“In politics, stupidity is not a handicap.” Napoleon Bonaparte

We have a complex world, especially with the current tumultuous ripples of the pandemic. As we seek to make sense of the ups and downs we tend to assume a binary stance- it must be good or bad. But really it is a complicated formula with lots of different variables within the economy and of course how that relates to particular investments. We’ve gone from devastating declines to roaring rebounds – but why?

Listen for a full review of the second quarter.

__________________________________________________________________________________________

Transcript

Hi there. Mike Brady with Generosity Wealth Management; a comprehensive full-service financial services firm headquartered right here in the Boulder Colorado. Although you can tell by the background that I am still at the cabin in Wyoming. If you’re going to be stuck inside may as well be stuck inside at 8500 feet with beautiful wilderness all around you while you’re working. I’m recording this on June 30. It was three months ago that I stood before you like I am right now to give a first quarter update and at that time February/March had been absolutely devastating, the biggest decline in a very long time, definitely since 2008 but also the worst kind of quarter because it was a very rapid decline very sharply and very rapid.

Who would’ve known, and this is where humility comes into it, that the very next quarter it would be roaring back and one of the best quarters in decades. It has been remarkable. Now what many people are trying to answer is why is that? This is probably my 12th or 13th video so far this year and there’s a theme that’s in these videos, which is we’re many times looking for simple answers to complex problems. I believe that it’s just sort of the way we’re wired, the way that we kind of evolutionarily, you know, it’s fight or flight that’s very simple. You don’t sit there and say well I wonder what the intent is of that thing who is chasing me. No, you have to make a couple of choices very quickly. Today we have a complex world and a lot of times we’re looking for well is this good or is this bad, it’s very binary in that regard. when really it is a complicated formula with lots of different variables into the economy and of course how that relates into particular investments.

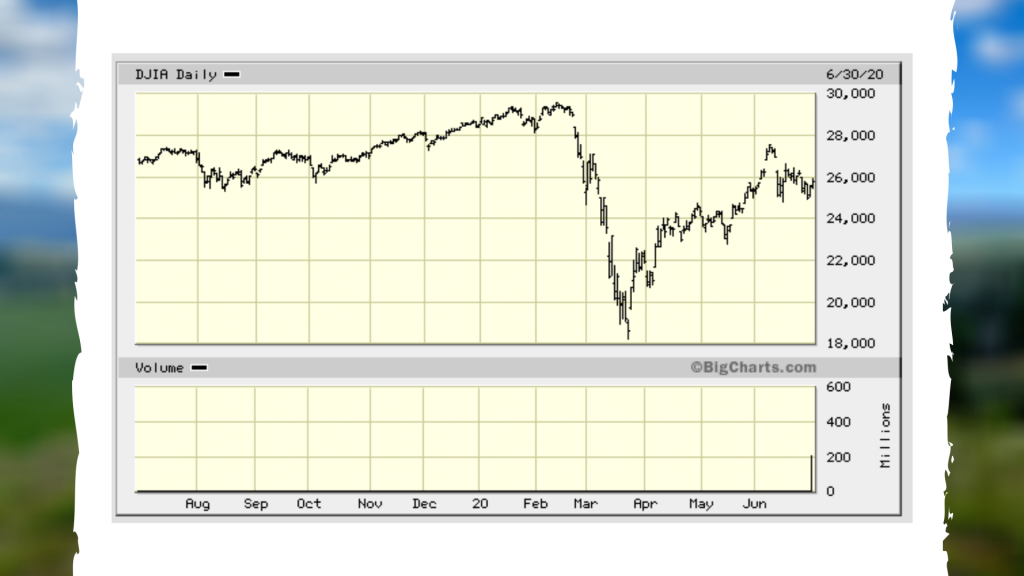

I’m going to put up on the screen a chart; that is what the unmanaged stock market index has done for the last quarter. And then I’m going to put another chart on; you can see the context of the last six months the year to date and then the last 12 months.

