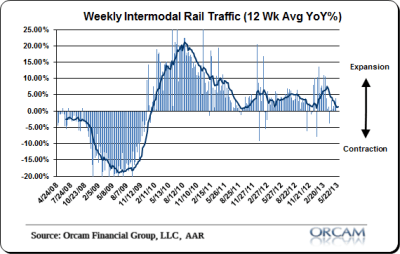

One of the mostly closely watched barometers for Warren Buffett is the level of rail traffic.

He believes that it’s a leading indication of how much productivity is going to happen in the future as goods are transferred across the U.S.

It’s currently still in traditional “expansion” territory, but it’s been weakening over the past year or so.

In my opinion, it’s reflecting the ho-hum economy we’ve all been experiencing. I’ll continue to watch it closely, as one of the variables to what may be in our economic future.