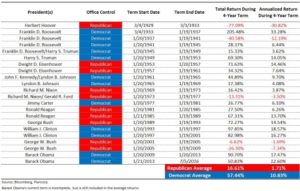

In my video this quarter (you have watched it, right?), I mention the long term nature of investing in stocks and bonds, with the presidency a relatively short term event.

Don’t fall into the trap of thinking all positives or all negatives because your party (or the other party) is in power.

We give too much blame and credit to the President, and when prudent investors have a long time horizon, it is better to stick to the strategy appropriate for you and your risk level, and don’t get emotional.