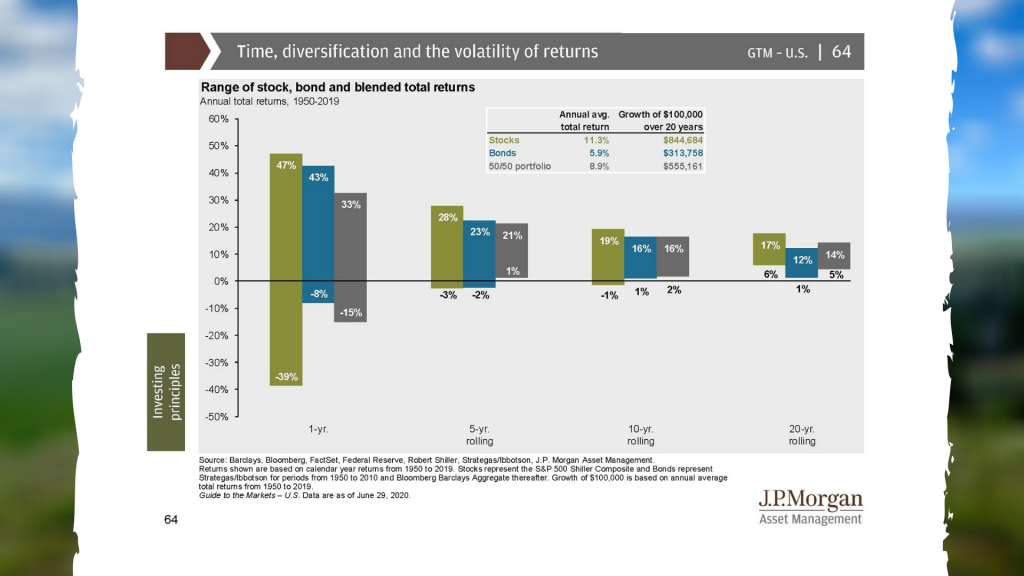

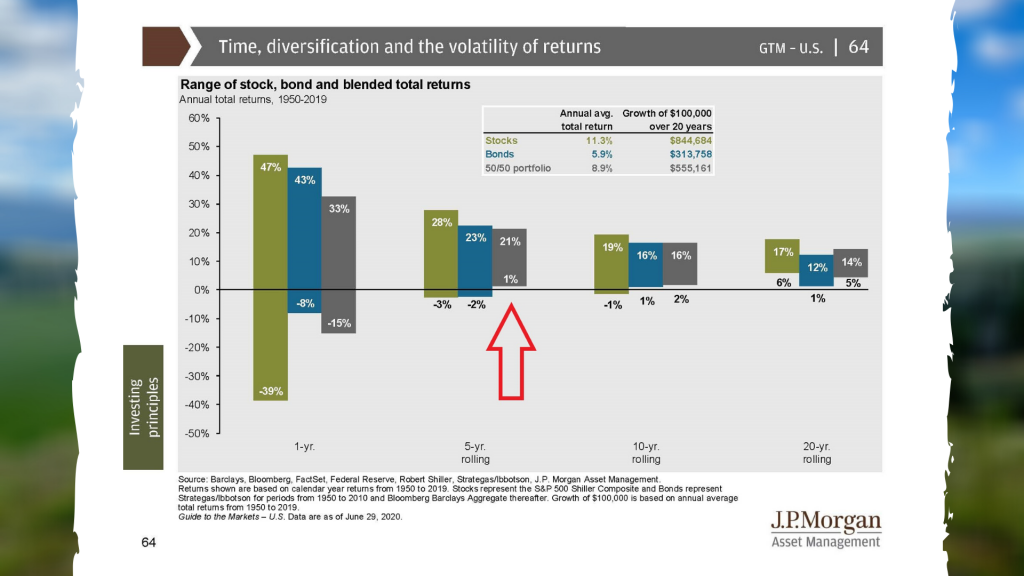

It’s important to remember how our time horizon and what’s happening today are interrelated. If we make long-term decisions based on short-term trends, short-term emotions that is a recipe for disaster. You’ve heard this from me in other videos, you’re hearing that from me today. So, it’s important for us to really let that sink in and ask ourselves how are we making decisions? Are we making things because of a story that we’re telling ourselves about what’s happening maybe to justify the feeling that we’re having or are we having a long-term more logical approach to it, which I believe is the better approach. I’m going to put up on the screen a chart. You’ve seen this before because it is such an important chart I think that it bears repeating.

The columns on the left-hand side going back to 1950, that’s 70 years, 70 years, that first column is 100 percent stock market index, the S&P 500 unmanaged, the next one is an unmanaged bond index, and then a blend of 50 percent of these two. You can see that they have high highs and low lows, that’s in one year looking back 70 years. When we look at rolling five year time frames since 1950 I want to highlight the third bar there, which is there has never actually been with a 50 percent stock and bond mix a year going back 70 years where you haven’t at least broke even or may just a little bit on average per year.

The future could be different. Absolutely. Anyone who says that they know the future completely 100 percent is fooling you and you shouldn’t believe them. However, for me if I’m investing long-term I think that it makes a lot of sense to be in the market and be diversified. It is also a wonderful time for us to have sort of, you know, in a Super Bowl or in a football game you have a half time and you take a break, you go get a hotdog, a hamburger and maybe a Coke. At the time you can reflect on the first half of the game and then talk about the second half. This might be a wonderful opportunity to make sure some of the area, other areas of your life are together: your retirement analysis, if you’re my client I’ve done one for you. If you feel like now is the time to talk about it again, you feel uncomfortable, you’re wondering what it might look like might need a refresher, give me a call and we can go over that. Life insurance because the loss of a spouse or significant other can be devastating, no matter what great planning you’ve done in other areas that loss of income or that lose can be just absolutely devastating. Loss of your ability work. There’s many things that we can look at. Estate planning, when’s the last time you‘ve done your estate planning? If it was gosh I don’t remember maybe ten years, you’ve got a problem in my opinion. You’ve got to look and keep those things updated. Now might be a wonderful time to make sure those things are in order as well.

