need the money tomorrow or next week because you would have no money in the market. That’s why we have to keep in mind the context of what we’re doing. Michael Brady, 303-747-6455. Have a wonderful, wonderful day. See you. Bye-bye.