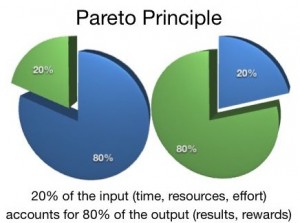

How about applying that to your financial plan?

Save 20% every year and live off only 80%.

Let that 20% work for you for your retirement.

Many times I’m asked what my rich clients did to get that way. Invariably I say that the majority spent less than they made, saved it, and invested wisely.