As we look towards the third quarter I think it’s going to be one of the most not memorable, the most important quarters in a very long time. We’ve just had a huge shock to the system from an economic point of view. In June we had some strong recovery numbers but the question is will that continue? Will the third-quarter be a very sharp reversal of the slowdown that we saw in April and May? There’s a lot of economists out there that believe that the third-quarter will be incredible. Of course, there are many who believes it will not. So, you’ve got to listen to both sides and make up the choice and the decision for yourself. However, I think that what this next quarter kind of how it unfolds may be very important to how the short-term future when we’re looking out six months and 12 months unfolds. The first quarter in my opinion was a huge overreaction, a huge oversold, very emotional to something that was unknown. It was that fog of war that they talk about. I think in April and May there was a realization that that might have happened, maybe things weren’t as we’re looking to the future not quite as bad as what it might have seemed like and February and March. But the real test I think is going to be this next quarter so I’m going to be standing in front of the camera here talking with you again three months from now and, of course, I’ll have videos along the way as well whenever something important happens or I’m just giving some words of advice that I want to share with you. This is what you should expect from your financial advisor if we’re on the same team. I’ve used the analogy of a fitness coach, I’m your financial coach, it’s the same type of thing you’ve got to have good communication. But I’m going to be here three months from now we’re going to see what this next quarter looks like. I hope that it’s good because I think that that will be really important for the long-term. But that being said, I think that long-term diversification, having the right time horizon with the right investments for that time horizon is very, very important, probably the most important thing. Michael Brady, Generosity Wealth Management; 303-747-6455. You have a wonderful day, wonderful weekend and, of course, let’s all hope for a wonderful quarter. Bye-bye now.